December 2022

17 Harcourt Street,

Dublin 2, D02 W963

T: 01 425 1000

F: 01 425 1001

Unit 3,

The Old Gasworks,

Kilmorey Street,

Newry, BT34 2DH

T: +44 (0) 28 3025 2771

W: www.cpaireland.ie

E: cpa@cpaireland.ie

Patricia O’Neill

Chief Executive

Eamonn Siggins

Editorial Adviser

Róisín McEntee

Technical Adviser

Laurence D’Arcy

Ciara Durham

T: 086 852 3463

E: accountancyplus@gmail.com

Published by

Nine Rivers Media Ltd.

E: gary@ninerivers.ie

CPA Ireland is committed to continuing to support our members who, as accountants, are once again at the forefront of meeting these challenges. The work that you do to ensure the survival of the SME sector in Ireland in particular is exemplary and inspiring. As a Financial and Strategic Business Advisor to SMEs, I am very proud to belong to the CPA Ireland community.

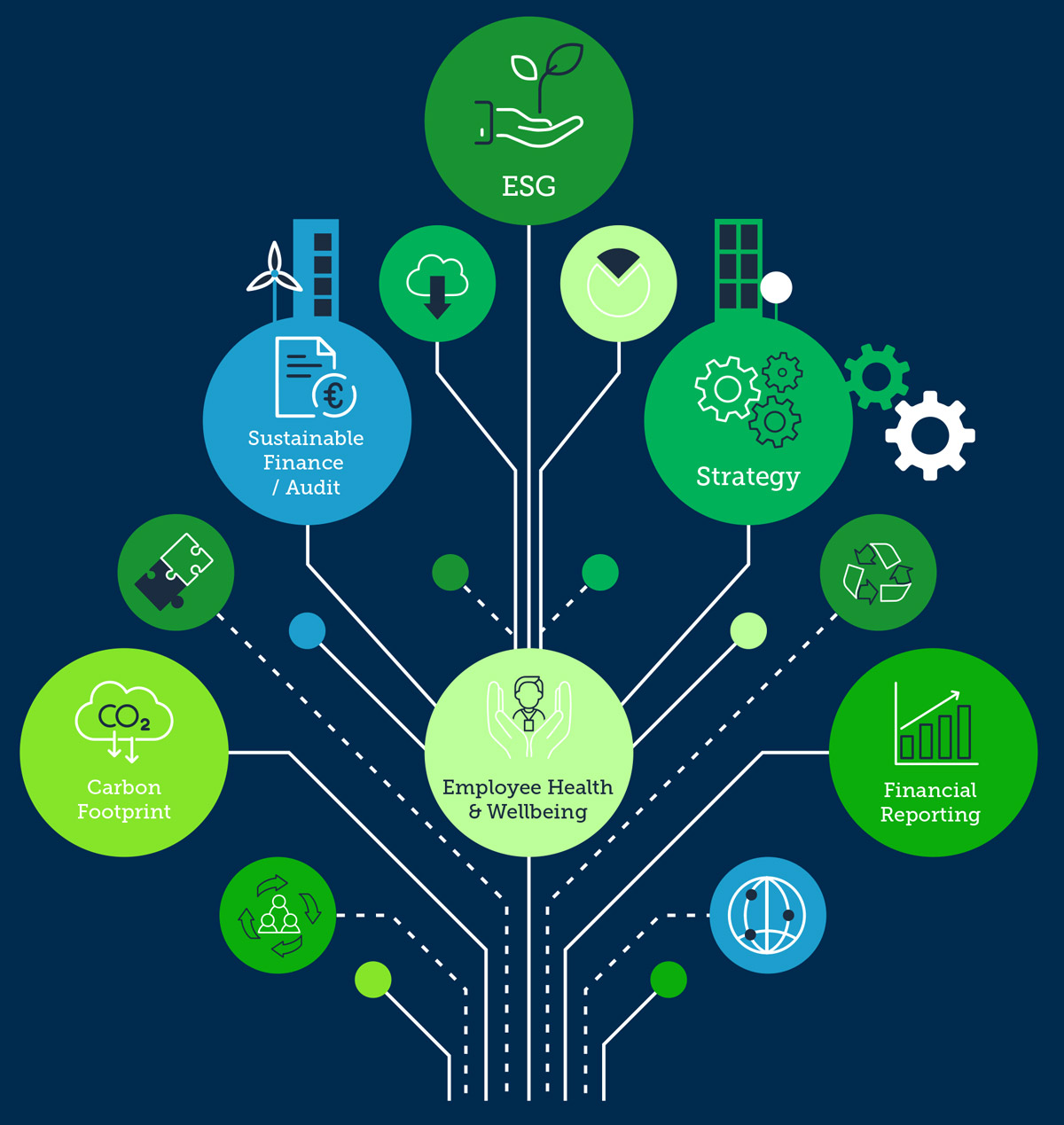

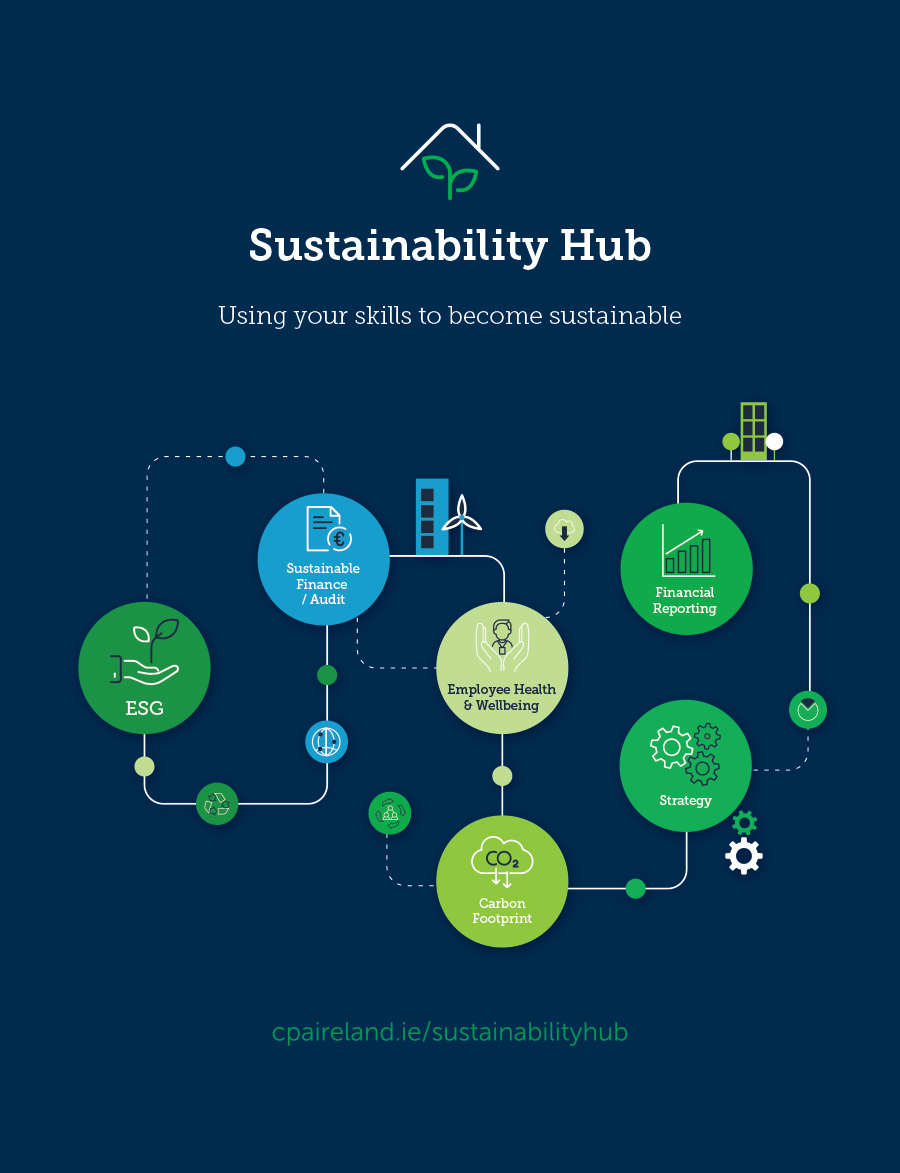

CPA Ireland is working towards becoming a fully sustainable organisation and we are committed to supporting our members on their own journeys to sustainability. In October 2022, CPA Ireland Skillnet launched a Sustainability Hub as we continue to expand our resources to take account of more of the United Nations’ 17 Sustainable Development Goals. This is an interactive and practical Sustainability Hub to help guide our members and students to develop sustainability strategies for business.

CPA Profile

In Practice

The Importance of Understanding Financial Literacy on Family Farms by Dr John Noah & Professor Teresa Hogan

Financial Literacy on Family Farms

