INSTITUTE

Institute News

Institute News

Commenting on the announcement of Budget 2024 Mark Gargan welcomed the measures that will enhance the abilities to access sources of finance, such as the extension of the EIIS. Startups with high potential to grow, will benefit from the new scheme to encourage so called angel investors.

The extension of the standard rate cut off point to €42,000 is another helpful measure that will assist Ireland’s squeezed middle, as will adjustments to the rates and bands of USC.

Concluding, Mark Gargan said “Ireland’s economy is reliant on the strength of our SMEs, who are more vulnerable to inflationary pressures than larger businesses. Today’s budget offers new supports, but it is essential that these are continuously monitored and enhanced if and when required in the months ahead.”

The Trainee Placement Service is a completely free recruitment service for all employers. Currently we are seeking employers with open roles for 2024 which would suit accounting students currently in their final year of college studies. If you have, or are planning on taking on a Trainee next year please let us know so we can add your company to our 2024 Graduate Programme.

This agreement was extended until 31 December 2024 at the IFAC Council meeting in Vienna. In November 2023, the MRA was signed for CPA Ireland by Mark Gargan, President and Eamonn Siggins, Chief Executive, and for SAIPA by Radha Gouri Govender, Chairperson, SAIPA and Shahied Daniels, Chief Executive, SAIPA.

Under the agreement, members in good standing of either body will be considered for membership by the other body. Members wishing to practice public accounting will be required to meet the specific regulatory and legal requirements in each jurisdiction.

CPA is one of the best-known international accounting designations and Irish professional qualifications are held in high regard worldwide. By becoming a CPA, you are joining a global network.

The samples are also a useful tool to support the ongoing training of staff and the production of high-quality financial statements.

The updated samples are for the following:

A micro company applying FRS 105

A small company applying FRS 102 Section1A

For details please click here. CPA Ireland – Sample Financial Statements Irish GAAP | CPA Ireland

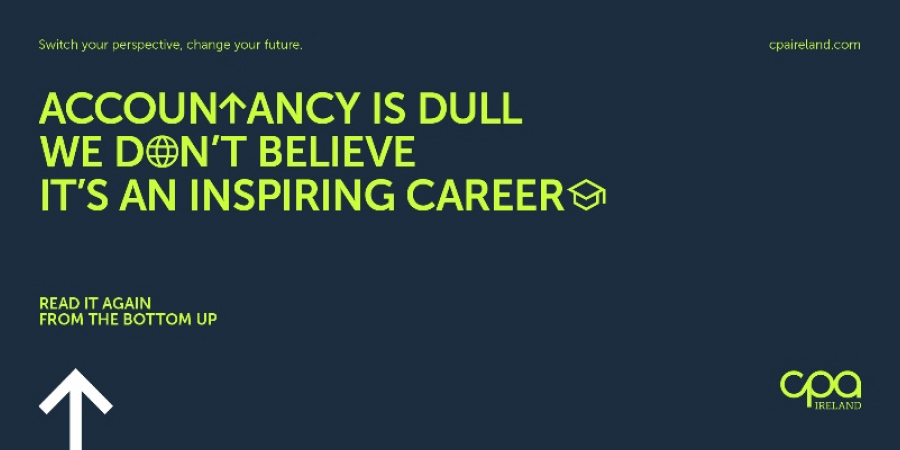

Our current campaign message is to promote a visionary career in that you can go anywhere as a CPA Accountant. To solidify this message and make ourselves more relatable, we want to show prospective students where they can go by showcasing the career paths of our members.

If you think your career path could help us influence the younger generation, please email Claire at cryan@cpaireland.ie

In conjunction with our VR developers, Sia Partners, CPA Ireland Skillnet has created a highly engaging and fun way to help learners better understand the benefits, pitfalls and organisational applicability of an RPA process in a virtual world through VR headsets.

- Three scavenger hunts: working in teams the learners will search the School of Innovation for various objects which represent different aspects of the RPA solution. The leaners will have to work in teams – one person can pick up an object which will launch a card explaining what the object represents. To gather more information, they will need to work with someone who can hold the magnifying glass – by using both together the learner will get more information about the object. Once the learner places the objects they believe to be correct on the podiums they press a button to the side – the correct answers are highlighted in green and the incorrect ones in red. If there are any objects highlighted in red, they must be removed, and the correct ones sought.

- Impact ranking: Place objects that represent different parts of the implementation process on podiums from least impactful to highest. As with the scavenger hunt when the learner picks up the object a card will appear in front of them with details of a particular impact i.e., “RPA can improve data quality and accuracy by reducing the risk of human error and standardising data entry processes”. In addition to the correct answers there will be a number of incorrect answers. Once the learner places the objects, they believe to be correct on the podiums they press a button to the side – the correct answers are highlighted in green and the incorrect ones in red.

- The data tracks: There are three data tracks, large, medium and small for both manual and RPA processing. The learner has the opportunity to move around the innovation hub on a track to help them feel the difference between an RPA data set which is fast and straight forward and a manual data set which is slower and less straight forward.

- The process builder: At this station the learners will be asked to combine what they have learned during the three scavenger hunts and complete a full RPA implementation plan by once again arranging the correct objects on the three podiums.

- Data visualisation: This is a dynamic data solution with a simple Bar Graph, object Visualizations, Light animations, Interactions with Data (& Data Views), Capability to dig into meta data and the Simple Filtering of Data. This station will give the learner an exceptional viewpoint of how data works.

- Case study/elevator pitch: working as a team the learners will have a few minutes at the end of the VR session to review a case study for an organisation that is looking into applying an RPA process. They will work together to put a plan in place for how best to adopt RPA. Once they have that finalised, they will pick up a virtual phone and call the trainer/administrator in the real world to give their pitch.

What others have said:

“I really valued the experience of being in the CPA Metaverse Innovation Academy. The Metaverse Academy is a unique and engaging way of learning that can make challenging training more enjoyable for the learner.”

Nick McCafferty, Development Advisor, Skillnet Ireland

“Thank you for hosting the Virtual reality training session on Friday last. The experience was novel and fascinating and a valuable insight into the future of knowledge transfer. I thoroughly enjoyed the session and found the course content more interesting when delivered through this medium.”

Ken Heade, CPA

Take the opportunity to discover virtual reality.

Book Now!

Thank you to our members who provided profiles and if it is something you would like to get involved in please feel free to reach out.

These updated changes can be found below: