Conducting a Scenario Analysis by Sheila Stanley

Climate-related scenario analysis is a tool that enhances critical strategic thinking and allows companies to explore alternatives that may significantly alter the basis for ‘business-as-usual’ assumptions.

Conducting a climate scenario analysis may seem a daunting task for companies that are doing it for the first time. The good news is that IFRS S2 has provisions for proportionate reporting in relation to climate scenario analysis.

Specifically, it states that when conducting a climate-related scenario analysis, companies are to consider the skills, capabilities, and resources, both internal and external, available to them in determining an appropriate approach to use. It also states that the company should conduct the analysis without undue cost and effort.

As such, companies can use publicly available climate-related scenarios from authoritative sources that describe future trends and a range of pathways to plausible outcomes. IFRS S2 also refers to documents published by the TCFD, including the ‘Technical Supplement: The Use of Scenario Analysis in Disclosure of Climate-related Risks and Opportunities (2017)’ and ‘Guidance on Scenario Analysis for Non-Financial Companies (2020)’, which companies can refer to as sources of guidance.

Companies are required to consider scenarios that are aligned with the Paris Agreement. The following are some of the main publicly available climate-related scenarios that companies can consider using:

- Intergovernmental Panel on Climate Change (IPCC) Scenarios

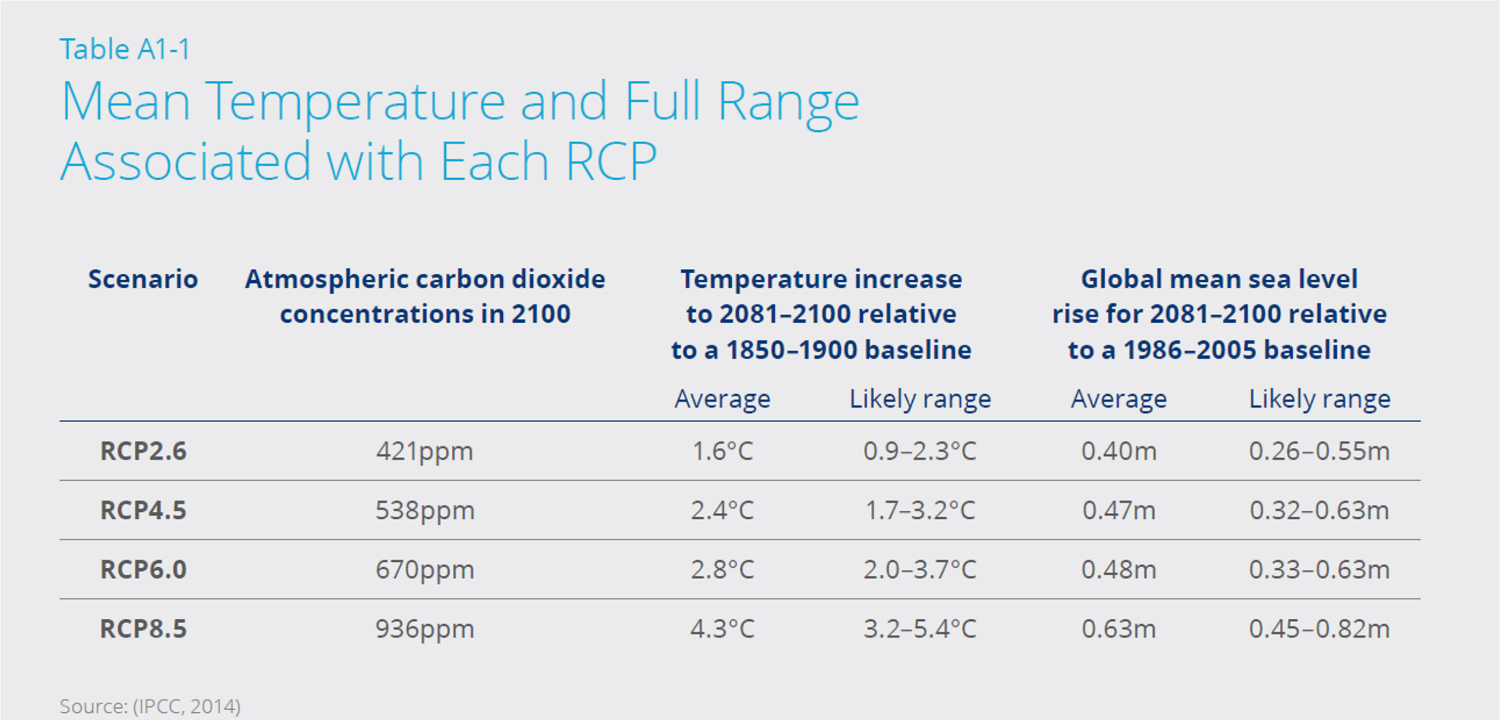

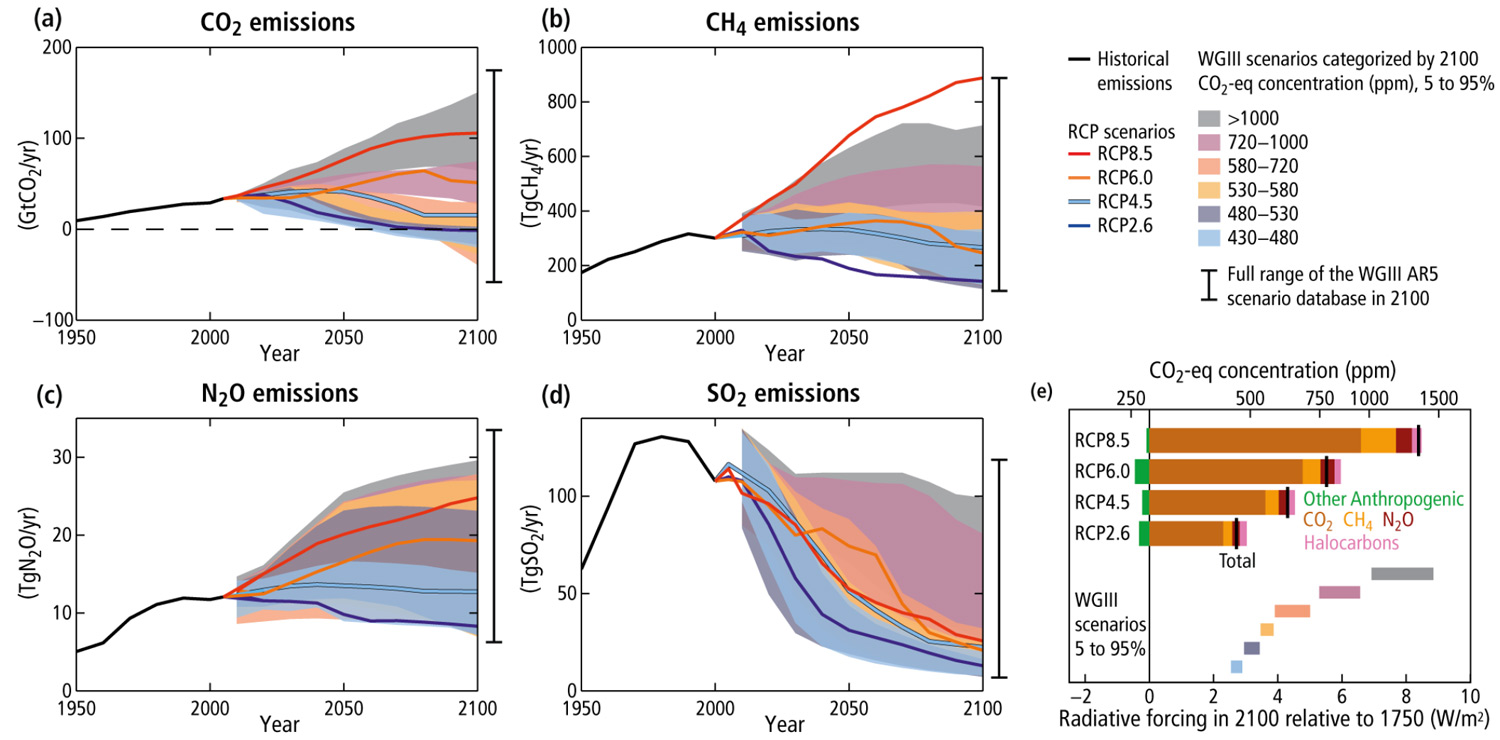

The IPCC scenarios are generally used to identify physical risks arising from climate change.

The two key IPCC scenarios are the Representative Concentration Pathways (RCPs) and Shared Socioeconomic Pathways (SSPs) scenarios.

- RCP2.6 – a stringent pathway that requires carbon dioxide emissions to start declining by 2020 and reach zero by 2100.

- RCP4.5 – an intermediate scenario where emissions peak around 2040, then decline thereafter.

- RCP6 – emissions peak around 2080, then decline thereafter.

- RCP8.5 – the most extreme of the pathways, it assumes that emissions continue to rise throughout the 21st century.

As for the SSPs, there are five alternative socio-economic futures that have been mapped as follows:

- SSP1: Sustainability – Taking the Green Road (Low challenges to mitigation and adaptation)

The world gradually but pervasively shifts towards a more sustainable path, emphasising more inclusive development that respects environmental boundaries.

- SSP2: Middle of the Road (Medium challenges to mitigation and adaptation)

The world follows a path in which social, economic, and technological trends do not shift markedly from historical patterns, with uneven development and income growth between countries.

