SUSTAINABILITY

The IFRS Sustainability Disclosure Standards by Sheila Stanley

With the IFRS Accounting Standards being used by 168 jurisdictions worldwide, the hope is for the IFRS Sustainability Disclosure Standards to live up to “ushering in a new era of sustainability-related disclosures in capital markets worldwide” as described by the ISSB.

However, IFRS S1 has to be applied in conjunction with IFRS S2 when providing disclosures on climate.

On 24 July 2023, the ISSB published a comparison of the requirements of IFRS S2 and the TCFD. While IFRS S2 disclosures are consistent with the four core recommendations and 11 recommended disclosures of the TCFD, IFRS 2 does require additional disclosures and more detailed information, effectively making it ‘TCFD and more’. Nevertheless, companies that are already producing TCFD Reports are well placed to seamlessly transition to fulfilling the requirements of IFRS S2 disclosures.

Responding to stakeholder feedback during the consultation process, the IFRS Sustainability Disclosure Standards are interoperable with the European Sustainability Reporting Standards (ESRS), and this is reflected in the ISSB allowing for companies to consider the ESRS in the development of its sustainability and climate-related financial information.

IFRS S2 requires companies to use the Greenhouse Gas (GHG) Protocol: A Corporate Accounting and Reporting Standard (2004) when reporting on its GHG emissions unless required otherwise by a jurisdictional authority or an exchange on which the company is listed. Furthermore, IFRS S2 requires companies to disclose its Scope 3 GHG emissions, which are emissions in the value chain, following the descriptions found in the Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (2011) (See Figure 1).

- Purchased goods and services

- Capital goods

- Fuel-and energy-related activities (not included in scope 1 or scope 2)

- Upstream transportation and distribution

- Waste generated in operations

- Business travel

- Employee commuting

- Upstream leased assets

- Downstream transportation and distribution

- Processing of sold products

- Use of sold products

- End-of-life treatment of sold products

- Downstream leased assets

- Franchises

- Investments

What is clear for now is the following:

- Similarities between IFRS Sustainability Disclosure Standards and the ESRS

The IFRS Sustainability Disclosure Standards supports interoperability with the ESRS which effectively means that there is a reduction of duplication. This is done through the following means:

- Both the IFRS and the ESRS adopt the TCFD architecture, i.e., the disclosure structure of Governance, Strategy, Risk Management and Metrics and Targets.

- Both the IFRS and ESRS require reporting on the value chain.

- Where IFRS Sustainability Disclosure Standards differ from the ESRS

The following are the main ways in which the IFRS Sustainability Disclosure Standards differ from the ESRS disclosures as noted in Appendix V IFRS Sustainability Standards and ESRS reconciliation table published by EFRAG:

- The IFRS Sustainability Disclosure Standards uses an implicit approach, whereas ESRS uses an explicit approach in terms of identifying specific disclosure topics. For example, in ESRS S1 Own Workforce and ESRS S2 Workers in the Value Chain, the dimension of impacts is explicit, while in IFRS S1 these two areas are not explicitly stated but are implied as a source of risks and opportunities.

- A significant difference is that the IFRS Sustainability Disclosure Standards use financial materiality whereas ESRS uses double materiality as the filter for companies to determine whether a sustainability-related risk and opportunity is material. Information required under the IFRS Sustainability Disclosure Standards is focused on those investors required to make informed decisions on sustainability-related matters that affect the company’s prospects in terms of cashflow, access to capital and cost of finance.

The IFRS approach suggests that climate change is financially material for all companies regardless of size, geographical location or industry. The expectation is that considering the pervasive effect of climate change, the majority of companies – if not all – will be financially impacted in some way or other.

The findings of a 2022 survey conducted by the European Central Bank (ECB) on leading large and mostly multinational companies on the impact of climate change on economic activity and prices provides insights into how climate change and related adaptation and mitigation measures are affecting businesses.

