Education & Sustainability

March 2024

17 Harcourt Street,

Dublin 2, D02 W963

T: 01 425 1000

F: 01 425 1001

Unit 3,

The Old Gasworks,

Kilmorey Street,

Newry, BT34 2DH

T: +44 (0) 28 3025 2771

W: www.cpaireland.ie

E: cpa@cpaireland.ie

Patricia O’Neill

Chief Executive

Eamonn Siggins

Editorial Adviser

Róisín McEntee

Technical Adviser

Phyllis Willoughby

Jenn Brennan

T: 087 203 4202

E: accountancyplus@gmail.com

Caitriona Minogue

T: 086 843 0622

E: accountancyplus@gmail.com

Published by

Nine Rivers Media Ltd.

E: gary@ninerivers.ie

President’s Message

Welcome to the March 2024 edition of Accountancy Plus.

We then undertook an extensive campaign to engage with our members, through which we shared our vision for a single, Irish-based, accountancy body that would be better placed to address the opportunities and challenges of the future and ensure a sustainable accountancy profession in Ireland.

I am pleased to report that following a membership vote at the Extraordinary General Meeting on Wednesday 21st February, this proposal was approved.

The proposal was passed by an overwhelming majority of our membership, with 97% of those voting supporting the proposal. I see this as an endorsement of the benefits this amalgamation will bring and the desire amongst members for a strengthened future for our profession.

This is a decisive step forward for Irish accountancy. As a single Institute, and the largest professional body on the island of Ireland, we will be in the best possible position to advance the health and sustainability of the accountancy profession. This new Institute will benefit from expanded resources, greater influence, and a larger membership base. This will help attract new entries into our sector, and further our ultimate goals of advancing educational standards, supporting the public interest, and providing value to our members.

It was fantastic to see our membership display such interest and enthusiasm in the future prospects of our profession during the course of this campaign. The attendance of so many members at our town hall meetings, both those held in person around the country and virtually, was very impressive. It inspired a thorough and thoughtful discussion of what we can do to increase student uptake, inform public policy, and provide the best quality of services for our members.

I, along with the other members of the CPA’s Council, am confident this amalgamation will deliver these benefits. As such, I would like to thank you for your consistent and earnest engagement with this proposal, and for ultimately giving it your seal of approval.

We look forward to carrying on our traditions of educational excellence, the highest professional standards, and strong member supports into our new home.

The members of Chartered Accountants Ireland also endorsed this amalgamation proposal at a Special General Meeting held on Wednesday 21st February.

We can now begin the next steps of this process. Over the next few months, we will continue to work closely with our counterparts at Chartered Accountants Ireland to secure regulatory and legal approval for this amalgamation. We will also discuss how the staff and Councils of both organisations will work together following amalgamation, ensuring that CPA Ireland’s proud legacy of service to members and the culture and heritage of our Institute will be maintained and enhanced in the newly amalgamated Institute.

We will make sure to keep our members informed throughout this process.

Once all requirements have been approved by IAASA and other relevant regulators, an application will be made to the High Court asking it to sanction this amalgamation. After this, we will complete the process and begin our renewed efforts to support our profession.

There are exciting times ahead for our profession, our students, and our members.

Now that the amalgamation has been approved, all members of the newly amalgamated Institute will soon be able to reap the benefits of a larger, stronger, more influential Institute. In the meantime, I look forward to engaging with you, addressing your concerns or questions you may have, and continuing to serve the membership of this body for the rest of my term.

President CPA Ireland

CPA Profile

CPA Profile

Conor Molloy

CPA Profile

Conor Molloy

Title: Accountant

Company: Clonmel Waste Disposal

Qualifications: CPA

There is a wide range of areas where an accountant contributes to the firm from cost analysis to management accounts, and of course they could provide me with first class mentoring. I am delighted to have completed the CPA qualification in 2023.

I can’t forget Michael O’Leary, however. I’ve read all his books and still get a kick out of them. He must be the coolest accountant I know.

It can be challenging at times but so worthwhile. Work-life balance is a priority and something I definitely needed while studying, so make sure you spend time doing the things you love.

I am also trying to fit in some travel after the pandemic scuppered my post-university plans. I am really enjoying exploring different cultures and landscapes, and certainly looking forward to the exam free year ahead!

CPA Profile

Ann-Marie Reddy

CPA Profile

Ann-Marie Reddy

Title: Principal

Company: Grant Reddy Fitzgerald / Blackthorn Capital

Qualifications: FCPA, CTA

What we do just would not work without her.

SUSTAINABILITY

How can SMEs start their sustainable transition? by Johan Barros

To help SMEs and their trusted advisors (such as accountants) with that, Accountancy Europe, Ecopreneur.eu – the European sustainable business association – and the European Association of Cooperative Banks (EACB) jointly published, at the end of 2023, new guidance documents.

The first one of these papers outlines five reasons why SMEs should take the sustainable transition seriously. The second one provides five first steps that a SME can take to kickstart their sustainability journey.

The papers were based on interviews with small and medium sized practitioners (SMPs) that are already providing or planning to provide sustainability services for SMEs. They also benefitted from considerable technical input and insights from experts from all three organisations.

The main message of these guidance documents? Just get started!

Consider, for example, the competitive advantage. SMEs with sustainable business models can expand their range of clients and business partners. This can happen, for example, by being better placed to secure contracts with larger companies who are legally obliged to consider the overall sustainability of their value chains.

For example, the costs of investment in a new plant or equipment may be offset by increased energy efficiency, especially at times of skyrocketing energy prices and when grants are available to finance energy-efficient assets.

Sustainability can even affect the business’ succession planning. A sustainable business that is adapted to the needs and realities of the environment is more resilient in the longer term and makes the next younger generation more interested to continue running the family business.

The benefits of positive branding should not be underestimated. Basing a business model around sustainability is more appealing for end-consumers who seek to cut their personal carbon footprint and can improve brand loyalty. This can, in turn, also strengthen the SMEs employee retention and commitment for the business.

Access to finance is another key opportunity. Firstly, sustainable SMEs can increasingly access diverse financing options, including loans, impact investments, and grants earmarked specifically for sustainable initiatives. Additionally, governments, the EU and international organisations actively support sustainable SMEs through funding programs and incentives, further expanding their potential access to capital.

The second positive and more indirect access to finance benefit is that sustainability planning leads to stronger management structure, accounting systems and internal controls. Reporting on these sustainability actions also enhances the SMEs corporate responsibility brand. All of these are factors that make the business more attractive to lenders.

Finally, sustainability goals make businesses focus on long-term strategic planning, instead of short-term results. It renders the business more risk resilient and adaptive, which should also improve their ultimate sale value.

The above are just a few positive examples for SMEs and their advisors to consider. Each of them should be carefully considered from the perspective of the specificities of each SME and their business model.

Some first simple steps, as outlined in Accountancy Europe’s papers, can be done by practically every SME. The best approach is to identify and start with ‘low hanging fruits’, and very simple steps. This is already much better than doing nothing at all.

Reaching out to experts, information points and national associations is one of the very first steps. Could the national SME association or chamber of commerce have resources and support for SMEs? Or could the national accountancy institute have information about local practitioners who support SMEs with sustainability? There is also the chance that the SMEs existing accountant can help or knows of someone within their network who can.

Another crucial step is to reflect on the business’ future vision, a process that can be guided by far-reaching questions, e.g.:

- Where does the owner see the SME in 5 or 10 years?

- What about in 20 years?

- Does the business model contribute to climate objectives?

- If not, what needs to change?

- How will the owner get the data to plan and monitor the change?

Many SMEs may be already ‘sitting’ on a lot of sustainability related data without even realising it. Data points such as gas and electricity consumption, material used in the production process, recycling practices, remuneration policies or gender balance should already exist.

Other data points – such as how the SME’s electricity provider’s energy is produced or employee satisfaction – should be relatively easy to obtain.

What about the SMEs value chain? Is the company overly reliant on key customers or suppliers with higher sustainability risks or exposures?

See the paper on five first steps for more insights on how a SME could get started – or how SMEs’ accountants can advise their clients.

Additionally, accountants often have a strong network of other experts and professionals to whom they can refer the SME when necessary.

They can, for example, help SMEs communicate with their value chain partners. Most accountants are not environmental engineers or energy experts – but they are experts in legal requirements and business planning.

Accountancy Europe

Value Chain and CSRD Reporting by Sheila Stanley

The CSRD requires value chain reporting, which covers the activities, resources, and relationships the reporting company uses and relies on to create its products or services from conception to delivery, including consumption and end-of- life. Activities, resources, and relationships along the value chain include the following:

- those in the company’s own operations, such as human resources;

- those along its supply, marketing and distribution channels, such as materials and service sourcing and product and service sale and delivery; and

- the financing, geographical, geopolitical and regulatory environments in which the company operates.

Value chain actors are found both upstream and downstream from the company. Actors upstream from the company include suppliers and provide products or services that are used in the development of the company’s products or services. Actors downstream from the company include distributors and customers who receive products or services from the company. In many cases, SMEs will find themselves either as suppliers or distributors in the value chain of a reporting company.

In December 2023, the European Financial Reporting Advisory Group (EFRAG) released a set of guidance documents to help companies comply with the requirements of the ESRS. Of these, the IG 2: Value Chain Implementation Guidance provides useful insights for SMEs in the value chain of large companies to consider.

As actors in the value chain of larger companies reporting under the CSRD, what can SMEs expect to face and how can they prepare themselves?

- Companies that were previously reporting under the Non-Financial Reporting Directive (NFRD) are to report on their FY2024 sustainability performance with limited assurance in the year 2025. Unlike the CSRD, the NFRD did not mandate companies to report on their value chain.

- Other large companies are to report on their FY2025 sustainability performance in the year 2026.

- Listed SMEs are to report on FY2026 performance in the year 2027.

Large companies – both listed and unlisted – refer to an EU undertaking or EU subsidiary of a non-EU entity that satisfies at least two of the following criteria:

- More than €50 million in net turnover (i.e., revenue)

- More than €25 million in balance sheet total (i.e., total assets)

- More than an average of 250 employees during the year

As of 1 January 2024, the ESRS came into effect through the adoption of the Commission Delegated Regulation (EU) 2023/2772 (ESRS Delegated Regulation). The ESRS Delegated Regulation provides details of the sustainability-related disclosure requirements that companies are to report on. The determination of which sustainability matters a company is to report on is based on the principle of double materiality.