- SSP3: Regional Rivalry – A Rocky Road (High challenges to mitigation and adaptation)

Resurgent nationalism, concerns about competitiveness and security, and regional conflicts push countries to increasingly focus on domestic, or at most, regional issues.

- SSP4: Inequality – A Road Divided (Low challenges to mitigation, high challenges to adaptation)

Highly unequal investments in human capital, combined with increasing disparities in economic opportunity and political power, leading to increasing inequalities and stratification across and within countries.

- SSP5: Fossil-fuelled Development – Taking the Highway (High challenges to mitigation, low challenges to adaptation)

Increasing faith in competitive markets, innovation, and participatory societies to produce rapid technological progress and development of human capital as the path to sustainable development.

- International Energy Agency (IEA) Scenarios

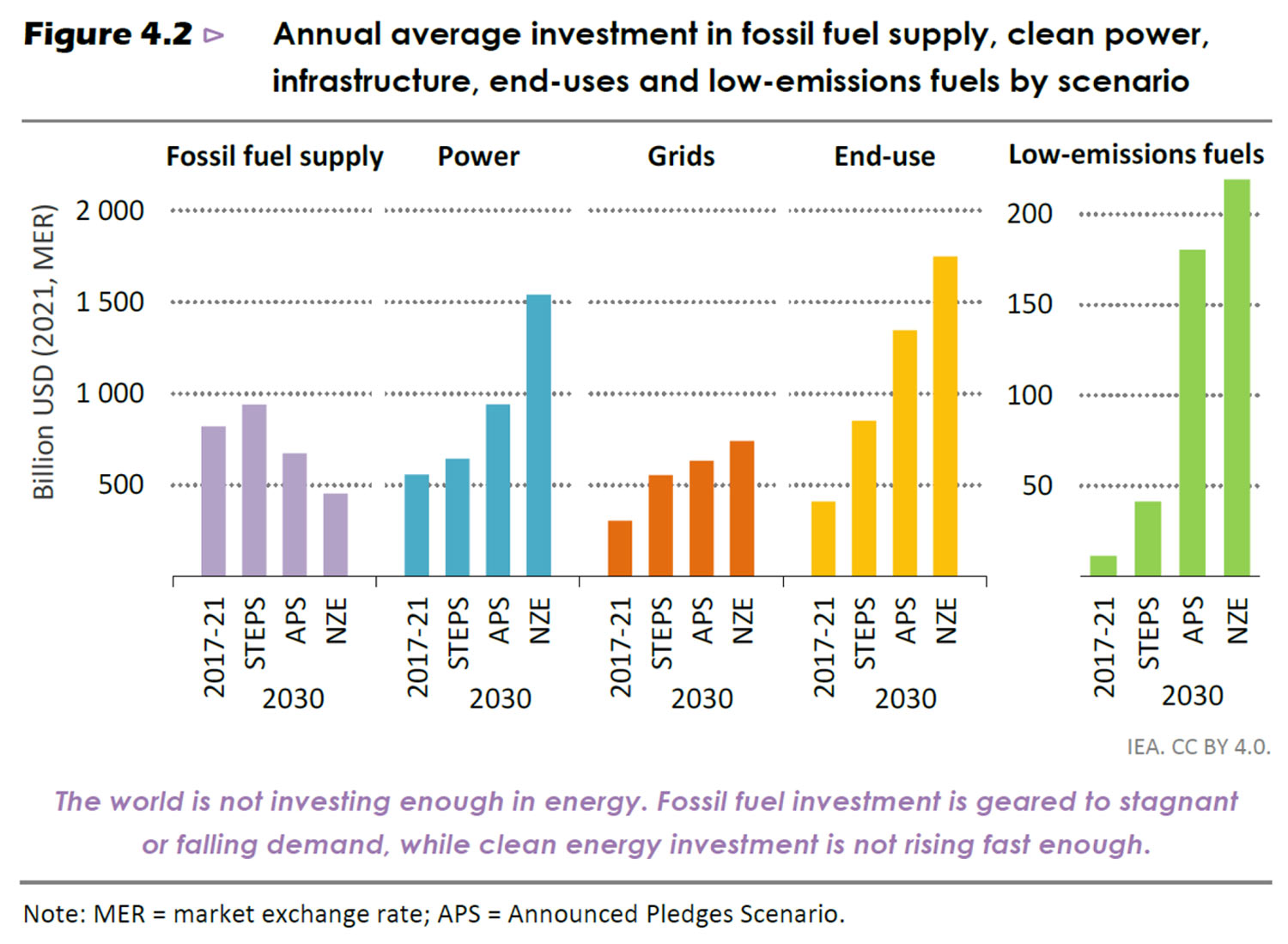

The IEA has published transition scenarios that explore the potential impact of the transition to a low-carbon economy. The three key IEA transition scenarios are:

