It is time for SMEs to jump on the tax advisory bandwagon by Matthew Leopold

Accountants are often the most trusted advisor to business leaders. The bigger accountancy firms were quick to take advantage of the need for premium advisory services and they are making big money.

The good news is that small to medium-sized firms can do the same. They are equally trusted by business leaders. They are probably providing advisory services already, but not charging for this advice.

Some specialist firms, such as Finerva, are already positioning themselves as being advisors first. According to Adam Brodie, the firm’s co-founder and CEO, venture capital investors and other accountancy firms with portfolio companies or clients seeking more specialist advice will often refer work to them.

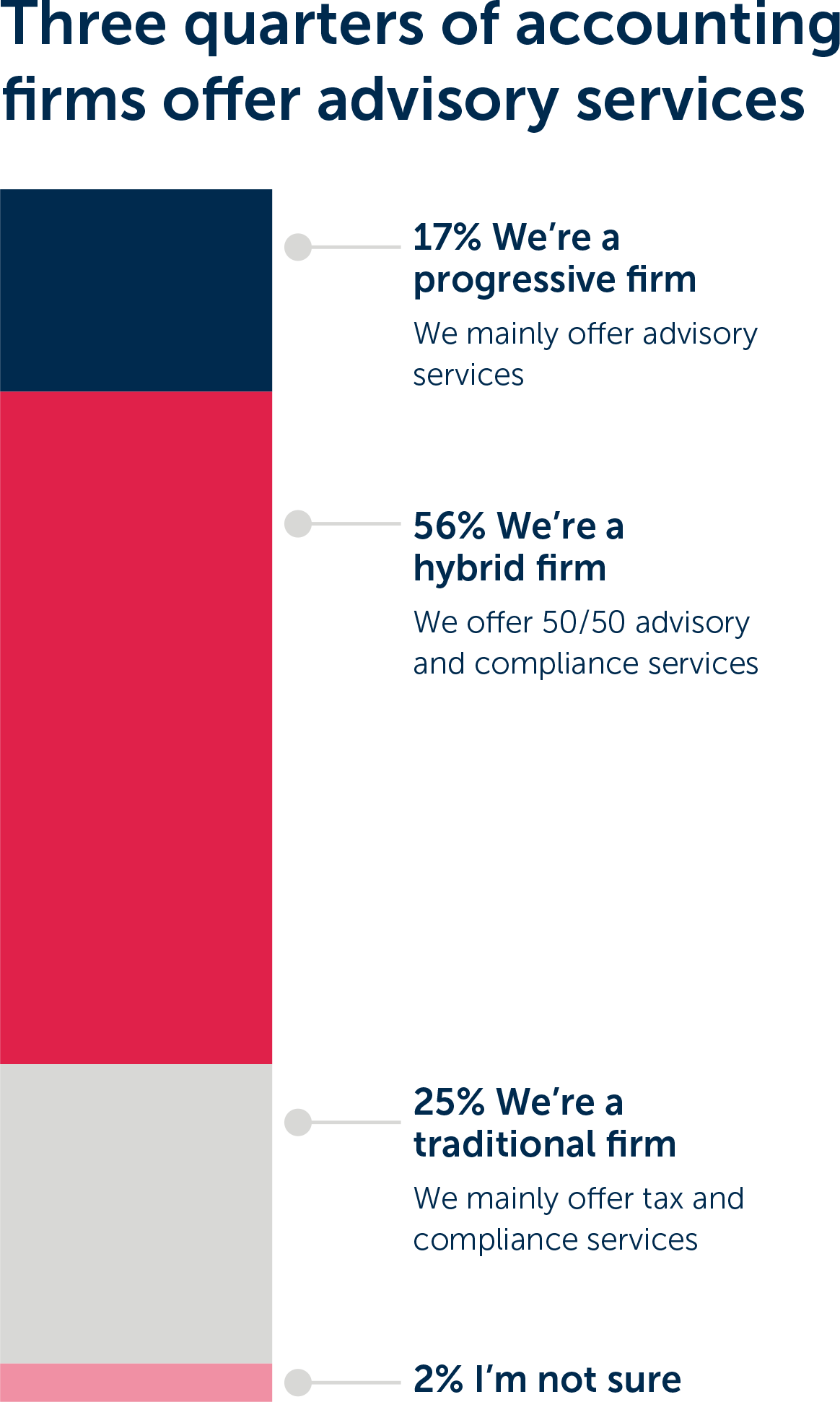

So, instead of fretting about the future of traditional compliance work, accounting firms are pivoting towards advisory services.

For accounting firm Grant Thornton UK, advisory matters now account for around two-thirds of their work, where previously compliance made up the bulk of work, says Karen Campbell-Williams, head of tax at Grant Thornton.

According to Key Facts and Trends in the Accountancy profession, for many of the top UK firms, non-audit services are now the biggest earners.

