IFRS 17 Insurance contracts in a nutshell by Robert Kirk

There was therefore the need to develop a new standard that could:

- Optimise comparability across insurers; and

- Enhance the transparency and quality of investor information.

The standard was eventually published in July 2017 but it has taken five years before its implementation into practice for accounting periods commencing on or after the 1st January 2023.

- Insurance contracts, including reinsurance contracts, it issues;

- Reinsurance contracts it holds; and

- Investment contracts with discretionary participation features it issues, provided the entity also issues insurance contracts.

Insurance contract

“A contract under which one party (the issuer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder”.

Insurance contracts are then grouped into separate portfolios as defined below:

Portfolio of insurance contracts

“Insurance contracts subject to similar risks and managed together”.

However, once the portfolios are determined they are then split into three separate groups none of which can be issued more than one year apart within the same group.

Under paragraph 16 each portfolio of insurance contracts issued must be divided into a minimum of:

- A group of contracts that are onerous at initial recognition, if any;

- A group of contracts that at initial recognition have no significant possibility of becoming onerous subsequently, if any; and

- A group of the remaining contracts in the portfolio, if any.

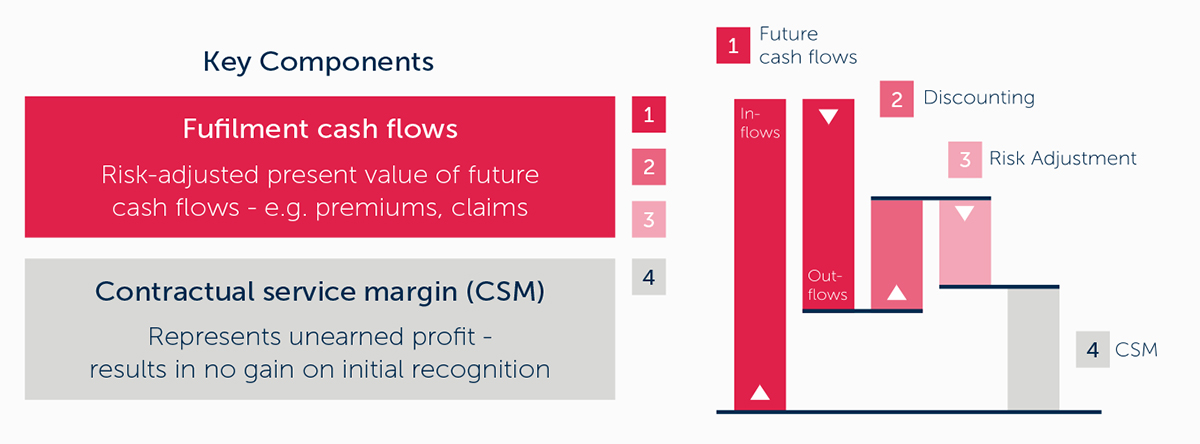

Under paragraph 32, on initial recognition, an entity must measure a group of insurance contracts at the total of:

- the fulfilment cash flows (“FCF”), which comprise:

- estimates of future cash flows;

- an adjustment to reflect the time value of money (“TVM”) and the financial risks associated with the future cash flows; and a risk adjustment for non-financial risk.

- the contractual service margin (“CSM”).

The first step is to ensure that all future cash flows within the boundary of each contract in the group are incorporated. It is possible to estimate the future cash flows at a higher level of aggregation and then allocate the resulting fulfilment cash flows to individual groups of contracts.

The estimates of future cash flows must be current, explicit, unbiased, and reflect all the information available to the entity without undue cost and effort about the amount, timing and uncertainty of those future cash flows. They should be always based from the perspective of the reporting entity, provided that the estimates of any relevant market variables are consistent with observable market prices.

The second step is to discount the future cash flows to present value. The discount rates applied to the estimate of cash flows have to:

- reflect the time value of money (TVM), the characteristics of the cash flows and the liquidity characteristics of the insurance contracts;

- be consistent with observable current market prices (if any) of those financial instruments whose cash flow characteristics are consistent with those of the insurance contracts; and

- exclude the effect of factors that influence such observable market prices but do not affect the future cash flows of the insurance contracts.

The third step is to recognise that there is considerable uncertainty regarding the measurement of future cash flows and so the discounted cash flows have to be adjusted to reflect the compensation that the entity requires for bearing the uncertainty about the amount and timing of future cash flows that arise from non-financial risk.