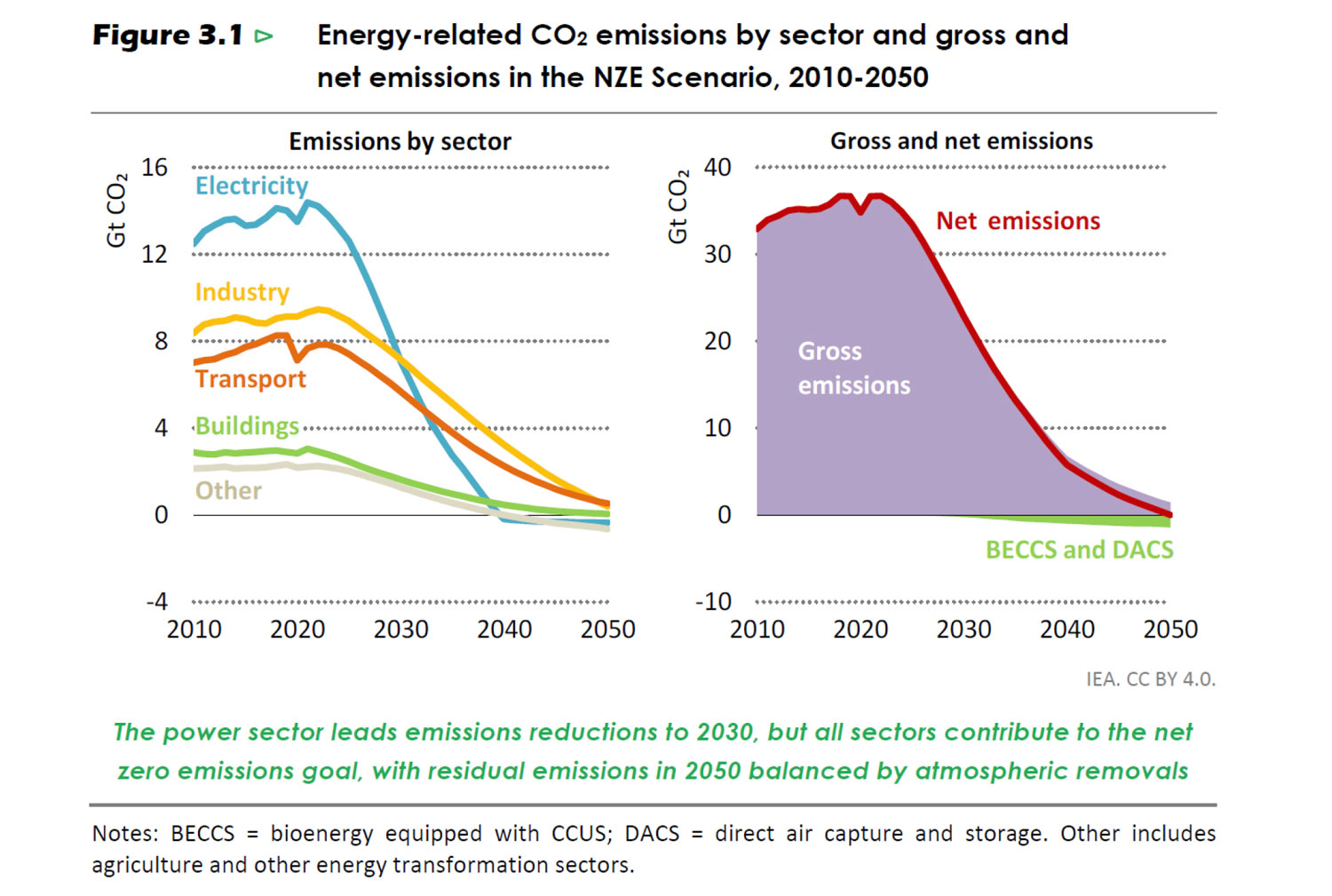

- The revised Net Zero Emissions (NZE) scenario – sets out the most technically feasible, cost effective and socially acceptable pathway to reach net zero greenhouse (GHG) emissions by 2050 (See Figure 3).

- The Announced Pledges Scenario (APS) – shows the trajectory if governments meet all aspirational climate targets on time.

- The States Policies Scenario (STEPS) – shows the trajectory based on current government policy, and those that are under development around the world.

Figure 4: Annual average investment in fossil fuel supply, clean power, infrastructure, end-uses and low-emission fuels by scenario [Source: IEA World Energy Outlook 2022]

- Network for Greening the Financial System (NGFS) climate scenarios

The NGFS has published a set of hypothetical scenarios as follows:

- Orderly scenarios – assume climate policies are introduced early and gradually become more stringent, with physical and transition risks relatively subdued.

- Disorderly scenarios – explore higher transition risk as a result of policies being delayed or divergent across countries and sectors.

- Hot house world scenarios – assume that some climate policies are implemented in some jurisdictions, but global efforts are insufficient to halt significant global warming.

