IT

The surprising tech skills in demand for accounting and finance by Alan FitzGerald

The surprising tech skills in demand for accounting and finance

by Alan FitzGerald

From the days of using pebbles to represent data to double entry bookkeeping principles formalised by Luca Pacioli through to the advent of computerised technologies for finance and accounting, the skillsets required in accounting have evolved in manifold ways over the centuries whilst still holding to the solid foundational principles set down in the 16th Century.

These days you can also be assured that, along with death and taxes you can confidently add another absolute, technology obsolescence as being a surety in life.

Pacioli would be both astonished and – I suspect – incredibly flattered, that many of the concepts he drew up in the 16th Century remain today in play, albeit in a way where a lot of the ‘work’ now goes on behind the scenes.

Whether you are starting an accounting firm or business, are part of a team or looking to exit a business, one of my philosophies is that it is key to create the best environment for your team to process any work you do for your clients and ensure that the systems and skills required to keep ‘the ship afloat’ are maintained and updated appropriately.

Accounting remains one of the few professions where, if push came to shove, it could still be undertaken manually. Whilst it would not necessarily be a lot of fun i.e. to manage a large business in handwritten ledgers, it proves that the requirements are for an ever-increased level of knowledge of not only accounting systems and processes but how they operate and importantly, integrate.

How systems interact with other systems and getting the most out of them for the benefit of the user and the client understanding of that output is where I see key skillsets developing. Accounting systems have always produced lots of ‘data’ but getting access to this has often proved to be difficult, especially across disparate systems. In many circles data is touted as ‘The New Oil’.

On face value, this is arguably correct. But oil in its most basic form is called ‘Crude’ for a reason. To get anything of substance out of it, it must be refined otherwise, you just have a messy and slippery substance which in its raw form is quite useless – sound familiar?

Accountants in practice have vast amounts of this raw data available about and concerning their clients.

This may include all the compliance history, information on their ideal client, the consistently late payers, the profitable and those that could really benefit from some ongoing advice, etc if only they’d listen. It is to this group where I see certain skills being required.

The increase in the availability of data that can be gleaned from a wide array of sources within modern accounting systems has revolutionised the speed and delivery of information to teams, business leaders, clients, reporting authorities and more, to make the decision-making process more efficient and accurate than ever before.

In my opinion, Information is the new fuel distilled from the vast fields of crude data.

But to the uninitiated to be faced with this seemingly endless stream of raw data can also be a peril.

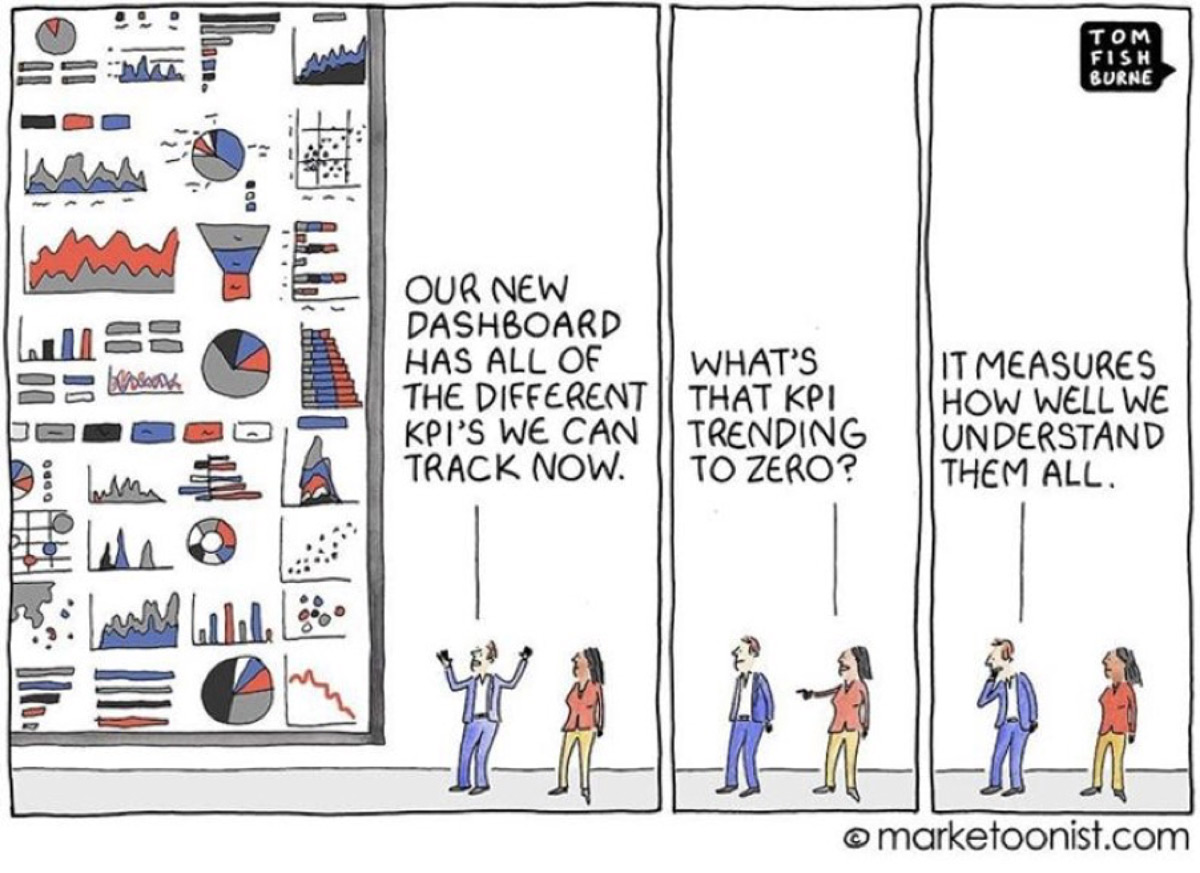

Enter the proliferation of graphical representation tools designed ‘to make your life easier…’. If only it were that simple.

