European sustainability reporting standards in the making – by Jona Basha

- expands the scope of the companies that fall under these rules;

- introduces a phased-in approach to application, starting from 1 January 2024;

- mandates providing sustainability information in a separate section of the management report;

- requires the sustainability information be prepared according to European Sustainability Reporting Standards (ESRS), and

- mandates assurance, starting with limited assurance but expanding to reasonable assurance.

More details in Accountancy Europe’s factsheet FAQs: all you need to know about the Corporate Sustainability Reporting Directive (2022).

The CSRD provided EFRAG with a mandate to develop these standards and deliver them as Technical Advice to the European Commission (EC). The EC would then adopt these standards as Delegated Acts.

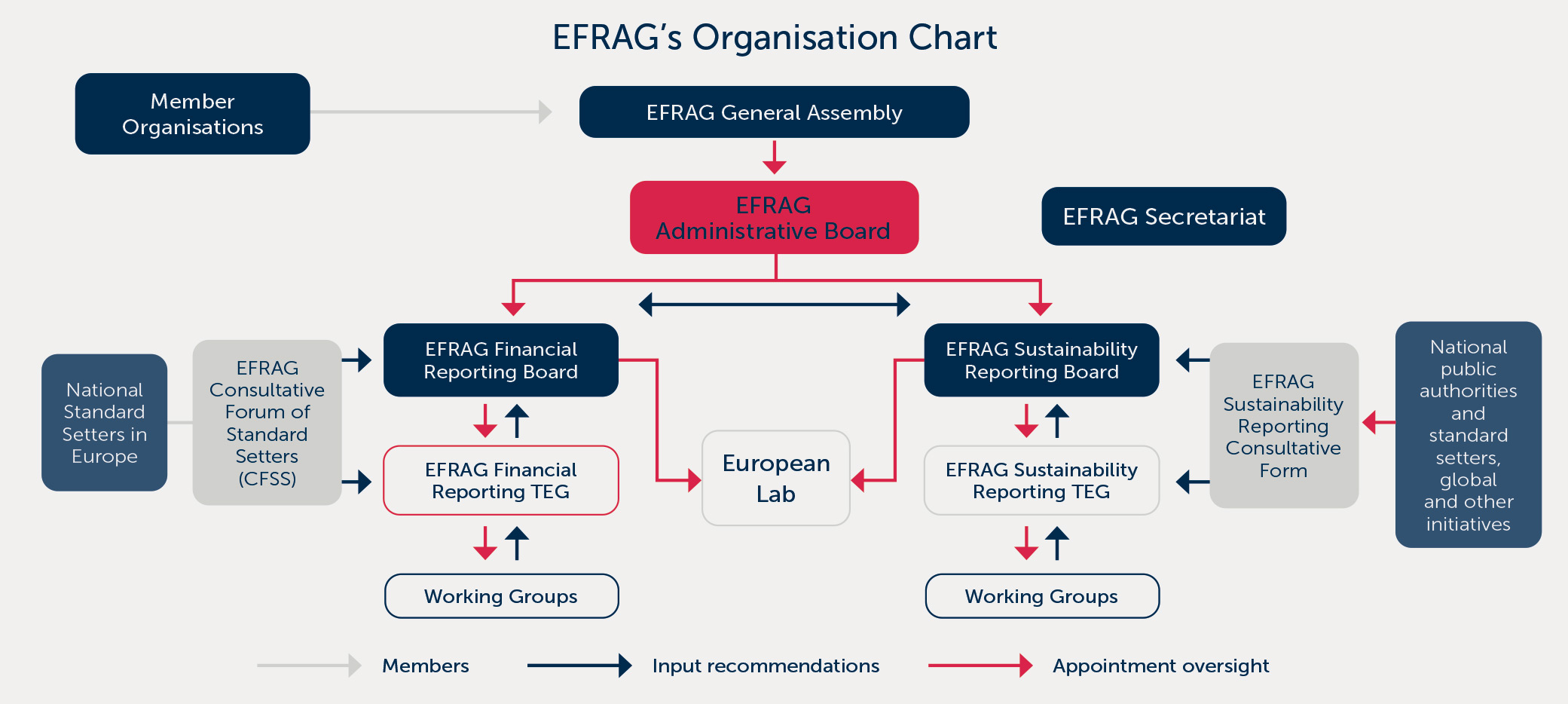

To fulfil the new duty mandated by the CSRD, EFRAG underwent a governance reform and established a sustainability reporting pillar whereby:

- the Sustainability Reporting Board (SRB), chaired by Patrick de Cambourg, is responsible for delivering the Technical Advice with the Draft ESRS to the EC

- the Sustainability Reporting Technical Expert Group (SR TEG), chaired by Chiara del Prete, provides recommendations to the SRB on the Draft ESRS.