There is no reason why smaller and medium-sized firms can’t also pivot to advisory services and share the opportunity.

London-based Finerva is proof that smaller advisory firms can thrive by offering specialist or niche services that clients can’t find elsewhere. “It doesn’t come down to how big you are—we are referred work from one of the big four [accountancy firms], and we regularly win clients from top 10 firms,” says Brodie. “Professional services are about personal relationships; that is still king.”

“The tax world has become more and more complex, and the scale of the legislation is constantly growing and changing all the time,” says Campbell-Williams. “In order to be able to file a corporate tax return, there’s quite a lot of add-on advisory that clients need if they’re going to get that right.”

“When it comes to advisory work, it’s only ever going to be tailored and bespoke and specific, so it’s never going to be a commodity,” says Young. “So, while compliance is still ever so important and at the core of what we do, the real opportunities are more on the advisory side.”

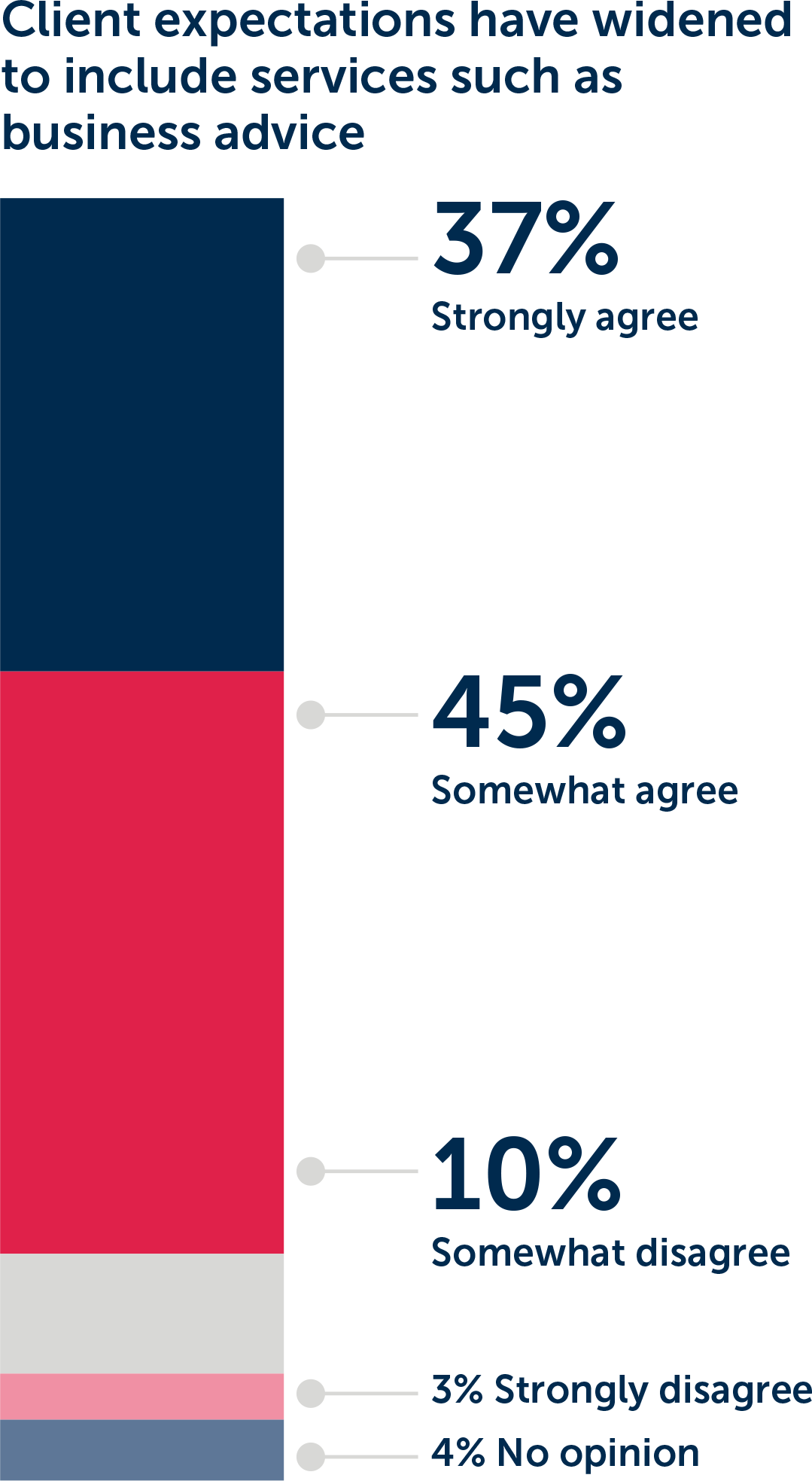

Some advice is simply an extension of compliance services. The demand for broader advisory services is only likely to increase as the business and tax environment becomes more complex.