With financial literacy being widely perceived as the solution to creating individual financial responsibility and contributing towards the stability of the economic system, there has been a significant increase in research measuring personal financial literacy across the world with studies generally finding widespread low levels along with significant heterogeneity within populations.

Surprisingly, there has been much less attention on financial literacy in micro and small enterprises (MSEs). In an Irish study,1 81% of owner managers stated that financial literacy was important, however only 46% thought they had a good level of financial literacy. Owner-managers were reluctant to address this weakness for a variety of reasons including a lack of time, the cost of training, inappropriate methods of training or believing it was not their responsibility but rather their accountant’s. These findings, and the lack of research in comparison to personal financial literacy, suggest there is still a lot learn about financial literacy in MSEs.

CPA Profile

Estée Bekker

Estée Bekker

Company: The Kenworth Group, South Africa.

Qualifications: Post-graduate diploma: Professional Accountant in Practice

Bachelor of Commerce: Majoring in Cost and Management Accounting

Professional Memberships: CPA, SAIPA, SAIBA

The hours required by the medical field proved to be too much with a small baby who needed his mother. I decided to leave the profession altogether and move over to the finance industry. But being the determined person I am, I decided that if I am going to make this change, I am going to do it thoroughly and to the best of my ability. When my son was 12 weeks old, I started my accounting internship whilst studying for my degree online.