At that stage provided the group of contracts are profitable the inflow created in step one will exceed the outflow in step 3 thus creating a potential profit. This is referred to in IFRS 17 as the contractual service margin (CSM). However, that potential profit is only earned by the reporting entity as it provides the insurance service to its clients which would normally be over a period of time. Thus, initially the CSM must be treated as forming part of the insurance liability or deferred income which is gradually released to profit and loss as the services are provided.

Of course, there will be some groups of contracts where the outflow in step 3 exceed the inflow in step 1 thus creating a loss. In that situation the loss must be written off to profit and loss immediately. There can be no negative CSM created.

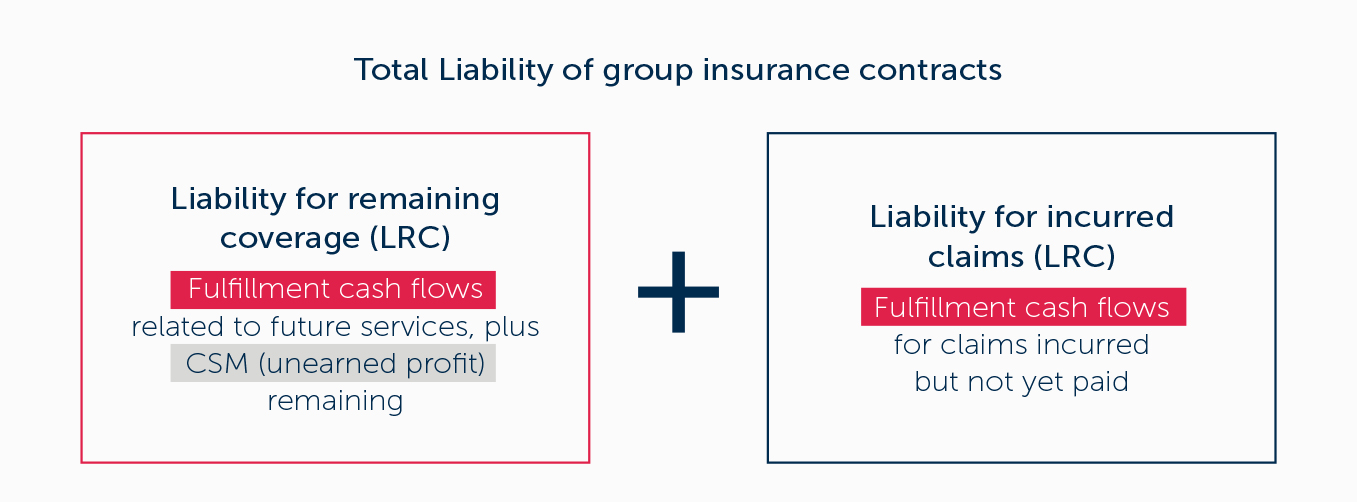

After initial recognition, subsequently, the book value for a group of insurance contracts at the end of each reporting period must consist of the sum of:

- the liability for the remaining coverage compromising:

- the future cash flows related to future services and

- the CSM of the group at that date

- the liability for incurred claims, comprising the future cash flows related to past service allocated to the group at that date. (see diagram below)

- the entity reasonably expects that this will be a reasonable approximation of the general model, or

- the coverage period of each contract in the group is one year or less

However, if at the inception of the group, an entity expects significant variances in the future cash flows during the period before a claim is incurred, such contracts are not eligible to apply that option.

By adopting PAA, the liability for the remaining coverage of the group of contracts is initially recognised as the premiums, if any, received at initial recognition, minus any insurance acquisition cash flows. Subsequently the book value of the liability is the carrying amount at the start of the reporting period plus the premiums received in the period, minus insurance acquisition cash flows, plus amortisation of acquisition cash flows, minus the amount recognised as insurance revenue for the coverage provided in that period, and minus any investment component paid or transferred to the liability for incurred claims.