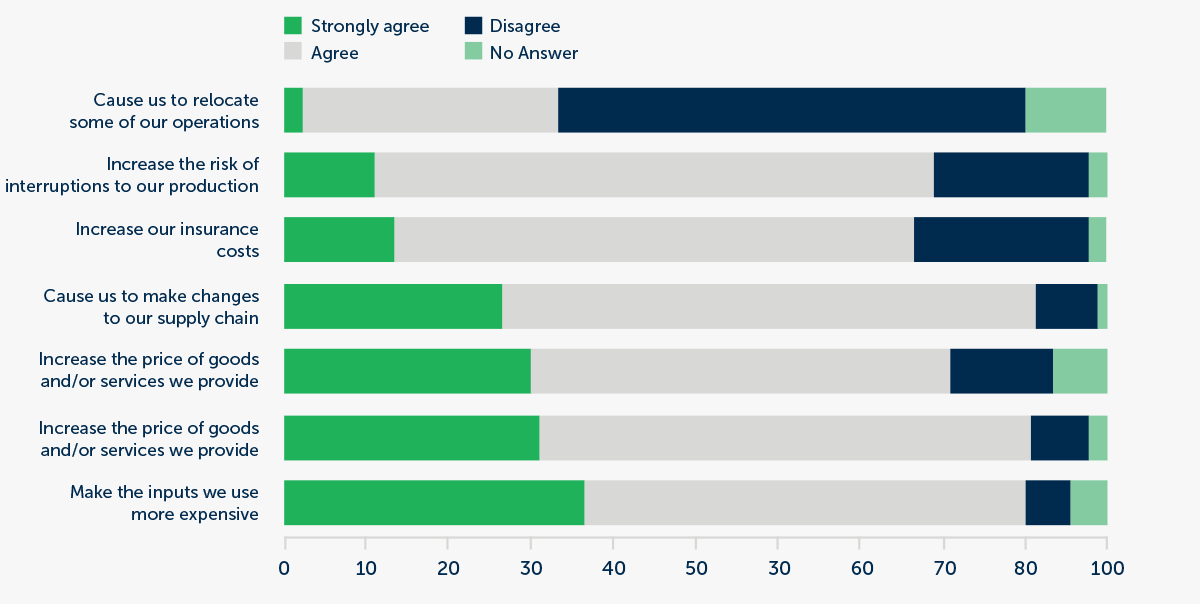

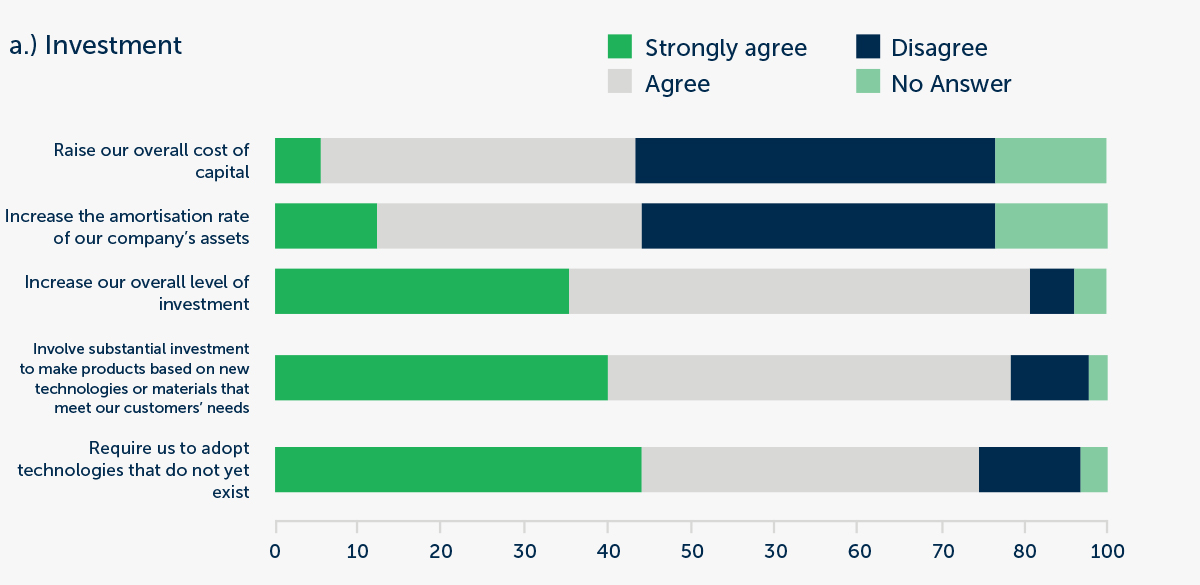

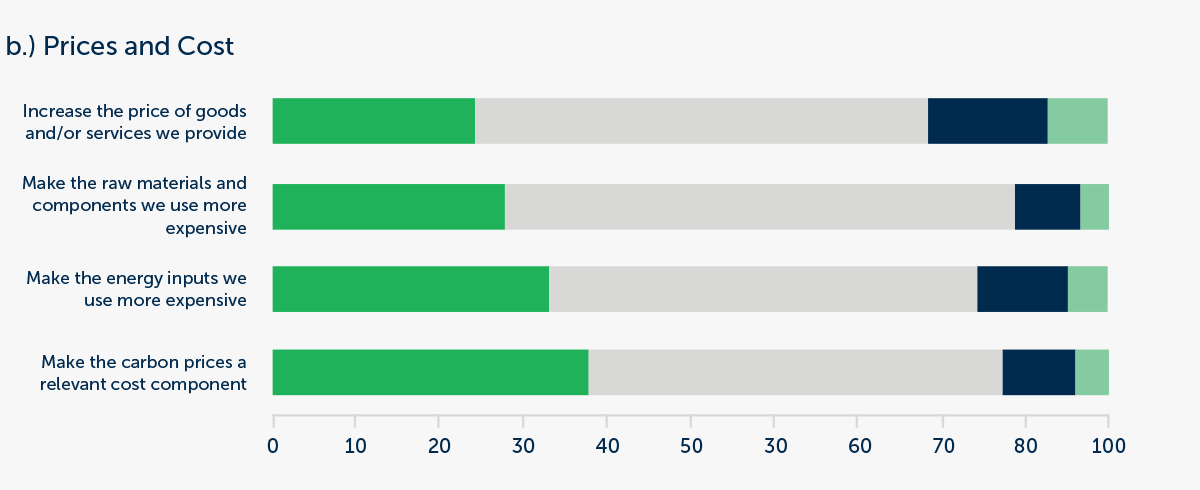

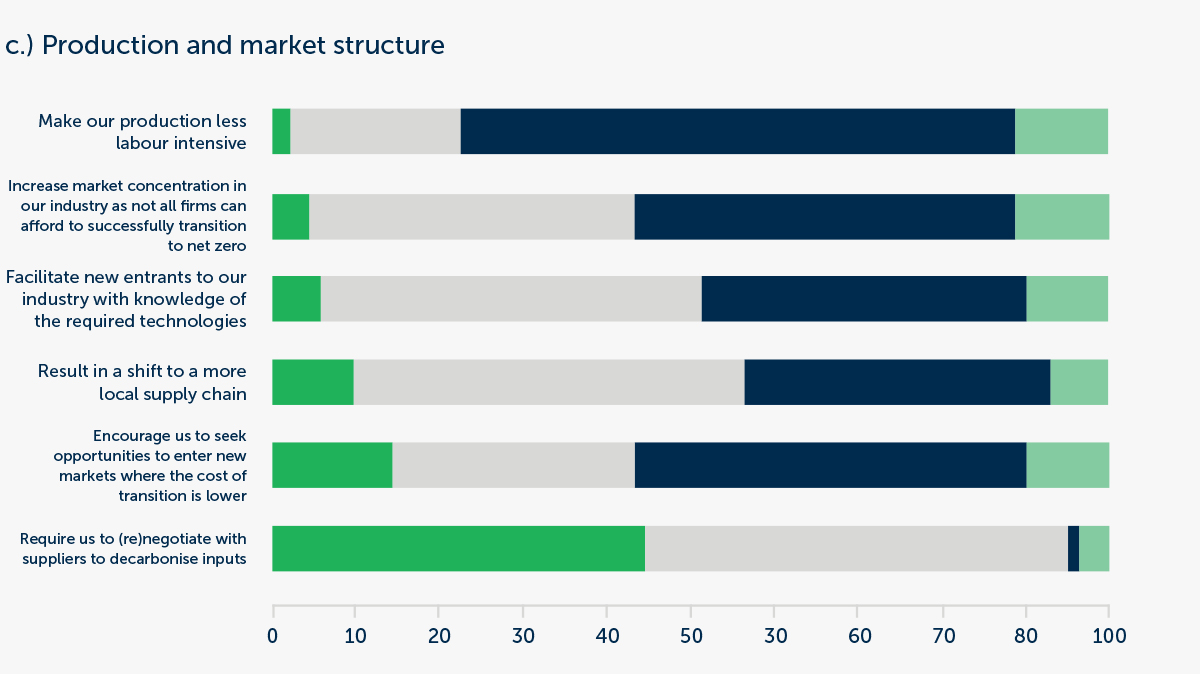

The survey found that most companies expect climate change and their firm’s adaptation to it to increase different types of cost pressure (See Figure 2). More than 90% agreed that climate change and their firm’s adaptation to it would require investment in new facilities or processes and changes to their supply chain, as well as make inputs more expensive.