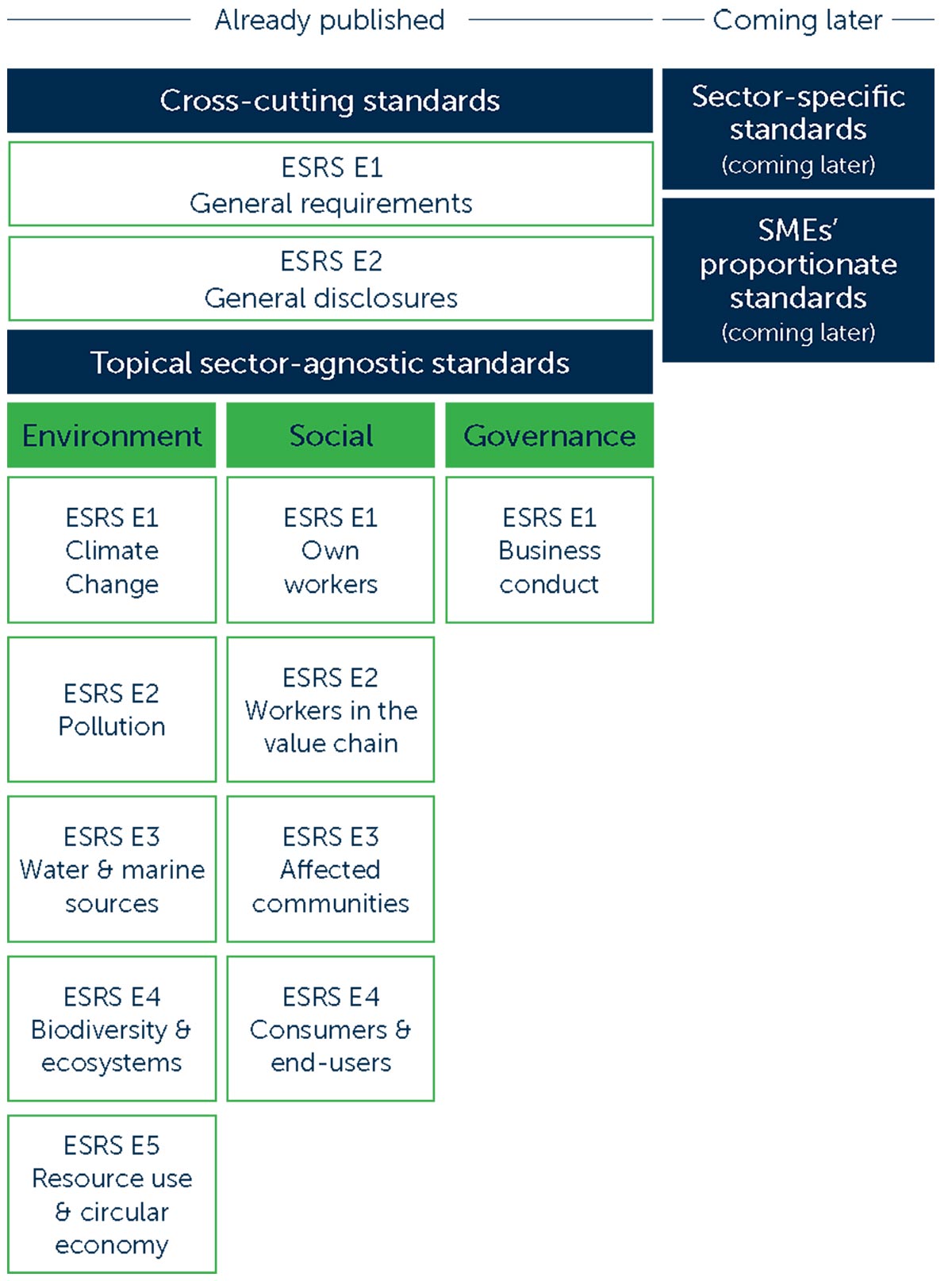

Double materiality essentially refers to two dimensions of materiality – impact materiality which covers the company’s impacts on people and the environment, and financial materiality which covers risks and opportunities related to sustainability matters that affects the company’s development, financial position, financial performance, cash flows, access to finance or cost of capital over the short-, medium- or long-term time horizons The sustainability matters that fall within the scope of the ESRS are wide ranging as outlined in fig 1.

As of the end of 2023 and moving into 2024, many companies that are in-scope for the CSRD for FY2024 have begun their double materiality assessments to ascertain which sustainability matters they will be required to report on. As part of this process, and because the CSRD requires companies to report on the value chain, these companies are reaching out to SMEs such as their suppliers and distributors to obtain their feedback as stakeholders.

The EFRAG IG 2 Value Chain Implementation Guidance provides more clarity in terms of guidance and explanations on value chain disclosures. While the guidance was developed for use by companies that are in-scope under the CSRD and not for SMEs, it does provide some useful points for SMEs to take on board.