CPA Profile

Alan Cosgrave

Alan Cosgrave

Company: MNP LLP

Qualifications: FCPA, CFSA, CICA

FINANCIAL REPORTING

Financial Reporting News

For reporting periods ending on or before 31 December 2021, the war is considered to be a non-adjusting event. As the Russian invasion occurred after the reporting date, the effects of the conflict should not be reflected in the financial statements, other than by disclosing the effect of the non-adjusting event were material.

For reporting periods ending on or before ending 24 February 2022 the consequence of the invasion becomes adjusting events and preparers must consider how sanctions and related effects could impact their financial statements, for example uncertainties regarding going concern, Impairment of assets, the effect expected for irrecoverable debts for receivables , classification of liabilities as current versus non-current and additional disclosures regarding assumptions.

In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future, which is at least, but is not limited to, twelve months from the date when the financial statements are authorised for issue. For example, for the year ending 31 December 2021, even though the significant impact on the financial statements occurred after year-end, management will need to consider the appropriateness of preparing financial statements on a going concern basis and will need to take into consideration the existing and expected effects of the current situation on the entity’s activities, if the effects of the invasion are so significant that an entity’s management has determined it intends to liquidate the entity or cease trading, or that there is no realistic alternative but to do so, then the financial statements would not be prepared on a going concern basis (FRS 32.7A), even though the event occurred after the period end.

Events after the end of the reporting period both favourable and unfavourable, that occur between the end of the reporting period and the date when the financial statements are authorised for issue should be disclosed disclosed as non-disclosure would affect the ability of the users to make proper evaluations and decisions.

There are two types of events those that provide evidence of conditions that existed at the end of the reporting period (adjusting events after the end of the reporting period)and) those that are indicative of conditions that arose after the end of the reporting period (non-adjusting events after the end of the reporting period (FRS 102.32.2).

If events are deemed to be adjusting events an entity shall adjust the amounts recognised in its financial statements, including related disclosures, to reflect adjusting events after the end of the reporting period. (FRS 102.32.4). If events are deemed to be non-adjusting events an entity shall not adjust the amounts recognised in its financial statements after the end of the reporting period. (FRS 102.32.6) these events are disclosed were material

European accounting enforcers priority areas for 2022 financial statements by Maurice Barrett

European accounting enforcers priority areas for 2022 financial statements

by Maurice Barrett

The European Securities and Markets Authority (ESMA) publishes a paper in October each year highlighting areas that EU accounting enforcers will focus on when examining companies’ annual financial statements. While the ESMA paper is prepared with listed companies in mind, the messages therein are equally relevant to a much wider range of companies.

The Irish Auditing and Accounting Supervisory Authority (IAASA) contributes to ESMA’s activities in the accounting enforcement arena through its participation in the ESMA-sponsored European Enforcement Co-ordination Sessions (EECS). With responsibility for the coordination of supervision of almost 4,500 issuers listed on the regulated markets in the EEA preparing IFRS financial statements, EECS constitutes the largest regional accounting enforcers’ network with supervision responsibilities for IFRS.

Law & Regulation News

Protected Disclosures Legislation

From 1st January 2023 the Protected Disclosures (Amendment) Act 2023 will commence.

The Act updates the Protected Disclosures Act 2014 and transposes the EU Whistleblowing Directive into Irish law.

From 1 January 2023, the Act will:

- Broaden the scope of the Protected Disclosures Act 2014 in relation to reporting of breaches of European Union law.

- Include protections for board members, shareholders, volunteers, unpaid trainees and job applicants who make a protected disclosure.

- Require organisations with more than 50 employees to have policies and processes for protected disclosures.

- Reverse the burden of proof for penalisation cases. This means the employer will need to prove that any alleged penalisation was not a direct result of the employee making a protected disclosure.

The new Office of the Protected Disclosures Commissioner will also commence operations on 1 January 2023.

Right to Request Remote Work to be introduced through Work Life Balance Bill

The Tánaiste and Minister for Enterprise Trade and Employment, Leo Varadkar T.D., and the Minister for Children, Equality, Disability, Integration and Youth, Roderic O’Gorman, T.D., together agreed that amending the Work Life Balance Bill is the most efficient and practical way to introduce the right to request remote work to all workers.

Hybrid Working – Here to Stay by Laura Graham

This type of working arrangement is most commonly known as hybrid working, but is also referred to as agile working, blended working or split-working. In response to market demand, many employers have implemented hybrid working for employees with roles suitable for hybrid working. There is a general recognition that failure to offer hybrid working may result in increased employee turnover and limitations on the ability to attract and retain talent in the future.

This is reflected in the 2022 National Remote Working in Ireland Employee Survey (“the National Remote Working Survey”) which found that, of employees surveyed who changed employer since the pandemic, 47% said remote working was a key factor in their decision.

Finance & Management News

Central Bank and Indeed research indicates wage growth increase in early 2022

The Central Bank of Ireland has published an Economic Letter “Wage Growth in Europe: Evidence From Job Ads”. It draws on data from millions of job postings on Indeed to present a new monthly wage growth tracker, examining trends in posted wages across France, Germany, Ireland, Italy, the Netherlands, Spain, and the UK.

