Introducing Ireland’s newest Life & Pensions provider – AIB life by AIB

- 38% of people surveyed have no pension in place.1

- Almost 50% of men and 40% of women say the reason for not having a pension is that they just haven’t got around to organising it.2

Out of fear, people often choose to postpone purchase decisions. They see life insurance, pensions, and investments as being complicated; the products are viewed as complex and it’s difficult to know who to trust, often relying on advice from family and friends rather than speaking to an expert.

It is clear that customers do not know where to start. Perceived financial insecurity is a very real barrier to behavioural change. To overcome this, there is a really big role to play for the trusted accountant to support customers in taking the first step to meet with a qualified financial advisor. AIB has 120 qualified financial advisors across Ireland offering appointments from 8am to 7pm daily, backed by a customer support team in Letterkenny.

AIB life can be accessed through the AIB Mobile Banking app. Once customers have been suitably advised they can sign, store and manage their policies through the app 24/7.

With digital authentication, no paper signature is required.

AIB life’s vision is to help people on their path to financial security, one step at a time. Whether they are looking to prepare for retirement, put in place a safety net to protect loved ones or a business, or looking to maximise tax efficiency, we have the product offering, and the digital and in-person capability to support.

Given that we are coming up to the end of the tax year, we wanted to share some more detail about the new AIB life pension solutions. We have designed our new AIB life Personal Retirement Savings Account (PRSA) to be highly flexible, so you and your clients can decide when and how much to add, adapting your approach as circumstances change.

We want to give everyone the opportunity to save for retirement, regardless of their career or situation. So, whether your clients are employed, self-employed, directors, or not currently earning, our PRSA provides a simple and straightforward way to kick-start, ramp up, or maximise their retirement savings.

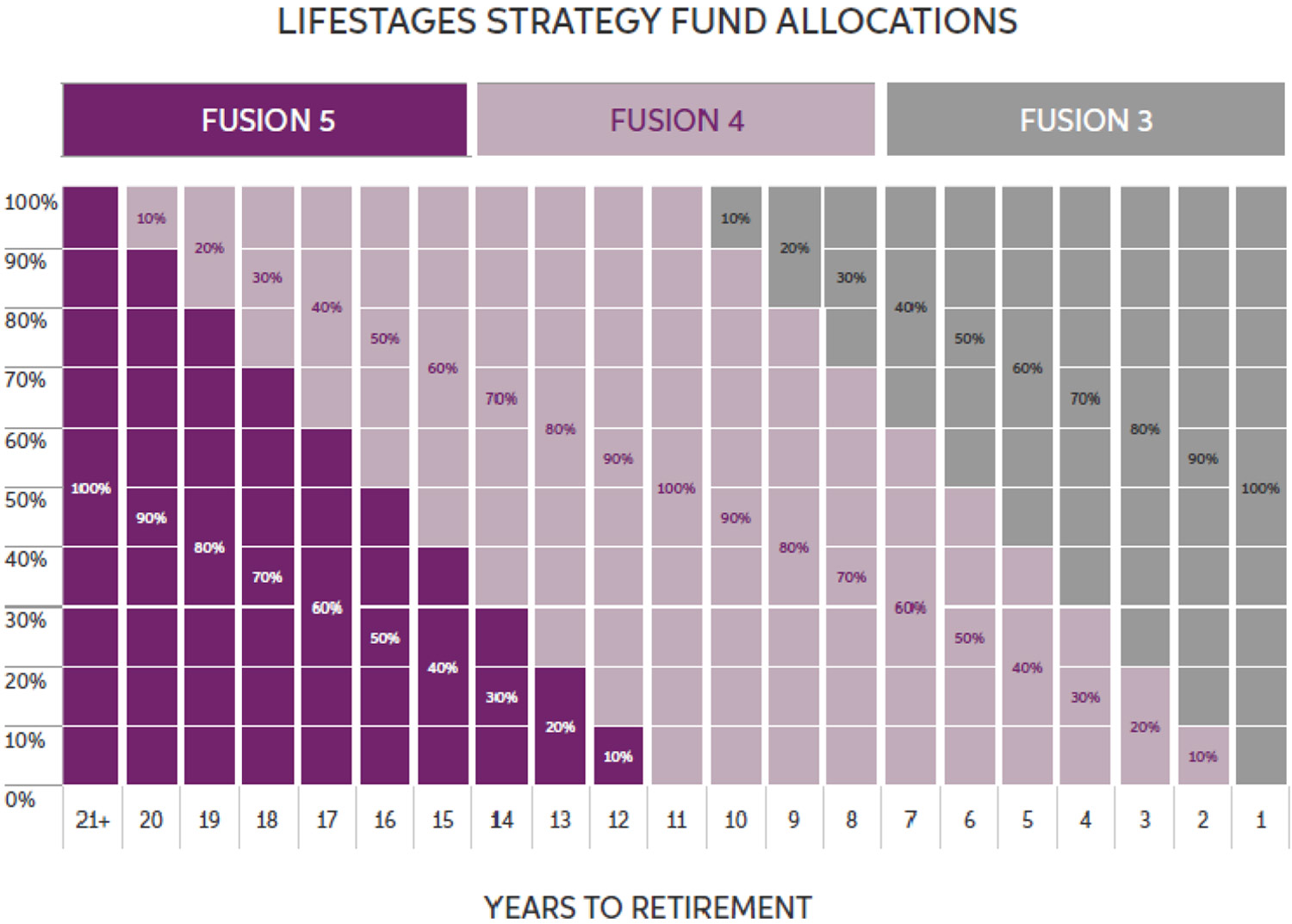

The Fusion fund range is the flagship multi-asset offering in the AIB life fund range. The underlying components have been strategically selected by the investment team at ILIM, in conjunction with AIB life, to invest in a broad range of diversified assets including equities, bonds, cash, alternatives, and property. The objective of the portfolio is to deliver long-term capital growth through diversified portfolios.

When building the Fusion fund range, our objective was to incorporate elements that would appeal to our customer base such as sustainability and risk management. We sought to provide a wide choice to suit different customer needs and, also wanted to include an innovative strategy that focused on future growth and trends.

We include further detail on the four elements of the Fusion fund range below:

Downside Protection: The Fusion fund range is highly diversified across asset classes, geographical regions, and sectors to ensure risk is spread across the portfolio. In addition, a risk management component is included, and the funds allocate between hedged and unhedged components.

Sustainability Focus: Supporting the transition to a net zero economy is a core value of the Fusion fund range and we believe that financial needs can align with having a positive impact on the world and society. We are continuously seeking to improve the sustainability of the fund range. The Fusion fund range is classified under Sustainable Finance Disclosure Regulation (SFDR) as Article 8 and also incorporates an Article 9 component which focuses on Climate Impact Equity.

Future Focus: An innovative and differentiated strategy focusing on megatrends is included in the Fusion fund range. This strategy focuses on growth-orientated megatrends in environment, technology, health and society. By concentrating on these future changes, we aim to diversify investments and generate attractive long-term returns.

move closer to retirement.

WARNING: The value of your investments may go down as well as up.

WARNING: This product may be affected by changes in currency exhange rates.

- CCPC PENSIONS RESEARCH 20 September 2022

- CSO Pension Coverage 2021

- Funds that promote environmental or social characteristics

- Funds that have sustainable investment as their objective