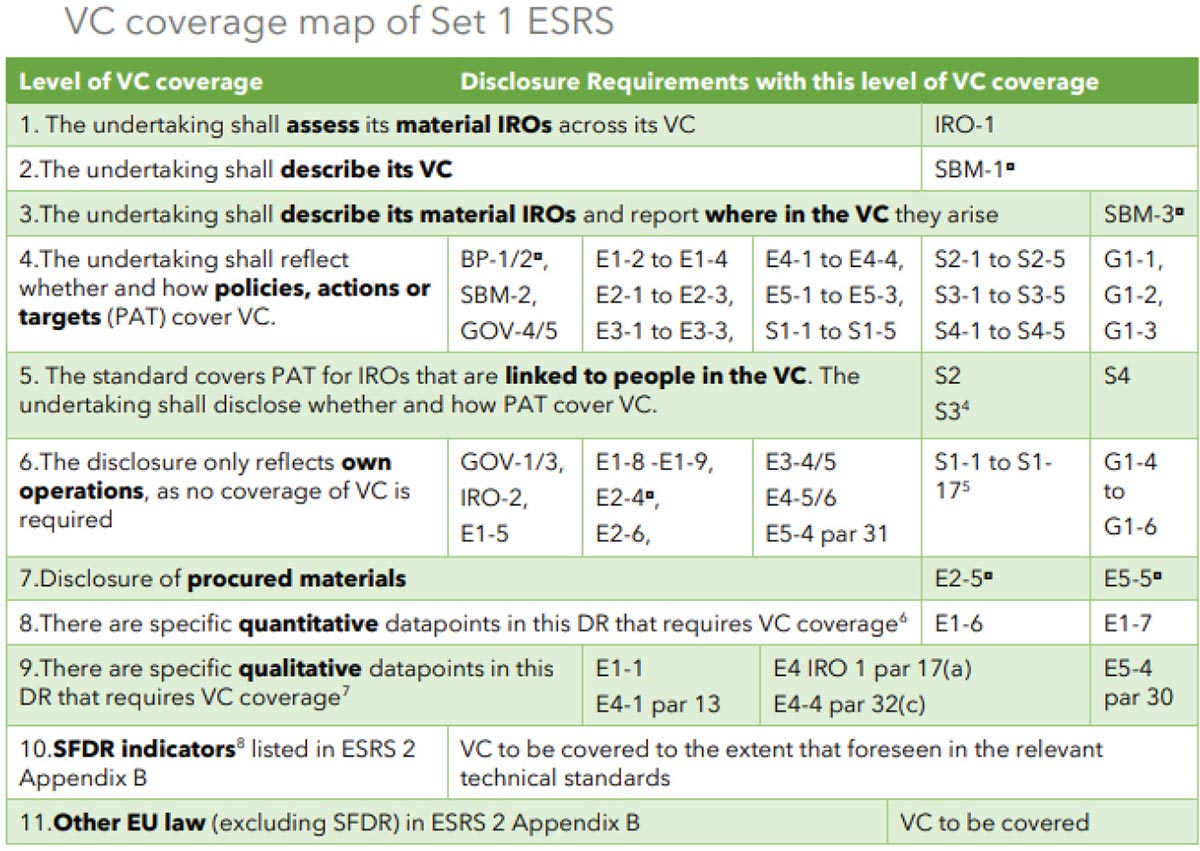

SMEs in the supply chain of companies preparing ESRS reports are considered part of the upstream value chain of the reporting companies, while SMEs that are distributors are considered part of the downstream value chain. The Value Chain (VC) coverage map in the IG 2 provides a snapshot of the specific disclosures within each general and topical standard that requires value chain information (See Figure 2). These cover disclosures under all 10 ESRS topical standards.

IG 2 makes it clear that a company will have to identify risks and opportunities that arise as a result of impacts and dependencies it has on its value chain to provide a fuller picture of its impacts on people and the environment which are connected to its activities, products and services. Effectively, what this means is that a company is to report on the sustainability-related impacts it may have on people and the environment as a result of its business relationships with SMEs such as suppliers and distributors that are involved in its business operations and activities. As an example, SMEs’ greenhouse gas (GHG) emissions that are the result of its business relationships with the reporting company is considered part of the Scope 3 value chain GHG emissions that the large company has to report on.

This means that companies will have no choice but to approach SMEs as part of the double materiality assessment process to obtain their feedback on potential impacts it has on the SME and conversely, to consider the risks and opportunities associated with its SME suppliers.