The Letter finds that posted wage growth accelerated sharply in the first half of 2022 before easing slightly in the third quarter. In the six-euro area countries analysed, wage growth reached 5.2% year-on-year in October, more than three times the pre-pandemic rate, while growth in the UK was 6.2%, double the pre-pandemic rate, and appears to have peaked at this level. For individual euro area countries, October wage growth was highest in Germany (7.1%), followed by France (5.0%), Ireland (4.7%), Italy (4.2%), Netherlands (4.0%) and Spain (3.5%).

Early signs are that wage growth in job ads has plateaued at these historically high levels and actually fallen in some countries. Combined with gradually declining job postings in certain countries, this suggests that some employers are starting to rethink their demand for labour as they balance the currently tight labour market against an increasingly uncertain and deteriorating economic outlook.

Tánaiste and Minister for Enterprise, Trade and Employment, Leo Varadkar, and Michael McGrath, Minister for Public Expenditure and Reform have announced details of the new €200 million Ukraine Enterprise Crisis Scheme.

There will be two streams of funding under the Scheme to assist viable but vulnerable firms of all sizes in the manufacturing and internationally traded services sectors. The first stream will assist firms suffering liquidity problems as a result of Russia’s war on Ukraine, and the second stream will also help those impacted by severe rises in energy costs.

The Tánaiste also confirmed that the Cabinet has approved the publication of legislation to unlock up to €1.2 billion in low-cost loans to SMEs and small mid-caps (up to 500 employees) under the Ukraine Credit Guarantee Scheme. It will open before the end of the year and provide low-cost unsecured working capital for SMEs and primary producers to help them to spread the increased input costs and limit disruption to supply chains.

Remote Working Guidance

The Department of Enterprise, Trade and Employment has included on its website guidance on working remotely to assist workers and businesses.

The website acts as a central access point bringing together State guidance, legislation, and advice in a single location. It is a live resource which is regularly updated as new guidance is published.

Leadership Insight: Eoin McGettigan

Company: Port of Cork Company Ltd.

I’m a chartered accountant by profession, have an MBA and am a Fellow of the Chartered Institute of Management Accounts.

Prior to joining the Port of Cork Company in 2020, I held senior board positions in Musgrave PLC as Chief Executive of Supervalu and Centra. I also fulfilled the role of Group Finance and Operations Director of Dunnes Stores and CEO of Lifestyle Sports.