- Too little, too late scenarios – assume that a late transition fails to limit physical risks.

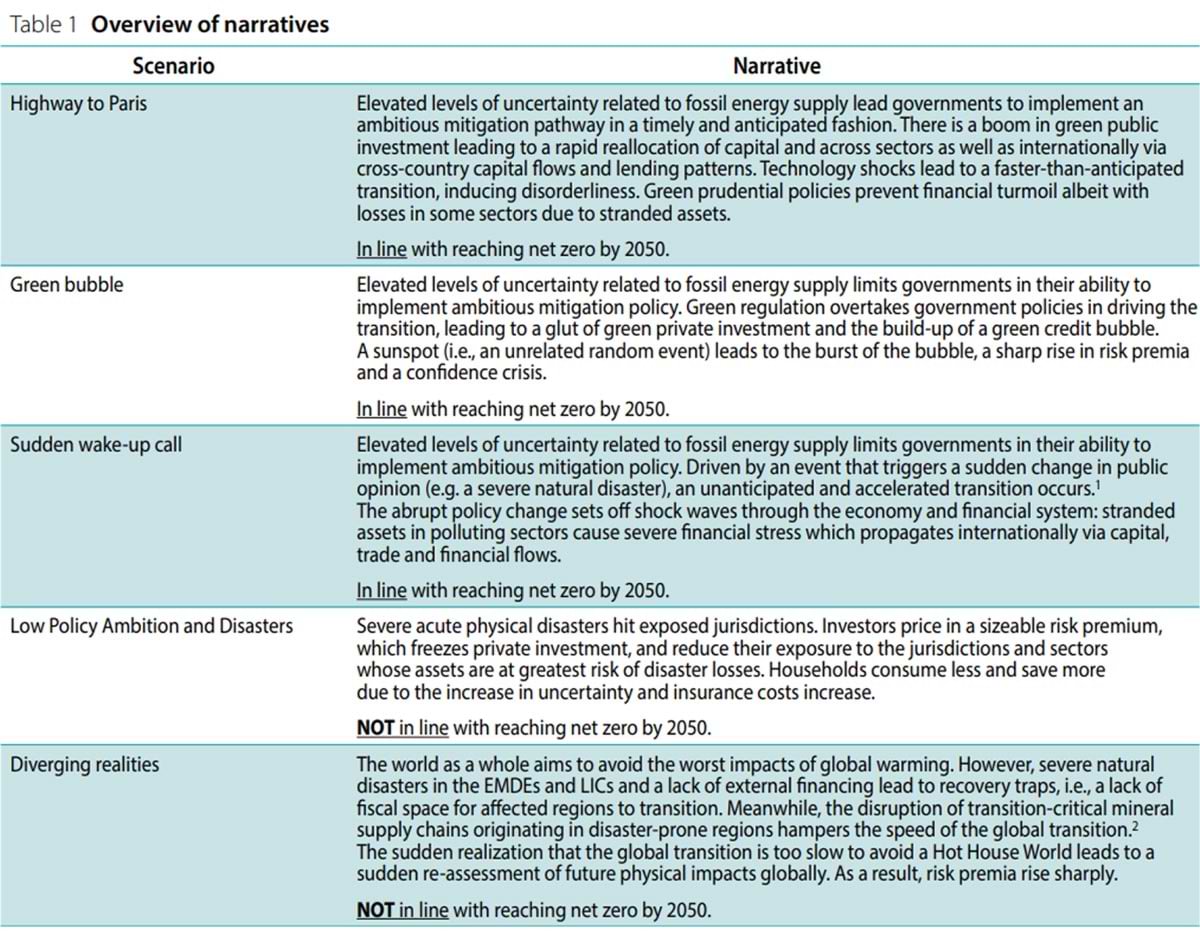

More recently, in October 2023, the NGFS published five new short-term scenarios (See Figure 5), focusing on a time horizon of 3 – 5 years, that capture a mix of transition and physical impacts and their interaction with the macroeconomy and financial sector. These new scenarios are as follows:

Figure 5: Overview of narratives of NGFS short-term scenarios [Source: NGFS Conceptual Note 2023]

- Highway to Paris scenario – immediate and technology-driven transition in which the private sector develops and adopts green technologies faster than expected, inducing a rapid shift in the supply side.

- Green bubble scenario – generous fiscal policy incentives in the form of subsidies leads to a glut of green private investment and expenditure.

- Sudden wake-up call scenario – abrupt and unanticipated transition in which policy makers initially procrastinate on strengthening climate policies, ignoring the need to accelerate the transition initially, until an event triggers a sudden change in policy stance.

- Diverging realities scenario – maps out possible futures with divergences across countries in their net zero transition paths.

- Low policy ambition and disasters scenario – reflects the short-run repercussions of insufficient long-term policy ambition and high physical risks.

