How Businesses Can Benefit from ESG by Sheila Stanley

The European Green Deal has been the driving force in entrenching sustainability within the EU regulatory landscape. While industry leaders recognise that compliance is both critical and necessary, not all are aware of the benefits that lie in store for companies that embrace sustainability as an integral part of their business model.

Results of a survey conducted by EY Ireland, the ‘EY CFO Survey 2023’, suggest that ESG is still considered a compliance and regulatory issue, rather than a source of commercial opportunity. In the survey, 43% of finance professionals indicated that sustainability regulatory compliance will be their main area of focus for the next two years. While 54% of finance professionals are finding there is greater focus on ESG reporting in the finance role, only 15% of them believe that building skills in ESG reporting is a priority. More telling is the finding that only 10% see opportunities in sustainability and decarbonisation as a growth driver in the year ahead. The survey suggests that the benefits and growth opportunities that come with embracing ESG remain unclear to many business leaders in Ireland. So, what are the potential benefits?

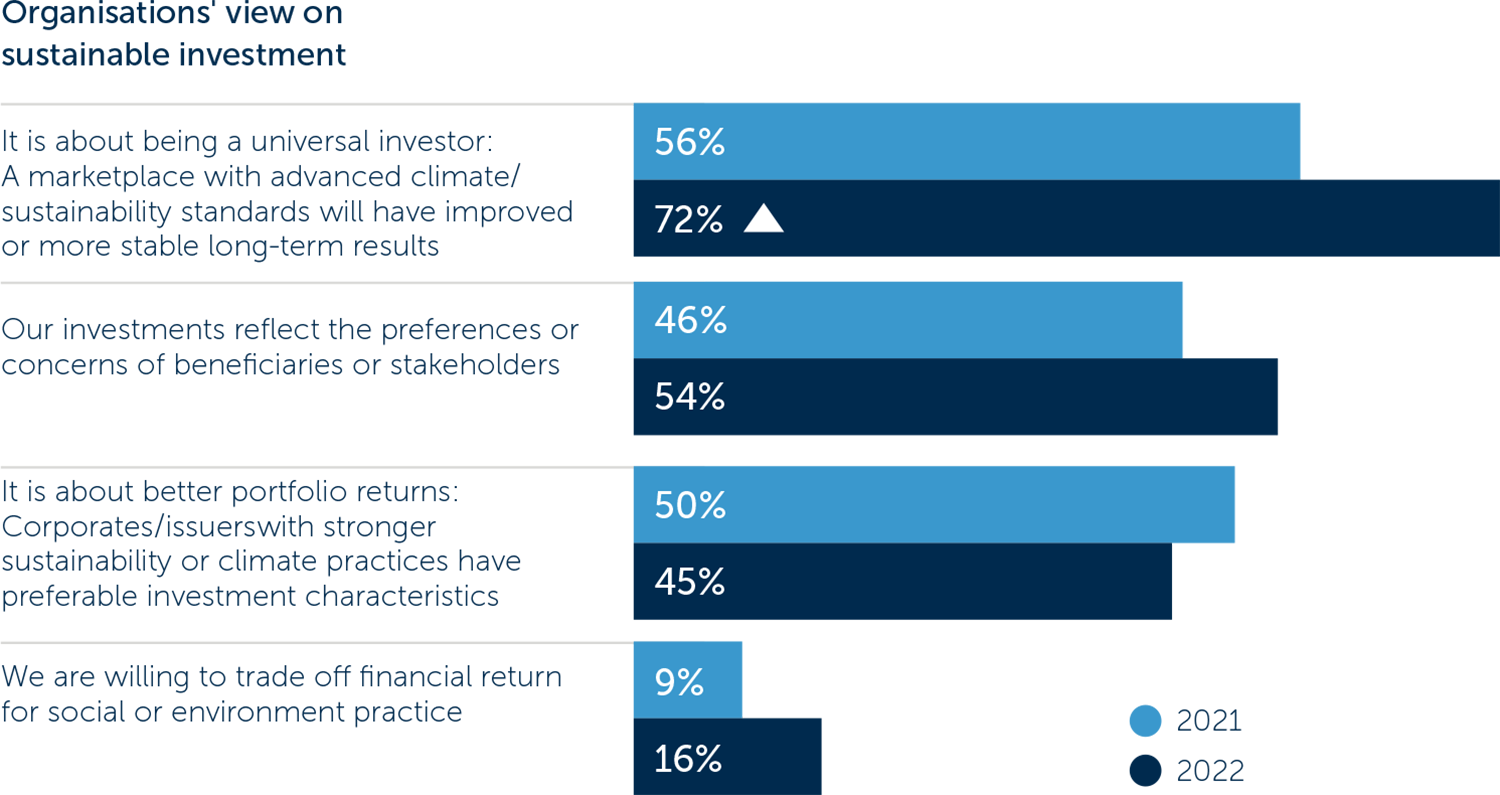

The 2022 FTSE Russell annual survey found that 86% of asset owners around the world are widely adopting SI. Asset owners have compelling reasons for implementing an SI investment strategy, opting to take a long-term view on sustainability.