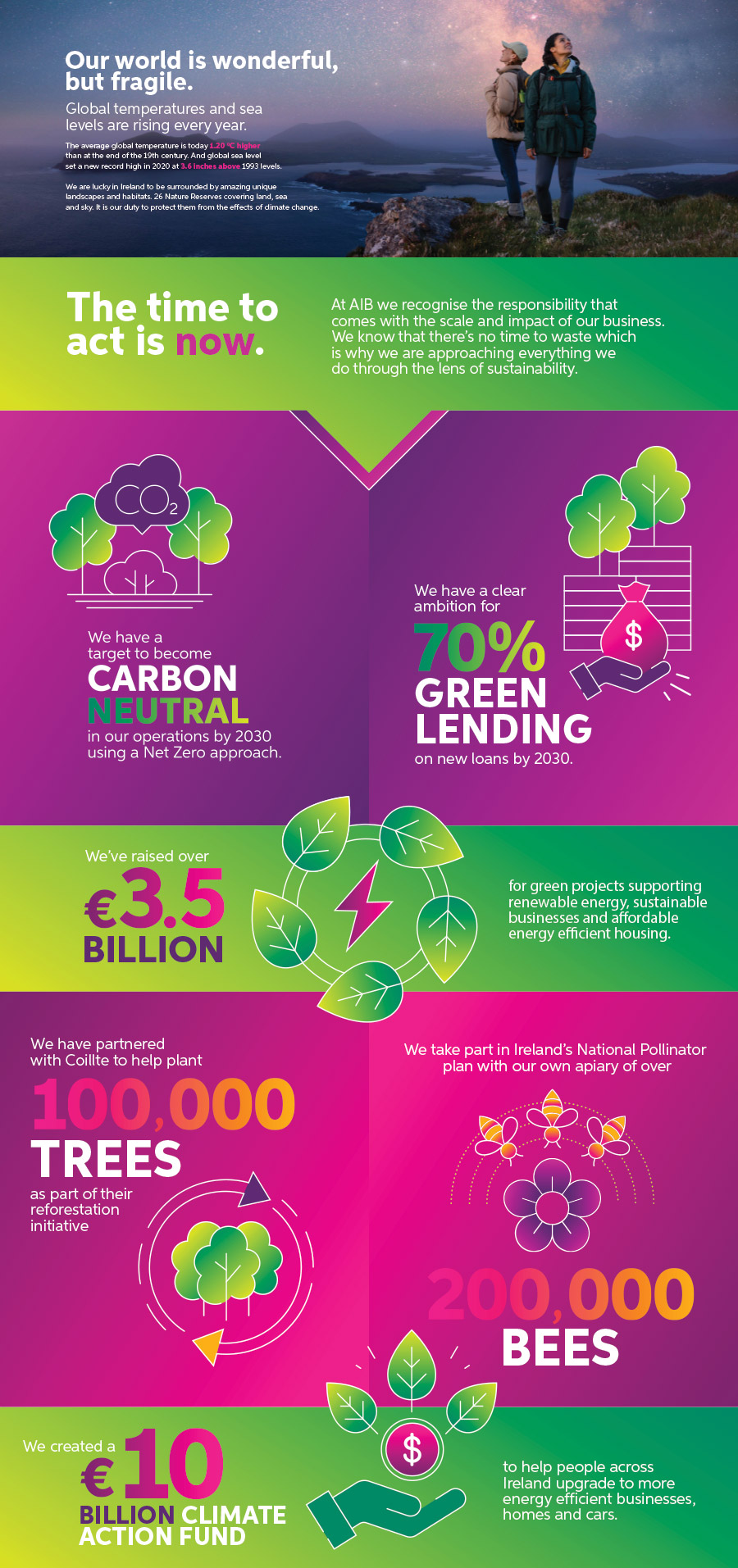

Sustainability programmes by AIB

When asked about their progress on implementing measures to address climate change, 34% of businesses reported they are only beginning to do so and have a long way to go, while 6% don’t know where to start. Businesses listed “upfront investment costs” as the leading barrier for their organisations to act more sustainably, with 55% of businesses mentioning it as a barrier. Less than half (46%) of organisations with more than 250 employees plan to spend over €100,000 on sustainability over the next two years, and 51% of all organisations plan to spend less than €40,000. Other barriers included uncertainty of return on investment (38%) and a lack of clear sector guidelines or advice (35%).

How to implement a successful outsourcing strategy into your accountancy practice by Jimmy Sheehan

Achieving balance isn’t just a goal for busy season. It can be difficult to grasp opportunities when we have little capacity or lack the skill to leverage and it’s hard to upscale fast to meet lucrative demands, more so when the employment market is buoyant.

There is an answer to this capacity problem though. Industry and technology advances mean that Outsourcing is now an excellent way to create an organisational culture of agile responsiveness without compromising on company values or sacrificing quality.

Transforming Sustainability into a Competitive Advantage by Anna Stella

Nielsen conducted a study in 60 countries to determine the potential effect of CSR. Out of the 30,000 consumers studied, 66% said they would pay more to brands that prove to be socially responsible. In another US-based study, Cone Communications found that 87% of Americans are willing to spend more on something if they see a company engaging in issues they care about. In essence, sustainability initiatives are a win-win for businesses. According to HBR, companies’ primary motivators to create CSR programs are sustainability, moral obligations, reputation, and operating license.

CSR is a great way to do good for the world while growing profits. Here are the top reasons why a company should incorporate sustainability in its long-term marketing strategy.

Taxation News

Taxation News

Section 8 sets out the:

- Circumstances in which Revenue withdraws tax exemption from charities and sports bodies, and

- The processes that are in place to do this.

Source: www.revenue.ie

To avail of the extension, the business must already be eligible for warehousing. The extension applies to the Period 1 end date for all taxes that the customer has warehoused, so if a customer has all the eligible taxes warehoused (VAT, PAYE (Employer), IT, TWSS, and EWSS) then all these taxes will get the extension for periods up to the end of April 2022. Under the terms of the extension, businesses concerned could continue to warehouse tax liabilities up to 30 April 2022, including the April PAYE Submission (due 14 May 2022) and the March/April VAT Return (due 19 May 2022). The warehoused liabilities can remain ‘parked’ on an interest free basis for a 12-month period until 30 April 2023 (this is “Period 2 – the zero-interest phase”). At that point, the debt can be paid in full, interest free, or alternatively be paid on a phased basis over a suitable timeframe at a reduced interest rate of 3% per year (“Period 3”).

The extension does not apply to businesses which were not in receipt of one of the relevant COVID-19 support schemes up to April 2022. This means that the warehousing periods are unchanged for those businesses: Period 1 ended on 31 December 2021; Period 2 began on 1 January 2022 and will end on 31 December 2022; and Period 3 will commence on 1 January 2023

Properties that were liable for LPT in 2022 were charged LPT based on the valuation of the property as ay 1 November 2021. This valuation date will be used for residential properties for the period 2022 to 2025. Properties which are now newly liable for LPT in 2023 will need to be valued as if they had existed on 1 November 2021.

Properties are newly liable for LPT if they satisfy either of the following conditions:

- If it is a newly constructed residential property completed after 1 November 2021 and before 1 November 2022.

- If the property has come to be lived in or become suitable for use as a dwelling after 1 November 2021 and before 1 November 2022.

Finance Bill 2022 by Mairéad Hennessy

There were no changes made to tax rates for 2023. The standard income tax rate will remain at 20% and the higher rate at 40%.