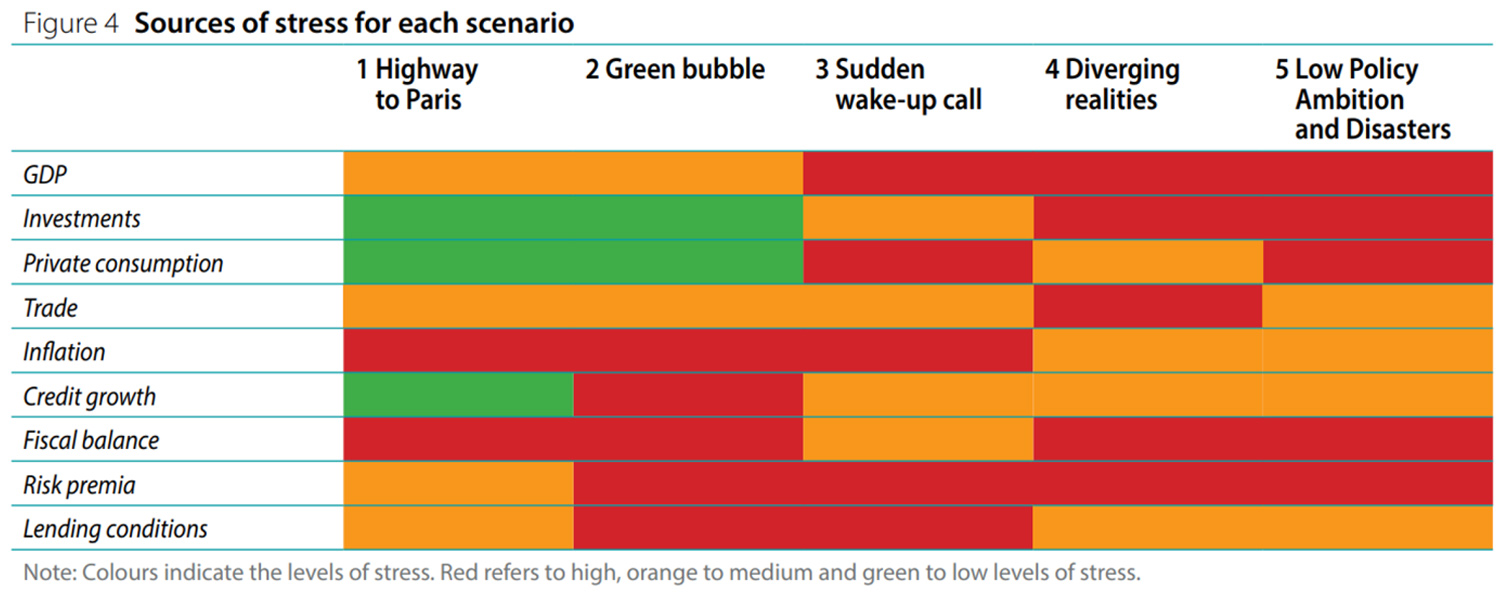

Varying sources of stress are associated with each of the NGFS scenarios (See Figure 6).

Figure 6: Sources of stress for each NGFS short-term scenario [Source: NGFS Conceptual Note 2023]

In addition to publicly available scenarios, companies can also access portals with tools they can use to analyse climate change and climate impact. Some of them are:

- The International Institute of Applied Systems Analysis (IIASA) – provides a wide variety of land, energy, transition, and water tools as well as online scenario databases for energy, GHG mitigation strategies and climate policies consistent with 2°C and IPCC scenarios.