The growth in remote working during the pandemic has also created greater demand for global mobility advice.

“There have always been expatriate tax and international tax issues, but it’s just that the way people have fallen into it has changed,” says Moniza Syeda, global mobility tax content manager at Tolley. “Rather than it being a planned secondment, or a specialised project where you need to go and work as an ex-pat with your special skills, now anybody can just get up and catch a plane and go and sit anywhere and do anything.”

In addition, demand for indirect tax advice is growing, particularly for companies that operate across borders, something that has become even more relevant in the wake of Brexit.

Demand for advisory services also increasingly extends beyond tax advice, including areas such as insurance and corporate finance.

“What we’re finding is that as we help our clients get bigger and bigger and more sophisticated, they inevitably need more advisory services as well as the standard compliance work,” says Young.

HURST is a medium-sized firm based in northwest England, principally in Manchester and Stockport; they have about 100 people across all lines of services. They started as a fairly traditional accountancy audit firm, but their specialist advisory teams have grown in the last six or seven years to be a significant part of the business.

Young said the impetus came from two sides. As clients gradually become larger and more sophisticated, they tend to have greater advisory requirements.

Internally, as people develop, they want more interesting work. So, bringing in interesting work makes the firm an attractive place to work.

“I’ve always felt that if we wanted to develop as a practice, you need to bring in this interesting work because the young, bright things coming into the industry, want this kind of work,” says Young.

There’s a financial imperative to that as well – compliance is becoming more commoditised, and therefore, it’s more about price. Whereas the advisory work is much more about value, what value does this piece of advice bring, rather than what does it cost?

The transition starts with one or two clients who need more complex advice. Then, you realise you can offer this service to others, and it becomes a virtuous circle where new skills grow from doing it.

Young says they still feel trepidation sometimes, but it’s “just a question of holding your nerve and being brave and having a bit of patience as well. The bigger firms have been doing this for 20 years, so you’ve just got to give it a bit of time to mature.”

He also warns that it is never going to be easy. With advisory work, from a financial point of view, you must go and find the work every day. There’s very little annuity or repetitive work. If you are an audit-only firm, you probably start with 75% of the business already booked. Whereas with advisory, you start at zero. So, it’s a challenge, but it’s a positive one.

On a practical compliance note, moving into advisory services can create potential liability issues. “Tax professionals need to be very careful that they’ve got their admin right in terms of their insurance and their liability,” says Moniza Syeda, global mobility tax content manager at Tolley.

Many do it as they feel it is the right thing to do. When advising clients on compliance, it is natural to advise them on tax reliefs and feed those into the tax return. Is that compliance or advisory?

“Many accountants undertake advisory work, but they don’t recognise it,” says Glenn Collins, head of policy, technical and strategic engagement at the Association of Chartered Certified Accountants. “What people have generally struggled with is the definition around advisory.”

Tax and accounting professionals often roll advisory into existing compliance work without having mechanisms to charge separately for that work.

Time to stop giving free advice!?

“Compliance is really important but make that breakpoint where you can when you’re looking at advisory work,” says Collins.

“Don’t be frightened of dipping your toe in the water and having a look at a lot of those [advisory] areas or asking yourself the question, how much advisory work have I given away in the past just because I’d regarded it as, or called it, something different.”

“It’s knowing when to stop that conversation before moving on to the next area,” says Collins. “A lot of the very sophisticated firms have that down to a fine-tuned art. But, for many of us who have been involved in compliance and advisory work over the years, we’ve all fallen into these traps of going that little bit further. That’s why it’s important to put in place a bit of discipline around moving from compliance to advisory.”

So, to start sharing in the advisory money, firms should be clearer about where compliance stops, and advisory starts and start charging for it.

Although many have moved to fixed fees for compliance work, charging for advisory services can be more challenging to price up since each job is unique. But clients like to know costs upfront instead of leaving the clock running.

“For advisory work, it has to be quoted on a bespoke basis because no two cases are the same,” says Brodie.

“We normally try and do fixed fees rather than hourly billing; we would only charge an hourly rate if we couldn’t get a handle on the scope or the amount of work, and perhaps they needed us to start work pretty quickly. But for the majority of work, we’re able to scope out a project and provide a fixed fee.”

Whatever way firms decide to bill clients, making it clear at the outset when something will be charged as advisory work rather than compliance will avoid potential disputes.

Of course, moving into advisory services is not for everyone. You might not want to rock the boat or risk losing existing clients. You may be making a good return and servicing your clients well by doing routine advisory work as part of your compliance service. That’s great!

But if you are ready to share in the advisory income stream, you can. Many smaller and medium-sized firms have done so very successfully. It is not a market reserved for bigger firms. You are only bound by the limits of your experience and ambition.

You can read the full Tolley report on Advicepower! How tax accountants can transition to advisory and other higher-value services, here.