The Standard Rate Cut Off Points (SRCOPs) for 2022 have been increased as follows:

Balance @ 40%

Balance at 40%

Balance @ 40%

Balance at 40%

Balance @ 40%

Balance at 40%

Balance @ 40%

Plus an amount equal to the lower income (subject to a maximum of €31,000)

Balance at 40%

In Practice News

The primary purpose of this paper is to provide preparers, auditors and users of financial statements with information to encourage discussion as to whether issuers adequately consider the appropriateness and completeness of climate-related disclosures provided in financial reports.

Given that climate-related matters are of interest to a broad range of stakeholders, IAASA has examined and will continue to examine companies’ financial statements to ensure that there is consistent treatment of climate-related information between the financial statements and information published elsewhere by the issuer (e.g., in the management report, in market announcements and in separate sustainability reports).

The annual renewal of practising certificates is reliant on compliance with CPD requirements. Members in Practice and Members working in Professional Offices are required to complete 120 hours over a three-year CPD cycle of which 75 hours are structured and 45 hours are unstructured CPD.

Get Proactive with the ISQM 1 and Ten Top Tips for Audit Firms by John McCarthy

and Ten Top Tips for Audit Firms

It’s never too late to meet the deadline and our message is: don’t despair. There is still time to get ready, although it’ll mean setting aside dedicated Audit Partner and senior audit staff time to achieve this. Regulators will be looking for clear evidence of progress by the end of 2022 and certainly by this time in 2023 when firm’s compliance with the standard will come under intense scrutiny.

Visible Expertise for Professional Services – Why and Where to Start by Mary Cloonan

In order to stay ahead of the curve and be top-of-mind for potential clients, professional services need to focus on building visible expertise. But what exactly is visible expertise? And how can professional services go about acquiring it?

Understanding a problem is most of the battle! by Alan Nelson

So, if you feel a particular situation is causing you difficulties, it’s important to find out as much about the situation as possible so that you can pinpoint and define the problem.

There are four steps you can follow to do this:

- Summarise the issue in one sentence.

- Think about why this is a problem.

- Understand the nature of the problem.

- Write a problem statement.

Let’s look at each of these steps in turn.

IT

Can cloud accounting help your sustainability and bottom line? by Alan Connor

Whatever your sector, cloud accounting can be both the means to support your sustainability aspirations, and indeed the end result in itself.

The UN World Commission on Environment and Development in 1987 defined sustainability as “meeting the needs of the present without compromising the ability of future generations to meet their own needs.”

The nature of True-Cloud solutions is that they are designed to revolutionise how you see and consume your IT. To provide an “any device-any browser” fully scalable approach. Future generations will see our historic reliance on sever rooms and physical servers in the same vein we now consider electricity on demand compared to having our own generators, or water on demand compared to our own water pumps. The next stage in evolution is to consume our technology on demand.

True-Cloud challenges us to consider a future without local servers, local infrastructure, UPS, switches, expensive cabling, with vastly reduced capital IT hardware spend, reduced IT obsolescence, and finally no more dusty rooms full of old PC’s and equipment.

IT

The surprising tech skills in demand for accounting and finance by Alan FitzGerald

The surprising tech skills in demand for accounting and finance

by Alan FitzGerald

From the days of using pebbles to represent data to double entry bookkeeping principles formalised by Luca Pacioli through to the advent of computerised technologies for finance and accounting, the skillsets required in accounting have evolved in manifold ways over the centuries whilst still holding to the solid foundational principles set down in the 16th Century.

These days you can also be assured that, along with death and taxes you can confidently add another absolute, technology obsolescence as being a surety in life.

Pacioli would be both astonished and – I suspect – incredibly flattered, that many of the concepts he drew up in the 16th Century remain today in play, albeit in a way where a lot of the ‘work’ now goes on behind the scenes.

Whether you are starting an accounting firm or business, are part of a team or looking to exit a business, one of my philosophies is that it is key to create the best environment for your team to process any work you do for your clients and ensure that the systems and skills required to keep ‘the ship afloat’ are maintained and updated appropriately.

IT

Due Diligence: Still vitally necessary to protect your business needs by Martin Dubbey

Don’t be a victim of fraud

by Martin Dubbey

Increasingly due diligence is seen by many as a necessary hardship in order to ‘tick box’ compliance enquiries. Whilst satisfying the regulator of this activity, companies and indeed individuals should not lose sight of the importance of more in-depth enhanced due diligence to satisfy themselves they are dealing with genuine and legitimate business interests. The growing number of frauds that we see, is an indicator that not everyone is learning this lesson.

Hardly a day goes past without receiving warnings about record numbers of victims of fraud, new fraud schemes, and how fraudsters are adapting their techniques in order to enhance the sophistication of their scams.

This was recently highlighted under Operation Skein, the gardaí investigation into the notorious Black Axe crime network who focussed on email fraud, targeting individuals abroad and laundering up to €64 million in Ireland with the help of 4000 money mules.

With the growing difficulties in the financial sector, discussions around enhanced cybersecurity, insider threats and the deepening financial crisis the growth in fraud is likely to become part of our daily consideration, which of course it should be. The financial losses experienced by victims are increasing, as too is the lesser discussed psychological impact.