Most business owners/entrepreneurs do not have accounting backgrounds and are therefore reliant on accounting firms to assist and guide them through what can be for the uninitiated an often-burdensome compliance quagmire. Richard Branson, who created the Virgin global empire, recounted a story where at the age of 50, he revealed in a board meeting, that he did not understand the difference between gross & net profit. It shows that the lack of knowledge never stopped him and that he had a good team around him too! His CFO subsequently explained it using a fishing net analogy and he now proudly boasts that he knows the difference!

Accountants speak a very special ‘language’ which frankly most are not interested in learning. This is where your ‘Anxiety Transfer Specialist’ services come into play. Take the pain to do with business structures, finance plans, compliance obligations, and more, away so that the client can focus on what they need to do, and they will be your most loyal advocates.

The skill of being able to interpret and translate the vast array of financial information available to you into meaningful insights that clients can action is the gold. If firms deliver stale reports, bunches of numbers etc, most clients will probably politely nod and leave and just go back to what they were doing, satisfied that they have tried…

Consider a doctor prescribing you this: “Deglute 1,000Mg of Acetylsalicylic acid in solid form with two parts Hydrogen and one part Oxygen and make contact with yours truly ante-meridian via a system for transmitting voices over a distance using wire or radio, by converting acoustic vibrations to electrical signals”.

That is a technical word salad when all it really means is “Take two aspirin with water and call me in the morning…”

Complex financial discussions with an entrepreneur without a finance background will often meet with blank stares. Understanding how to deliver good and bad news in a way that reflects their level of understanding is a term I call KYA – Know Your Audience.

If an accounting firm can interpret the manifold data which leads to key understandable information also known as the ‘Explain it to me like I’m five years old’ theory, I believe that they can choose who they want to work with from the line of people/companies wanting to work with them. I was once present at a Big4 partners meeting where one partner suggested that the “best & brightest” may not be beneficial to them if they couldn’t talk to a client.

Oscar Wilde once quipped ‘I’m not young enough to know everything’. As we see a new generation of accountant enter the market, using these solutions is becoming their realm and expertise. Many of them will have an almost innate knowledge of data and systems and their skills are increasingly being acquired by accounting teams to interpret the vast amounts of tax and financial data. Coming from an environment where almost everything in their private lives is connected from the world being on their watches to the interconnectivity of their social media platforms to summoning an Uber to take them to anywhere in a seamless, cashless transaction.

The firms that are cognisant of this fact are the ones to which these and future generations of worker will be attracted as they are used to being in a connected world. It becomes imperative that firms match their technology to the new accountants’ expectations to also be ‘connected’ but in my experience many firms are not.

In my experience from dozens of one-on-one interviews with team members it is quite common for newer members of a firm to question processes from an IT perspective as their frustration levels with what can be done outside of the firm is not reflected in the ‘professional’ environment.

Unfortunately, given the size of the market, the range of software for an accounting firm compared to the overall market, is very limited. It is highly bespoke, and most products follow a set of guiding principle/concepts drawn up in the 1990s as to how they operate.

There will also always be a perpetual battle between balancing the needs of a firm to produce work, and the reports required to cater and satisfy the wide range of clients, especially where, through the democratisation of technology, clients can often be more technologically advanced than the accounting firm that services them.

An area that has changed is the market for the end services, particularly reporting where data can be extracted by software into visual representation. This market has grown significantly and now has a wide variety of software(s) available.

Excel will never disappear and is a readily accessible solution. It is the mainstay of all accounting firms, but it is neither the best at representing data nor the sharing of data, particularly to a less-skilled recipient. PowerBI is rapidly becoming the go-to solution for firms looking to cater to a wide audience of clients and scenarios. The challenge with PowerBI is that, like learning guitar it appears to be quite easy to pick up initially, but as most find out, it is very hard to master. This is where tapping into the companies that offer ‘out of the box’ reporting solutions such as Futrli or Syft* are often easier paths to tread, at least initially; these utilise a template approach to reporting so that reports can be generated quickly and with little effort.

Leonardo Da Vinci is quoted to have said that ‘Simplicity is the ultimate in Sophistication’, and many of these solutions are incredibly useful and as per the cartoon above can provide great insight into a business, if used wisely.

But it is in the delivery of the information to the recipient in a format which is easy to understand that is more important than ever and that has become the surprising and sought-after element. The rare mixture of technical, accounting and ‘soft-skills’.

If a firm gets that combination right, then like the fabled mousetrap, the world will beat a path to their door.

* You can learn more about these and other solutions on CPA Irelands Digitalisation Hub

Alan has 30 years experience in technology, nearly 23 of those just in Tax and accounting software. In 2015, based on demand from accounting firms, he established Practice Connections Advisory and offers independent and technology agnostic advice to firms big and small in practice management, workflow, tax, document management and reporting solutions options.