These investors have stated that the largest barrier to increased SI adoption is the availability of ESG data. Organisational views on SI have seen significant changes between 2021 and 2022 indicating greater adoption of SI principles (Figure 1).

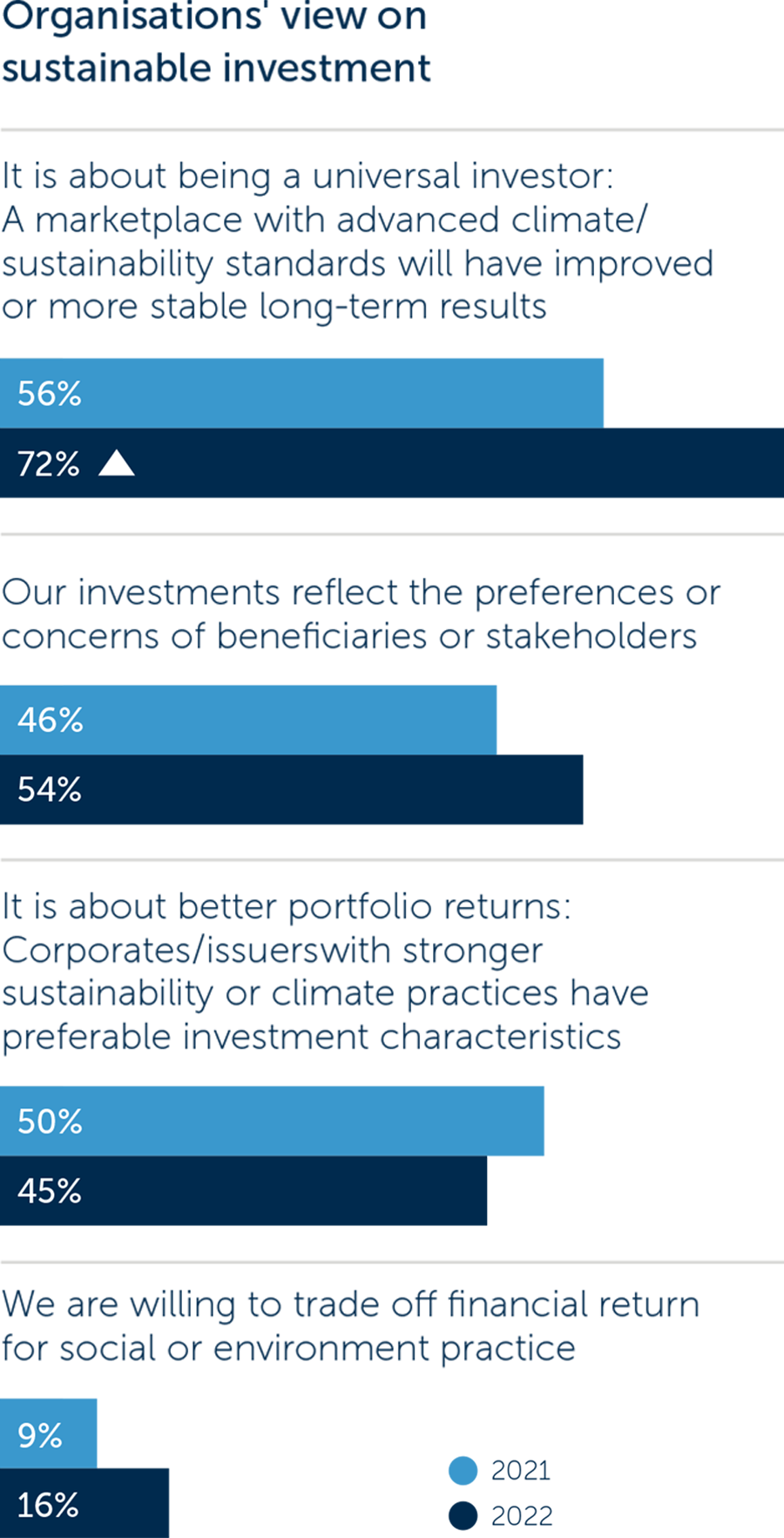

The impact of these legislations is being felt by companies across the board. A recent Grant Thornton survey has found that while ESG lending thus far has been dominated by large, listed companies, there has been a shift towards lenders increasingly focusing on ESG criteria for the mid-market as well (Figure 2). SMEs will therefore have to come to grips with ESG as part and parcel of their daily operations and management, should they want to access competitive rates for bank loans and overdraft facilities.