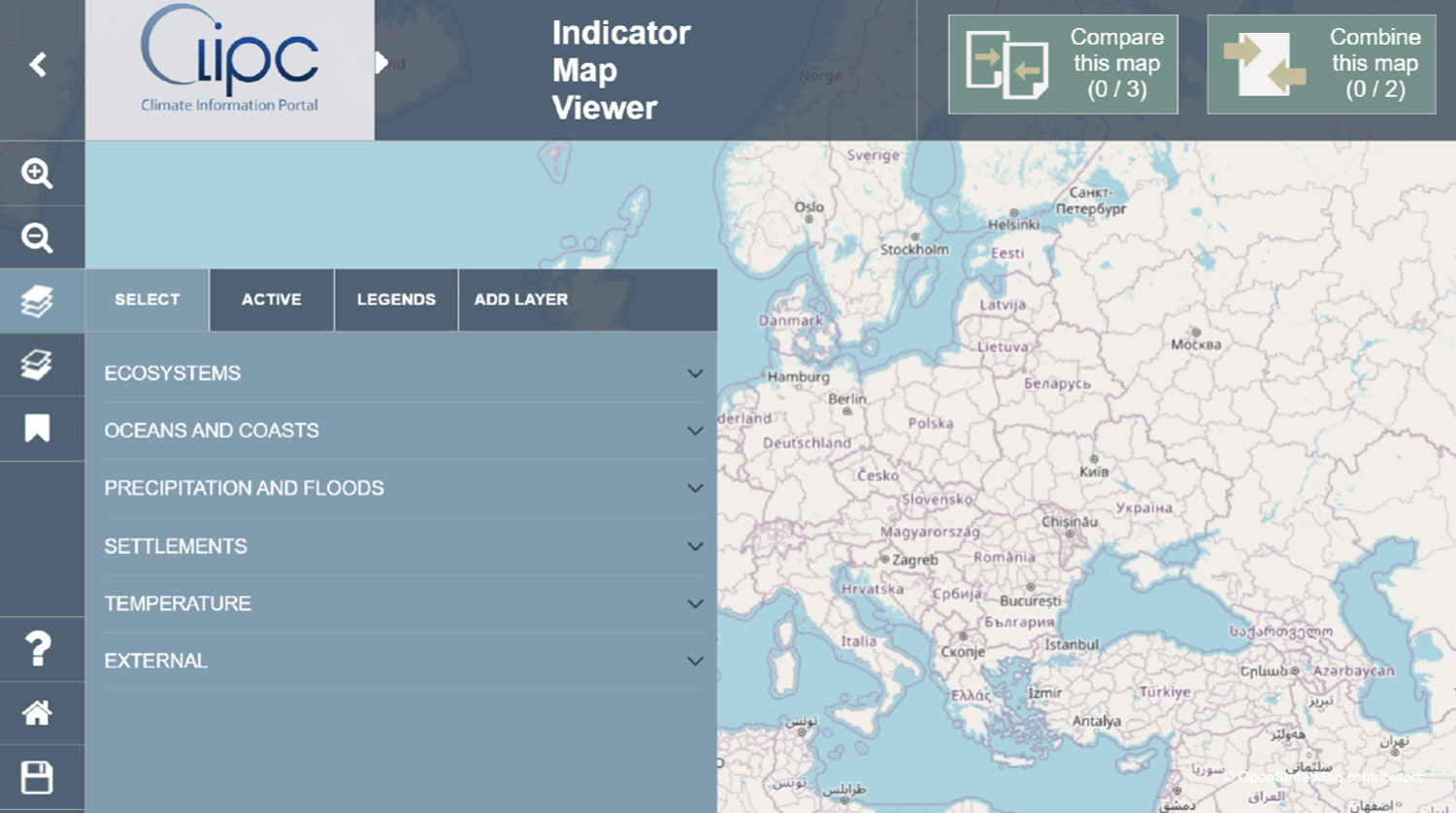

- The European Climate Information Portal (CLIPC) – provides access to climate information such as data from satellite and in-situ observations, climate models, data re-analyses, and transformed data products enabling assessment of climate change impact indicators. CLIPC also provides a toolbox to generate, compare, manipulate, and combine indicators (See Figure 7).