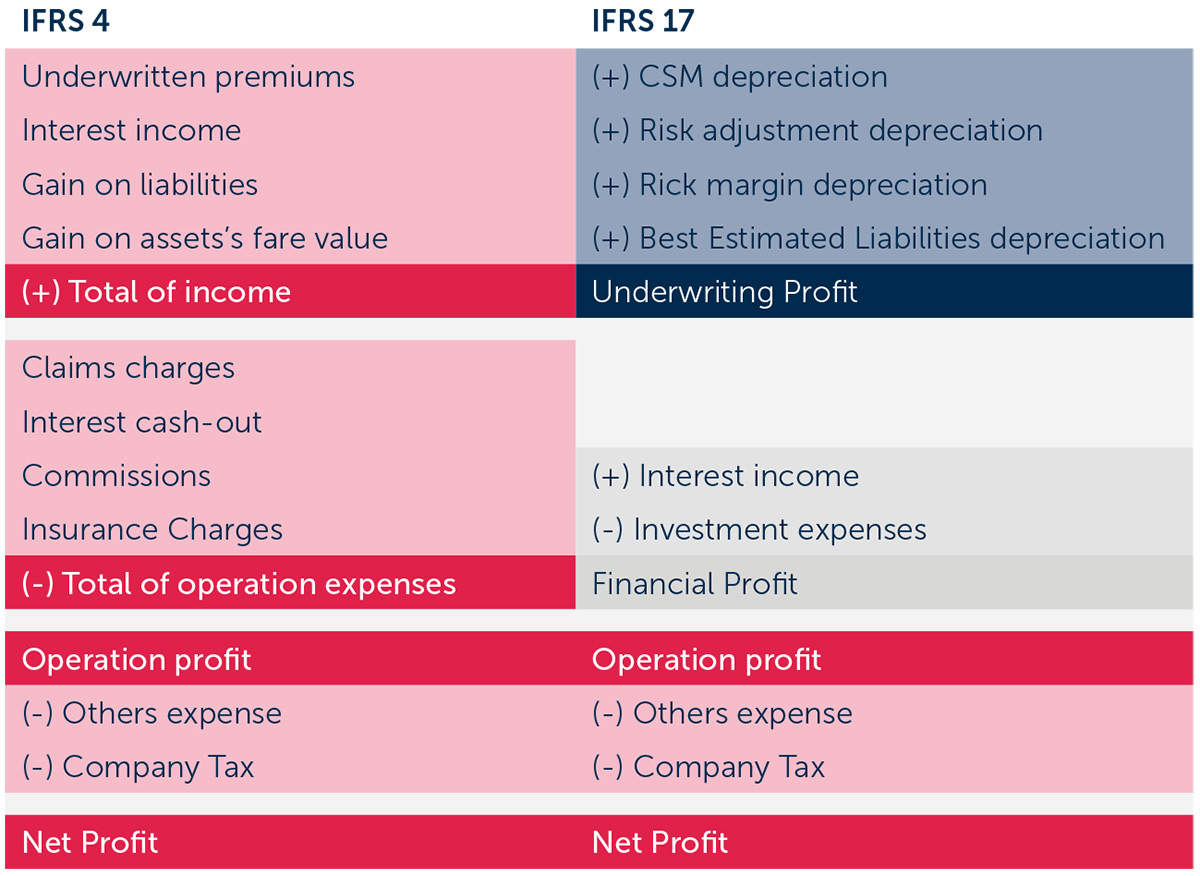

- the insurance service result, which depicts the profit earned from providing insurance coverage; and

- the financial result, which captures:

- investment income from managing financial assets; and

- insurance finance expenses from insurance obligations; the effects of discount rates and other financial variables on the value of insurance obligations

In the diagram below one can see the insurance service result being reported separately from other financial services activity.

To achieve that objective, an entity must disclose qualitative and quantitative information about:

- the amounts recognised in its financial statements for contracts within the scope of IFRS 17

- the significant judgements and changes in those judgements made when applying IFRS 17; and

- the nature and extent of the risks from contracts within the scope of IFRS 17.

It achieves this by:

- providing updated information about the obligations, risks and performance of insurance contracts;

- increasing transparency in financial information reported by insurance companies, which will give investors and analysts more confidence in understanding the insurance industry; and

- introducing consistent accounting for all insurance contracts based on a current measurement model

Although geared to the insurance industry itself, it must be remembered that it is a general standard for all companies and it is important that non insurance companies look carefully at their existing contracts to see whether they also meet the definition of insurance contracts and thus also have to apply the standard to those contracts.