It is clear that any changes in the supply chain of larger companies would impact SMEs in the supply chain, thus making it necessary for SMEs to also incorporate climate mitigation and adaptation related practices within their own organisations to remain profitable into the future.

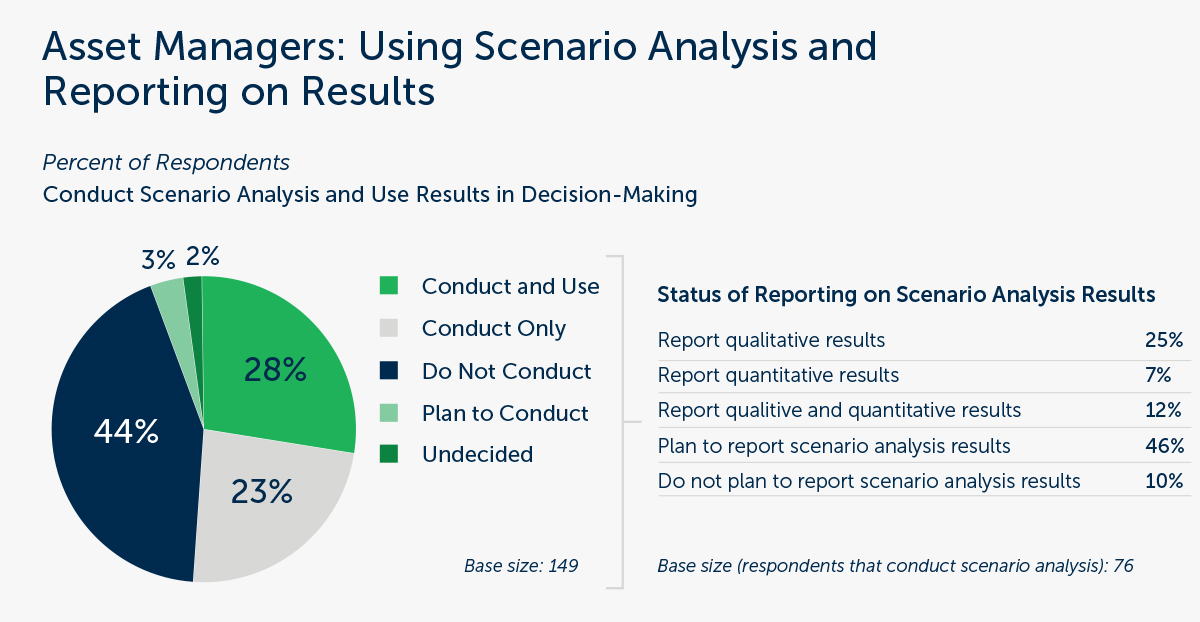

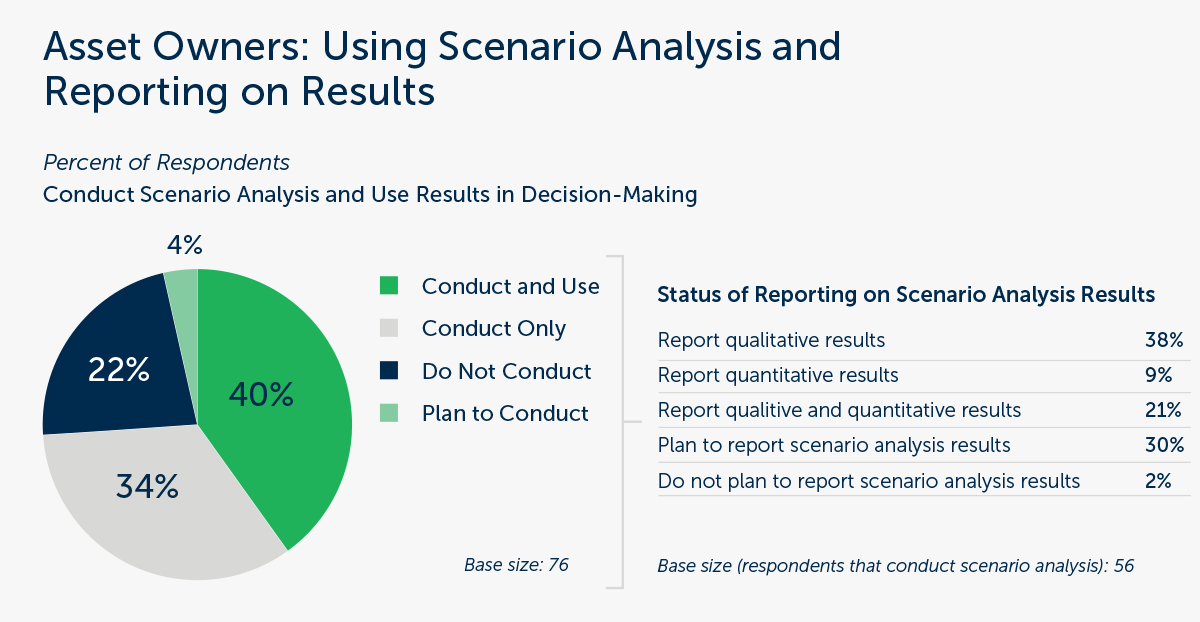

The question then is whether this requirement is too onerous for smaller companies. The point that is made by the ISSB and the TCFD with regards to scenario analysis is that it can be a tool for companies to use to inform and enhance critical strategic thinking. Considering the uncertainties associated with climate change, scenarios are a way for companies to explore alternative outcomes that may alter the basis for ‘business-as-usual’ assumptions.

- Evaluate internal systems and processes for collecting, aggregating and validating sustainability-related information across the company and the value chain.

- Consider the sustainability-related risks and opportunities that affect the business by applying the industry-based SASB standards.

- Review the ISSB’s standards and supporting materials, including the SASB Standards, CDSB Framework and TCFD Recommendations.

- IFRS. ISSB issues inaugural global sustainability disclosure standards. Available at: https://www.ifrs.org/news-and-events/news/2023/06/issb-issues-ifrs-s1-ifrs-s2/

- IFRS. Who uses IFRS Accounting Standards? Available at: https://www.ifrs.org/use-around-the-world/use-of-ifrs-standards-by-jurisdiction/

- Comparison IFRS S2 Climate-related Disclosures with the TCFD Recommendations. Available at: https://www.ifrs.org/content/dam/ifrs/supporting-implementation/ifrs-s2/ifrs-s2-comparison-tcfd-july2023.pdf