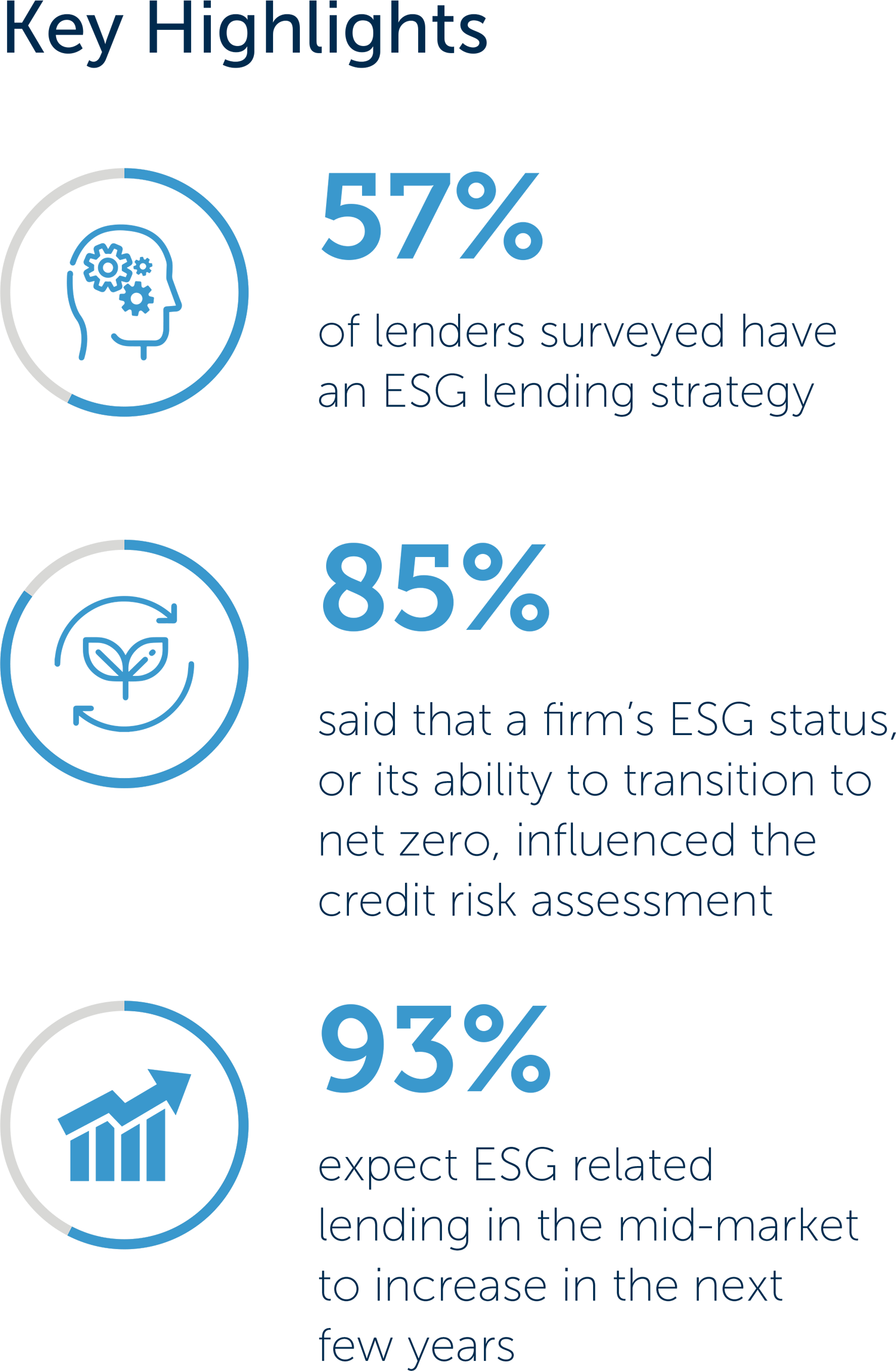

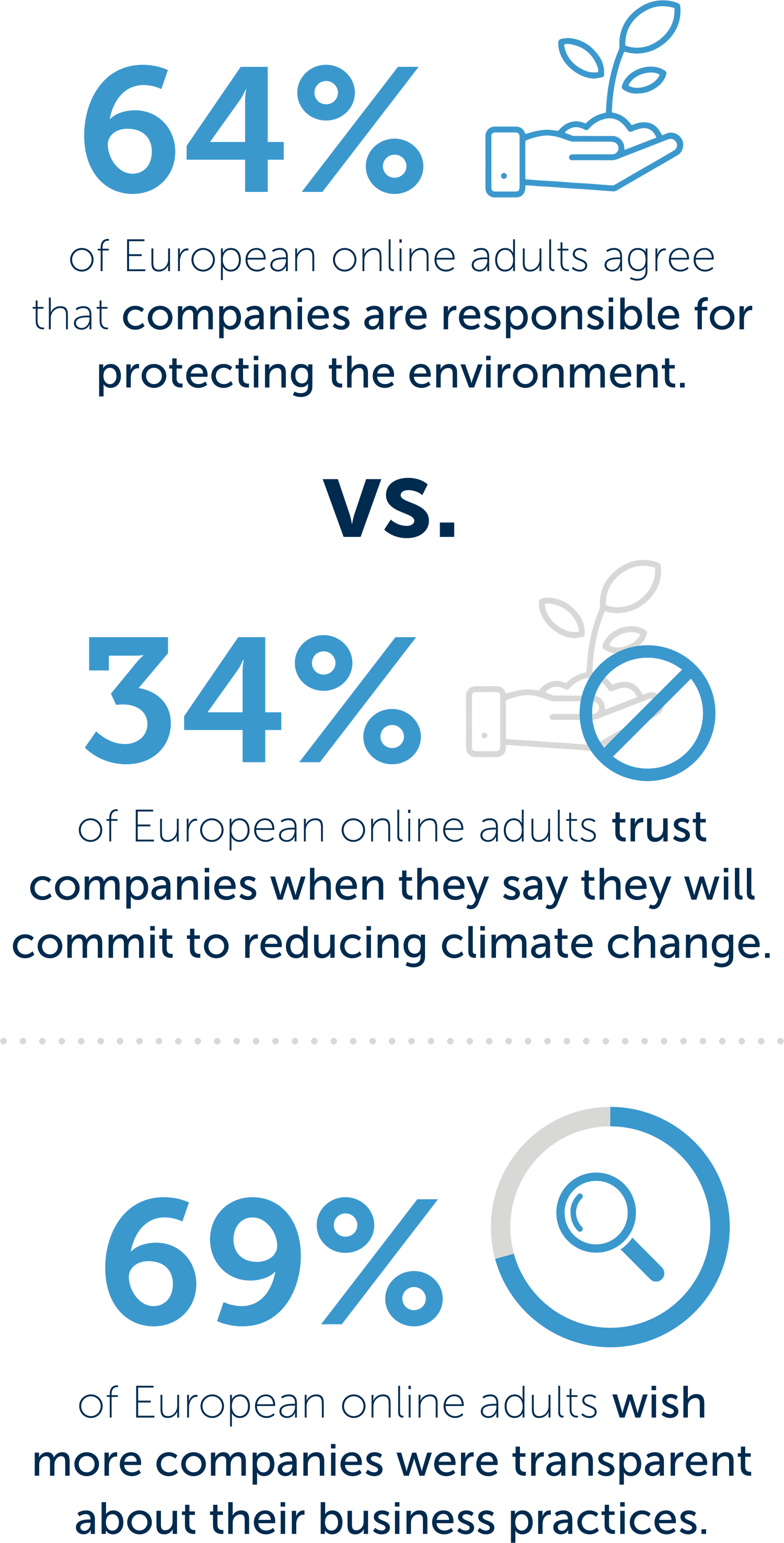

A joint study conducted by McKinsey and Nielsen IQ found that US consumers are backing up their concerns on sustainability with their wallets. The study conducted on 44,000 brands across 32 food, beverage, personal-care, and household categories found that consumers are shifting their spending towards products with ESG-related claims (Figure 3).

This will undoubtedly impact consumer choices when it comes to restaurant and food options.

The E in ESG – Environmental – focuses on environmental factors that affect the long-term sustainability of our planet in relation to climate change. ESRS 1 to 5 focus on the conservation of natural resources and biodiversity without foregoing economic and social progress. They cover climate change (ESRS 1), pollution (ESRS 2), water and marine resources (ESRS 3), biodiversity and ecosystems (ESRS 4) and resource use and the circular economy (ESRS 5).