IT

How FinTech will revolutionise the Accountancy industry by Patrick Horgan and Paul Moore

by Patrick Horgan and Paul Moore

What is the best way to view the seemingly endless innovative technologies coming on stream in the accountancy industry? Curiosity, rather than scepticism, might be the approach to take. After all, it is always much easier to continue doing things as we always have instead of embracing change. The embracing of change, despite the challenges that come with it, is where we will find improvements and advancements in how we operate.

As a rule, technology should be viewed as supporting, not replacing, accountants. It is understandable that worries might exist in relation to skills like creative problem solving being removed, but instead it should be viewed as an opportunity to enable accountants to do more valuable work. Leave technology take care of monotonous or time-consuming jobs and focus on being more creative or collaborative. Most of the tasks that can be handed over to technology are ones that could be automated, and the truth is, forward thinking organisations have always favoured automation.

It is important to note the success of FinTech in accountancy to date before we look at any future impacts. The implementation of cloud-based accounting and bookkeeping has radically changed how accountants manage and interact with their clients. This was especially relevant during Covid-19 when firms had to adapt and operate remotely during the pandemic. Indeed, it has become such a mainstay of the industry over the last twenty years that we probably take it for granted.

INSTITUTE

Institute News

Institute News

CPA Ireland Skillnet launches Sustainability Hub

In recent years, climate and weather catastrophes, environmental disasters, legislation and regulation, consumer demand, the investor perspective and the views of all stakeholders in the business ecosystem have dramatically shifted sustainability from a theme to an action item at the heart of every business.

Under the agreement, members in good standing of either body will be considered for membership by the other body. Members wishing to practice public accounting will be required to meet the specific regulatory and legal requirements in each jurisdiction.

CPA is one of the best-known international accounting designations and Irish professional qualifications are held in high regard worldwide.

CPA Ireland and CIIA Partnership

Members of CPA Ireland now have the option to join the Chartered Institute of Internal Auditors by passing the online CIA challenge exam and satisfying the qualifications for good standing.

Deirdre McDonnell and Gillian Peters

Both Deirdre and Gillian can reflect on their achievements with pride.

Have you paid your Annual Subscriptions?

View Cart is a good place to check. For Practice Firms, you should check any fees charged to firm.

Budget 2023 – CPA Ireland Response

Commenting on the announcement of Budget 2023 Áine Collins welcomed the creation of the Business Energy Support Scheme: “Just as every household in Ireland is experiencing soaring energy costs this is a growing concern for many SMEs. The new BESS scheme will be an extremely welcome support and assist businesses with the short-terms pressures. However, it is key that this scheme is easy to access and does not rely on arduous red tape which time poor SMEs will struggle to complete.

CPD News

CPD News

Sustainability Hub

Sustainability reporting will not be confined to large companies, and we are already seeing SMEs being asked to verify their sustainability credentials within the supply chain of larger companies and when tendering for public contracts.

Women in Business – Celebrating Women

We are looking forward to once again hosting one of our favourite events, Women in Business, this December. Women in Business 2022 is taking place in Cork on 7th December and in Dublin on 15th December.

We are excited to introduce you to our speakers including Niamh O’Shaughnessy, Design Skillnet and Fiona Buckley, Steps to Success with Trish O’Neill, CPA Ireland, chairing the events. A key benefit of these events is the opportunity to network with fellow members, speakers and CPA Staff members. We look forward to seeing you there.

End of CPD Cycle

Practice:

- 75 structured hours

- 45 unstructured hours

Industry:

- 60 structured hours

- 60 unstructured hours

For our newer members who have qualified in the past two years your CPD requirements are calculated on a pro rata basis.

CPD Wrap Ups

The CPD Wrap Up 2022 will take place online on 13th & 14th December.

Key Event Details:

Time: 9.30am – 4.40pm each day

CPD Credit: 16 hours for both days

Student News

Special congratulations to our prizewinning students who each achieved first place in their CPA examinations in 2022 (April and August sittings).

Please note, the final date for submission of any training completed in 2021 or 2022 will be 31 January 2023. After that date it will only be possible to submit training for 2023 onwards.

Students who submit their training as required will receive feedback from the Institute highlighting any issues to ensure that every student is on track to meet the Institute’s requirement in terms of depth and breadth of training.

Trainees who do not comply with the requirement to log their training each quarter, may find that although they have more than three year’s relevant experience, they are unable to apply for membership on completion of examinations, as they do not have sufficient training logged and accepted by the Institute.

on the Key Dates page of the CPA Ireland website.

This shows, for example timetables for 2023 examinations (April and August), exam registration deadlines, training submission deadlines, as well as information for students who hope to apply for membership in 2023.

Information & Disclaimer & Publication Notices

Accountancy Plus is the official journal of the Institute of Certified Public Accountants in Ireland.

It acts as a primary means of communication between the Institute and its Members, Student Members and Affiliates and a copy is sent automatically as part of their annual subscription. Accountancy Plus is published on a quarterly basis.

The Institute of Certified Public Accountants in Ireland, CPA Ireland is one of the main Irish accountancy bodies, with in excess of 5,000 members and students. The CPA designation is the most commonly used designation worldwide for professional accountants and the Institute’s qualification enjoys wide international recognition.