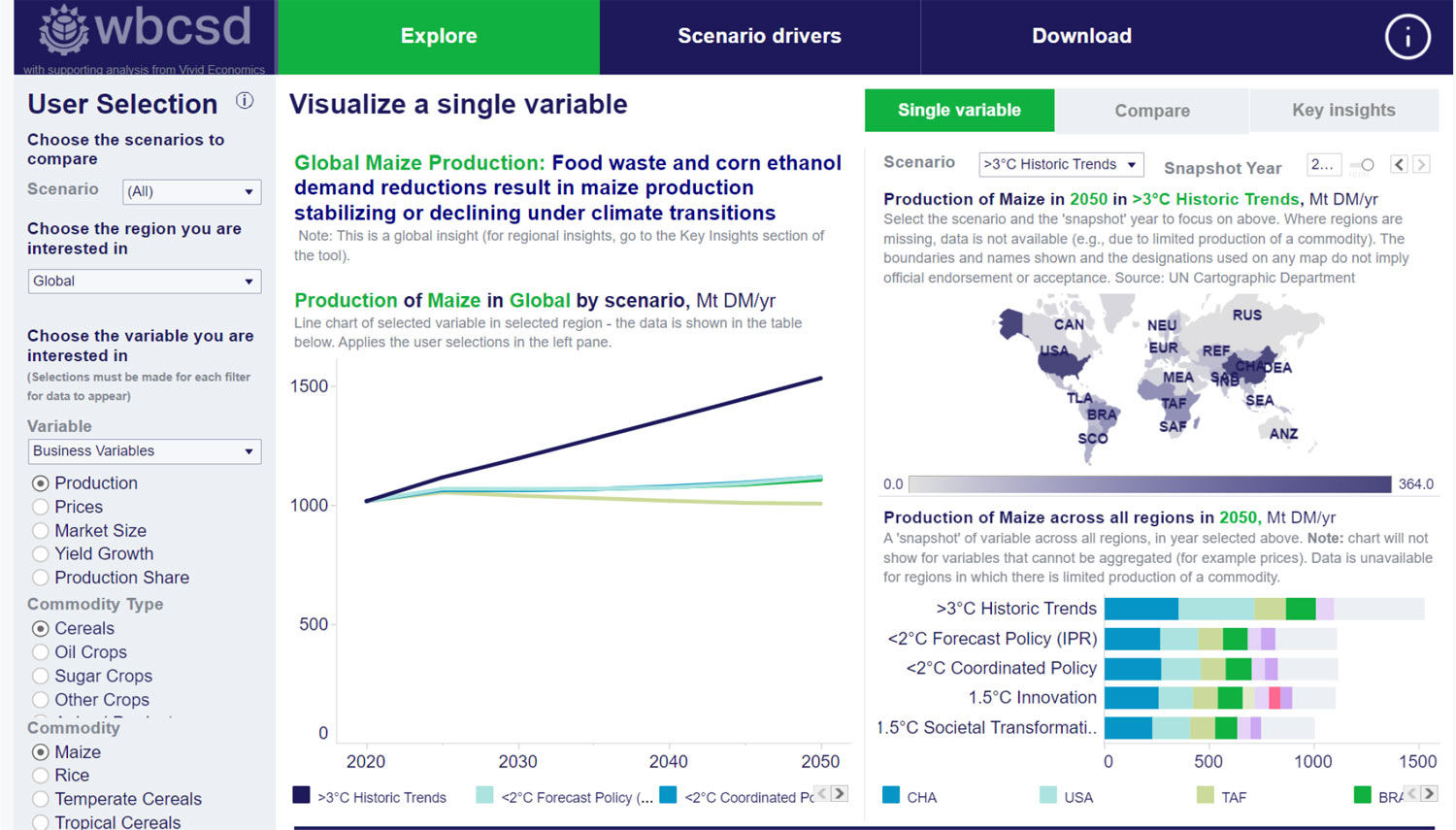

- The World Business Council for Sustainable Development (WBCSD) climate scenario tool for the Food, Agriculture, and Forest Products industry – helps companies effectively apply scenario analysis, better assess the resilience of their strategies, and disclose information. (See Figure 8.)

SMEs will need to focus on how to best prepare themselves for conducting their first climate scenario analysis. Here are some tips to consider:

- Select at least one or two publicly and freely available climate-related scenarios – IFRS S2 allows for companies to use a particular scenario or a set of scenarios, as long as the company provides a reasonable and supportable basis for doing so.

- Select scenarios and narratives which are relevant to the business, and which will provide an understanding of how the company’s financials will be affected.

- Create a link between the climate-related scenario analysis and the anticipated financial impacts on the company, to help guide strategic thinking and decision making.

Sources:

- TCFD. The Use of Scenario Analysis in Disclosure of Climate-related Risks and Opportunities. Available at: https://www.tcfdhub.org/scenario-analysis/

- Centre for International Forestry Research (CIFOR) Working Paper. Climate Scenarios: What we need to know and how to generate them, https://www.cifor.org/publications/pdf_files/WPapers/WP45Santoso.pdf

- TCFD. TCFD 2023 Status Report. Available at: https://assets.bbhub.io/company/sites/60/2023/09/2023-Status-Report.pdf

- IFRS. IFRS Foundation welcomes culmination of TCFD work and transfer of TCFD monitoring responsibilities to ISSB from 2024. Available at: https://www.ifrs.org/news-and-events/news/2023/07/foundation-welcomes-tcfd-responsibilities-from-2024/

- TCFD. Guidance on Scenario Analysis for Non-financial Companies. Available at: https://assets.bbhub.io/company/sites/60/2020/09/2020-TCFD_Guidance-Scenario-Analysis-Guidance.pdf

- IPCC. IPCC Fifth Assessment Report 2014. Available at: https://ar5-syr.ipcc.ch/topic_futurechanges.php

- IEA. World Energy Outlook 2022. Available at: https://www.iea.org/topics/world-energy-outlook

- Riahi et al. (2017). The Shared Socioeconomic Pathways and their energy, land use, and greenhouse gas emissions implications: An overview. Available at: https://doi-org.ucd.idm.oclc.org/10.1016/j.gloenvcha.2016.05.009

- NGFS Climate Scenarios Portal. Available at: https://www.ngfs.net/ngfs-scenarios-portal/

- NGFS. Conceptual note on short-term climate scenarios. Available at: https://www.ngfs.net/sites/default/files/medias/documents/conceptual-note-on-short-term-climate-scenarios.pdf

- CLIPC. Climate Information Portal. Available at: http://www.clipc.eu/indicator-toolkit

- WBCSD. Exploring climate transition risks and opportunities. Available at: https://climatescenariocatalogue.org/explore-the-data/