At the heart of the European Green Deal is the EU’s objective to be climate neutral by 2050. This would mean a future European economy with net-zero GHG emissions. Towards achieving this end goal, the EU has set a mid-term target to reduce GHG emissions by at least 55% by 2030 and is backing this up with various policy and legislative tools.

As challenging as this may sound, the transition to a climate-neutral society also presents businesses with opportunities. At COP 27, Taoiseach Michael Martin announced that the provision of wind energy would be accelerated to ensure that Ireland meets its climate-reduction commitments which is aligned with EU policy. As noted in a study commissioned by the European Parliament, ’Decarbonisation of Energy – Determining a robust mix of energy carriers for a carbon-neutral EU’, the shift to a net-zero future will involve the large-scale expansion of low-carbon electricity while phasing out unabated fossil fuels.

Companies are also under ever increasing pressure to improve their operational processes in order to reduce their environmental footprint. While this poses challenges, it also comes with significant benefits. Key ways businesses are improving their environmental performance are by reducing their use of raw materials, energy, water, and packaging. This in turn has led to reduced business costs. The Sustainable Energy Authority of Ireland (SEAI) has also noted that businesses can save up to 10% on their energy bills by implementing no-cost and low-cost energy efficiency measures and has a section on its website dedicated to providing SMEs with tips and resources on how they can achieve this.