Source: EFRAG’s website

The SRB and SR TEG held their own discussions, and in parallel, EFRAG organised outreach events and educational sessions on the EDs. Upon the closure of the comment period, EFRAG outsourced the analysis of the feedback received as well as the cost-benefit analysis, the latter being a mandatory element in EFRAG’s Technical Advice to the EC.

- incorporate a four-architecture structure1 based on the TCFD pillars and the International Sustainability Standards Board’s (ISSB) structure2

- reduce significantly the number of requirements and datapoints

- are better organised and streamlined, clearer and more concise

- refocus on materiality and remove the ‘rebuttable presumption’

- consider better international standards.

The Draft ESRS adopt a mixed materiality and mandatory approach that combines the need to provide useful and relevant information with complying with various EU legislation requirements.

They include the general requirements and principles that underpin all ESRS in Draft ESRS 1. These cover the qualitative characteristics of information, double materiality, value chain, time horizons, consolidation and presentation of information.

Double materiality, a key concept in ESRS, is the unity between financial materiality and impact materiality. Companies need to make their materiality assessments based on these two perspectives to determine what information is relevant to disclose. Specifically:

- impact materiality considers the company’s material actual or potential, positive or negative impacts on people or the environment over the short-, medium- and long-term, whereas

- financial materiality looks at risks or opportunities that may cause material financial effects in the short-, medium- and long-term.

Resultantly, and another key element, is that the ESRS look at material impacts, risks and opportunities over the short-, medium- and long-term.

Such disclosures should be provided both in relation to the company’s own operations, but also its value chain.

- welcome the improvements made compared to the Eds, including the significant reduction of requirements, removal of the rebuttable presumption, adoption of the TCFD structure

- call for more guidance on the concepts and application, including practical examples in the ESRS. Particularly we call for such guidance on the concepts of ESRS 1 (e.g. on double materiality and how to make the related judgements, value chain information, calculating the financial effects, consolidating), which underpin the other standards

- call for realigning with the final ISSB standards, as differences emerged due to the different standard setting processes timing

- call for incorporating the definitions, disclosures and guidance of the Taskforce on Nature-related Financial Disclosures (TNFD), which was published in March 2023.

- call for more consistency and clarity, including on the approach between the materiality and mandatory disclosure requirements, links between topical standards and ESRS 2 (terminology and definitions)

- express our due process concerns, including the lack of field-testing, due to the rushed way in which the standards were developed.

This LSME is important because it sets the value chain boundaries of the bigger companies that would apply the full suite of ESRS. In addition, it provides a flavour of the simplifications as per the proportionality requirement in the CSRD for SMEs.

Accountancy Europe will engage on both the LSME and (voluntary) SME standard throughout their development process. There is no confirmation on the timeline of the other EDs, including for the sector ESRS.

Accountancy Europe will engage in this process as we continue voicing the European profession in the development of both European and international sustainability reporting standards.

- The disclosure requirements in the Draft ESRS are categorised in the following pillars: (1) governance, (2) strategy, (3) impact, risk and opportunity management, (4) metrics and targets.

- Task Force on Climate-related Financial Disclosures (TCFD) recommendations as well as ISSB’s IFRS sustainability reporting standards are structured in the following four pillars: (1) governance, (2) strategy, (3) risk management, (4) metrics and targets.

Jona was part of a corporate finance department in a conglomerate, where she led the preparation of consolidated financial statements and first-time adoption of IFRS. Prior to that, she was part of PwC where she provided accounting and tax reporting and advisory services.

She is a member of the UK Association of Chartered Certified Accountants (ACCA). Jona is Albanian, fluent in English and Italian with proficient Spanish.