The Institute’s membership operates in public practice, industry, financial services and the public sector and CPAs work in over 40 countries around the world.

The Institute is active in the profession at national and international level, participating in the Consultative Committee of Accountancy Bodies – Ireland – CCAB (I) and together with other leading accountancy bodies, the Institute was a founding member of the International Federation of Accountants (IFAC) – the worldwide body. The Institute is also a member of Accountancy Europe, the representative body for the main accountancy bodies The Institute’s Offices are at 17 Harcourt Street, Dublin 2, D02 W963 and at Unit 3, The Old Gasworks, Kilmorey Street, Newry, BT34 2DH.

The views expressed in items published in Accountancy Plus are those of the contributors and are not necessarily endorsed by the Institute, its Council or Editor. No responsibility for loss occasioned to any person acting or refraining to act as a result of material contained in this publication can be accepted by the Institute of Certified Public Accountants in Ireland.

The information contained in this magazine is to be used as a guide. For further information you should speak to your CPA professional advisor. Neither the Institute of Certified Public Accountants in Ireland or contributors can be held liable for any error, or for the consequences of any action, or lack of action arising from this magazine.

Disciplinary Tribunal – Invest/09/20

At a disciplinary tribunal hearing held on 1 September 2022, the following charge of misconduct was proven in relation to Member Anne Cunningham, Clane, Co. Kildare in accordance with bye law 6.5.1(e) in that in the course of carrying out her professional duties, she provided or purported to provide financial services in connection with a matter in which she had been engaged by a client and it is alleged that those services were inadequate and were not of the quality that could reasonably be expected of her.

Misconduct is established that the member was engaged by a client to complete the financial statements for her company and to file these with Companies Registration Office and Revenue Commissioners along with the associated returns and personal tax returns. The returns were not filed by the Member which resulted in the client incurring late filing fees with Companies Registration Office and loss of audit exemption.

The Tribunal ordered that the Member:

- Be reprimanded

- Be fined €3,500

And contribute €2,500 towards the Institute’s costs (payable over 36 months)

The Tribunal also ordered those details of these findings and orders be published in Accountancy Plus with reference to Anne Cunningham by name.

Disciplinary Tribunal – Ref: Invest/09/21

At a disciplinary tribunal hearing held on 11 May 2022, the following charges of misconduct were proven in relation to Michael Joseph Cronin (Member) of 1 Terenure Place, Terenure, Dublin 6w, in accordance with:

- Bye law 6.5.1(e) in that in the course of carrying out his professional duties, he provided or purported to provide financial services in connection with a matter in which he had been engaged by a client and those services were inadequate and were not of the quality that could reasonably be expected of him; and

- Bye Law 6.5.1 (f) in that he performed his professional duties inefficiently or incompetently to such an extent, or on such a number of occasions, as to bring discredit to himself, the Institute and the Profession of accountancy.

That the following charges of misconduct are proven in relation to Cronin & Company (Firm) of 1 Terenure Place, Terenure, Dublin 6w in accordance with:

- Bye law 6.6.1(e) in that in the course of carrying out its professional duties, it provided or purported to provide financial services in connection with a matter in which it has been engaged by a client and those services were inadequate and were not of the quality that could reasonably be expected of it.

- Bye Law 6.6.1 (f) in that it performed its professional duties inefficiently or incompetently to such an extent, or on such a number of occasions, as to bring discredit to itself, the Institute and the Profession of accountancy

Misconduct is established in that a client of the Firm, invested through the Firm in a tax efficient holiday home scheme in or about 1992 and the Member and Firm failed to adequately explain and/or account to the client for the rental income from the investment, its location, the tax status of the income generated, its structure, the partnership agreement, authority to expend funds on behalf of the partnership, to account for any distributions made to other partners, including the sums, dates of distribution, and failed to make distributions to the client as a partner.

The Tribunal imposed the following Orders:

In relation to Michael Cronin:

- Severe Reprimand

- Fine €10,000

In relation to Cronin & Company:

- Reprimand

- Fine €10,000

And a contribution towards the Institute’s costs of €7,188.

In accordance with bye law 6.32.1 (f) the Tribunal imposed the following conditions:

- That the Member and Firm be prohibited from holding a Client Account and any funds remaining in the client account be transferred to a duly authorised law firm to manage.

- That the Member and Firm facilitate and co-operate with a practice review to be conducted by the Institute with a focus on the movements in the Client Account.

- That the Member and Firm prepare full annual statements of rental income and expenditure for all the properties held in the holiday home scheme for each year from 2000 to June 2022.

- That the annual statements of rental income and expenditure be sent by the Member or the Firm to each of the Investors in the holiday home scheme and each one be advised in writing of the basis on which the fund has been managed to date and the basis on which it is intended to manage the fund in the future and include relevant material in relation to the tax treatment of the fund.

- That none of the financial implications of any of the sanctions imposed in this case be imposed on the client account or on the investors concerned.

The Tribunal also ordered those details of these findings and orders be published in Accountancy Plus with reference to Michael Cronin and Cronin & Company by name.