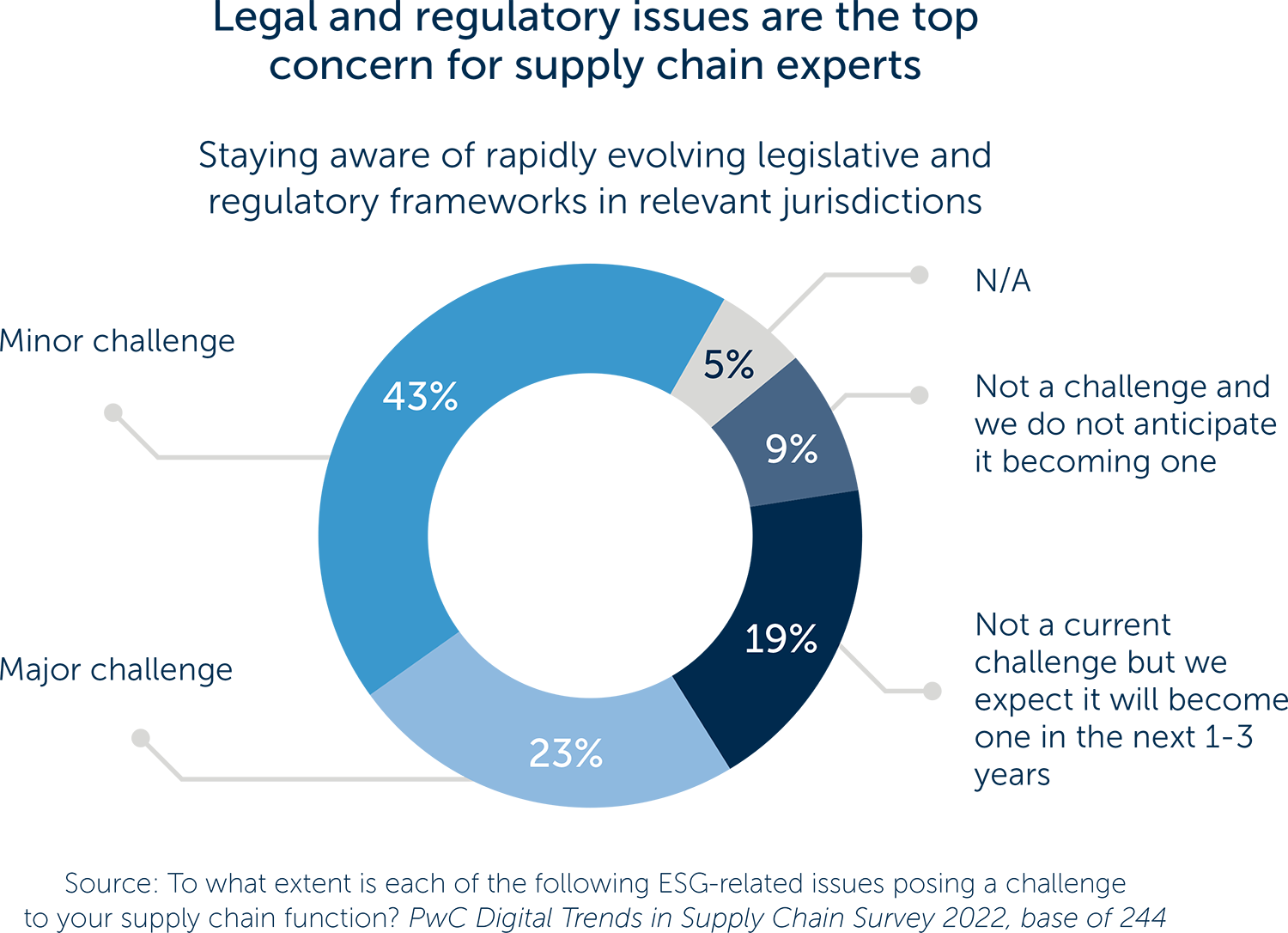

The ’PwC Digital Trends in Supply Chain Survey 2022’ found that responding to regulatory changes is the largest supply chain ESG challenge companies are facing today (Figure 6). In the survey, 66% of respondents said staying aware of rapidly evolving legislative and regulatory frameworks in their respective jurisdictions is currently a challenge, with 23% considering it a major challenge.