- Greenhouse Gas Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard (2011). Available at: https://ghgprotocol.org/sites/default/files/standards/Corporate-Value-Chain-Accounting-Reporing-Standard_041613_2.pdf

- Draft ESRS Appendix V – IFRS Sustainability Standards and ESRS reconciliation table. Available at: https://www.efrag.org/d?assetUrl=%2Fsites%2Fwebpublishing%2FSiteAssets%2FED_ESRS_AP5.pdf

- Financial Stability Board. FSB Roadmap for Addressing Financial Risks from Climate Change Progress report. Available at: https://www.fsb.org/wp-content/uploads/P130723.pdf

- IFRS. Proposed Taxonomy and comment letters: IFRS Sustainability Disclosure Taxonomy. Available at: https://www.ifrs.org/projects/work-plan/ifrs-sustainability-disclosure-taxonomy/proposed-taxonomy-cls-ifrs-sds/?utm_medium=email&_hsmi=268072821&_hsenc=p2ANqtz-9aCWjDwdkgxVUJPRuJ2djlX6rAlPl96XSdl_SUOHTr5YW2Wp-Uf3qUVunP2Qracb_Y3jD_xEJd3hldQP3Zu8eTTQAml4HR_HmBhqJSLvJzGJADXE4&utm_content=268072821&utm_source=hs_email

- Proposed IFRS Taxonomy. Available at: https://www.ifrs.org/content/dam/ifrs/project/ifrs-sustainability-disclosure-taxonomy/proposed-taxonomy/pt-cd-issb-2023-1-sustainability-taxonomy.pdf

- IFRS Survey on IFRS Taxonomy. Available at: https://ifrs.qualtrics.com/jfe/form/SV_b1tkOcILTYv0ghU

- IFRS. Feedback statement on IFRS Sustainability Disclosure Standards. Available at: https://www.ifrs.org/content/dam/ifrs/project/general-sustainability-related-disclosures/feedback-statement.pdf

- European Central Bank. The impact of climate change on activity and prices 0 insights from a survey of leading firms. Available at: https://www.ecb.europa.eu/pub/economic-bulletin/focus/2022/html/ecb.ebbox202204_04~1d4c34022a.en.html

- 2022 TCFD Status Report. Available at: https://assets.bbhub.io/company/sites/60/2022/10/2022-TCFD-Status-Report.pdf