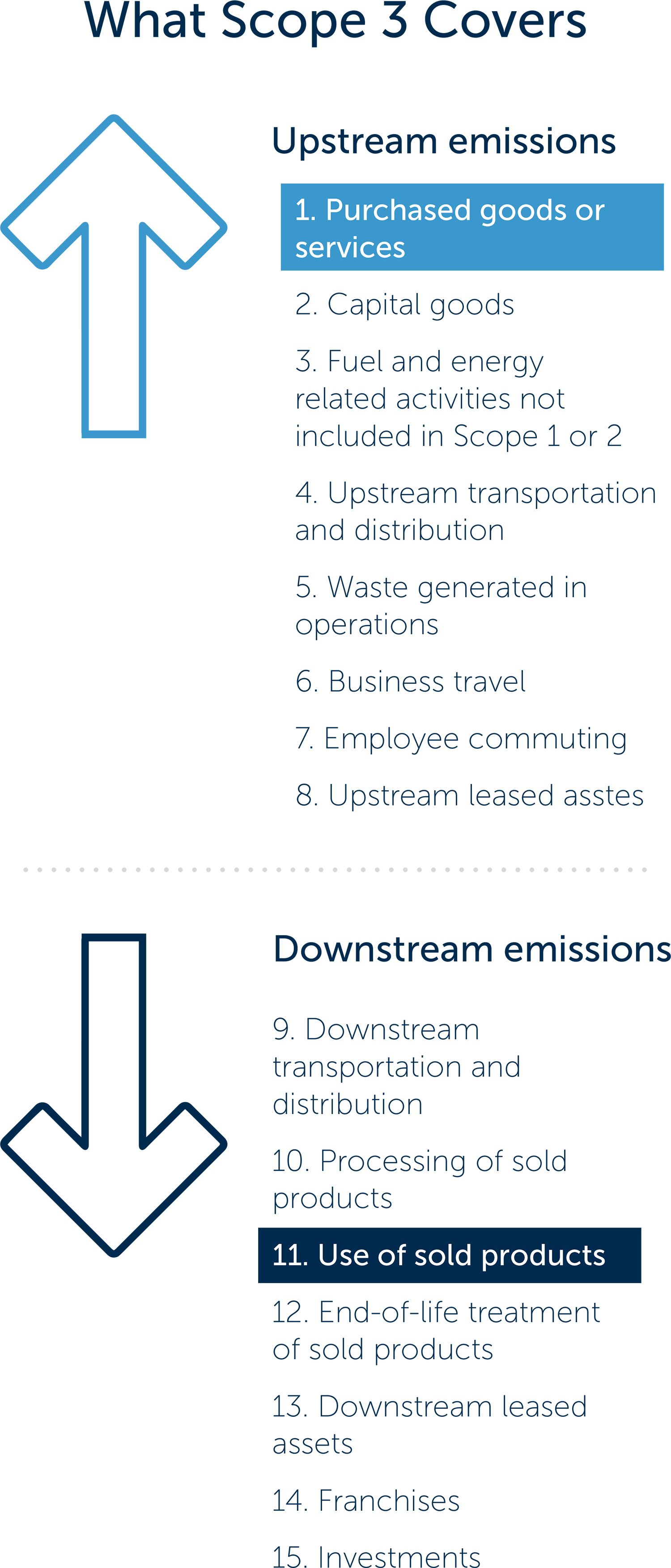

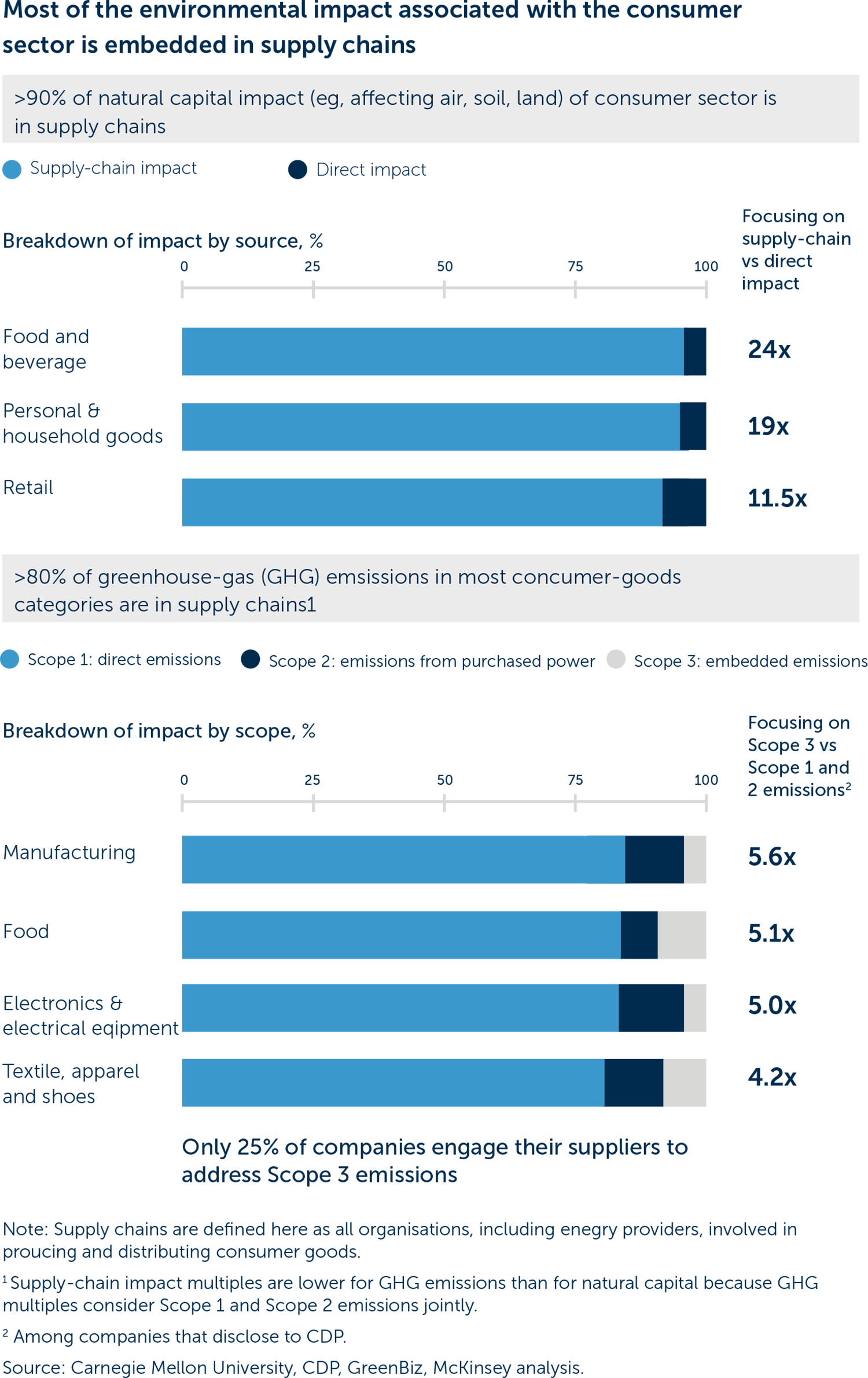

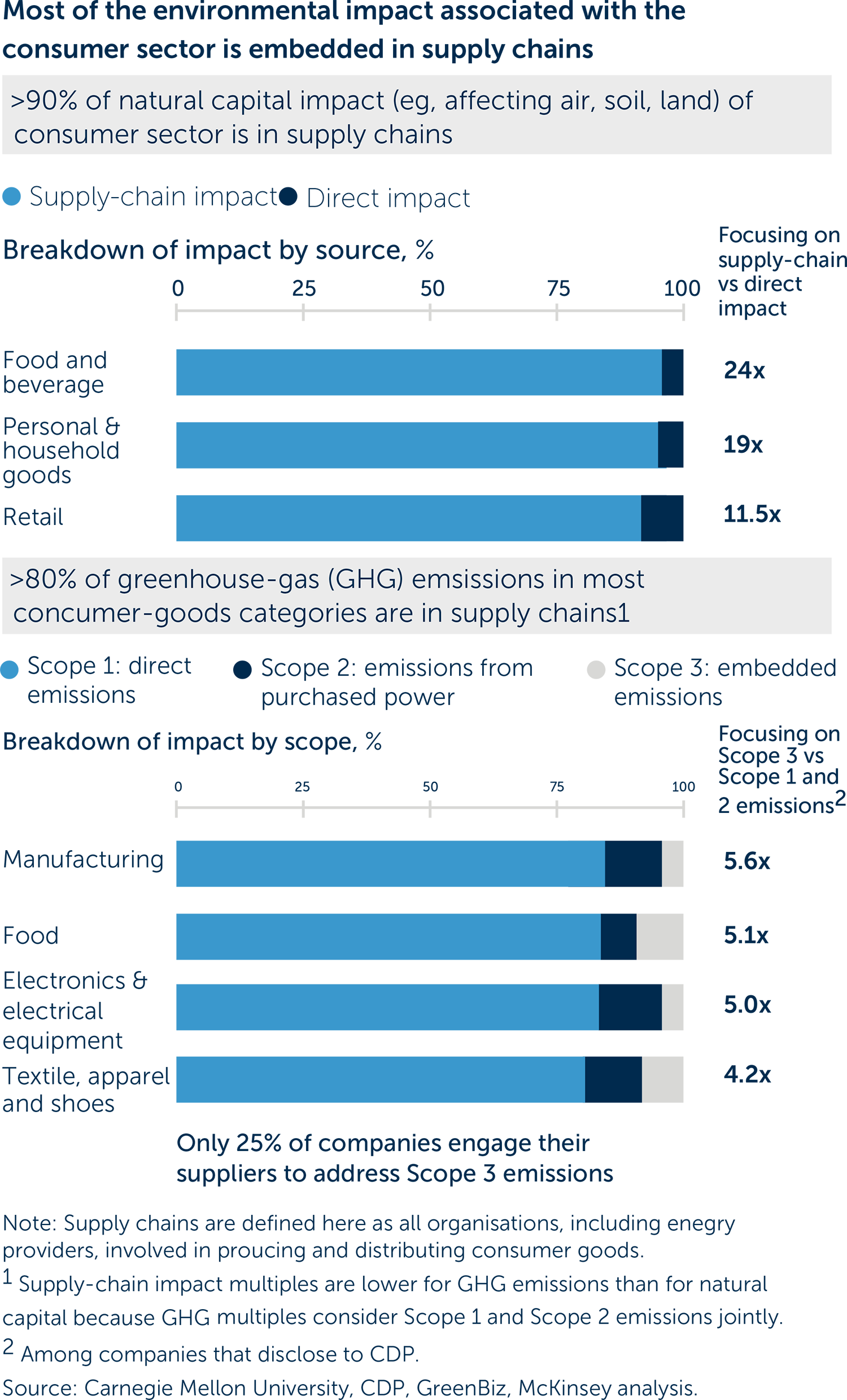

A significant portion of a company’s GHG emissions are Scope 3 emissions. While this varies from one sector to another, according to McKinsey more than 80% of the GHG emissions of companies in the consumer goods sector emanate from their supply chain (Figure 7).

Consequently, the sustainability performance of the value chain has become an important criterion for large companies. SMEs that want to retain their long-term business relationships with large corporations and global multinationals will have to step up on their own sustainability measures to keep up with changing regulatory demands.

Tangible rewards lie in store for companies that embrace ESG as part of their business model. While this may involve some capital outlay, there will be significant return on investment as a longer-term payoff. Going beyond the objective of compliance, there are also opportunities for businesses to future proof themselves and remain a thriving entity in a low carbon/net-zero economy.

https://finance.ec.europa.eu/sustainable-finance/overview-sustainable-finance_en

https://www.grantthornton.co.uk/insights/esg-lending-momentum-is-building-for-the-mid-market/

https://www.forrester.com/blogs/european-consumers-drive-the-sustainability-demand/

https://www.kerry.com/insights/kerrydigest/2023/sustainable-nutrition-foodservice

https://www.europarl.europa.eu/RegData/etudes/STUD/2021/695469/IPOL_STU(2021)695469_EN.pdf

https://www.bordnamona.ie/bord-na-mona-accelerates-decarbonisation/

https://www.pwc.com/us/en/services/esg/library/scope-3-emissions.html