According to IG 2, companies will have to provide information on how their policies, actions, and targets in relation to each topical standard cover the value chain. By extension, these policies, actions, and targets that companies develop which encompass the value chain will affect how SMEs conduct their own business. SMEs will have to ensure that their own business conduct and activities are aligned with supplier/distributor Environmental, Social and Governance (ESG) and the procurement policies developed by the reporting company.

- Start having the conversation with the reporting company it is a supplier of to find out what the latter’s sustainability considerations are with regards to the products/services provided.

- Find out what information the reporting company will require under the ESRS as a result of its double materiality assessment.

- Review its own processes and systems to gauge its capacity to provide data and information to support the company’s reporting requirements.

- Start thinking about how to incorporate ESG into its business model to ensure its long-term business viability and profitability. An ESG compliant supplier/distributor will become a supplier/distributor of choice for large companies as sustainability reporting requirements further strengthen in the coming years.

- Create awareness and support the dissemination of sustainability knowledge amongst its employees. This will ensure that its employees will be able to effectively engage with the reporting company as well as implement in-house sustainability strategies and development plans that are developed to build out the SME’s sustainability value proposition.

- Adopt the right mindset. Rather than viewing this as a burdensome reporting requirement, SMEs should view this as a strategic investment and opportunity.

- Finally, make the most of government supports available for SMEs to begin their sustainability journey. These include the Green Transition Fund which provides support to SMEs to become more sustainable and prepare themselves for a low-carbon, resource-efficient future through initial planning, capability building, investment, research and innovation.

- Digital and climate transformation projects under the Green Transition Fund are being funded through the EU’s Recovery and Resilience Facility under Ireland’s National Recovery and Resilience Plan (NRPP) 2021-2026.

- Another valuable support available is the Climate Toolkit 4 Business, a toolkit that allows businesses to gauge their environmental impact based on information they have at hand such as energy, water or waste bills and create an improvement plan.

- EFRAG proposes implementation guidance for ESRS (iasplus.com)

- EFRAG IG 2 Value Chain Implementation Guidance. Available at: Download (efrag.org)

- Expected Contributions Of The European Corporate Sustainability Reporting Directive (Csrd) To The Sustainable Development Of The European Union (researchgate.net)

- Delegated regulation – EU – 2023/2772 – EN – EUR-Lex (europa.eu)

- European Sustainability Reporting Standards (ESRS) adopted by EC | EY – Global (Issue 3, August 2023)

- Climate Toolkit 4 Business | Zero Carbon Journey

- Improve sustainability | Business Support | Enterprise Ireland (enterprise-ireland.com)

Law & Regulation News

- Additional listing of over 140 individuals and entities to the sanctions list.

- A ban on direct or indirect import, purchase or transfer of diamonds from Russia.

- A direct ban applies to non-industrial natural and synthetic diamonds.

- Introduction of a no Russia clause which prohibits re-exportation to Russia of particularly sensitive goods and technology, including Russian military systems.

- Further circumvention measures relating to dual use goods and technologies, including extending the transit ban to all battlefield goods.

- Exceptions were introduced for personal use items.

- A ban on Russian nationals from holding any posts on governing bodies.

- Tighter compliance rules have been introduced to clamp down on circumvention to support the implementation of the oil price cap.

The Department of Finance ask that all entities familiarise themselves with the measures introduced and how they can comply with the sanctions.

The relevant Statutory Instruments are, or will be shortly, available on the Irish Statute Book. Further information on restrictive measures can be viewed also at:

- The EU Council website, from which the measures agreed at an EU level in response to the crisis in Ukraine can be found

- The European Commission website, from which Frequency Asked Question documents are available

- The Central Bank of Ireland

- D/Foreign Affairs – who also have domestic guidance on the implementation of sanctions at the bottom of that page.

Please monitor the websites referenced above closely in the event that further information is available or further restrictive measures are adopted. It is very important that all supervisors in particular keep up to date on developments and ensure that the obligations arising from the sanctions are communicated appropriately to all obliged entities.

All legal and natural persons are bound by the obligations in the sanctions and supervisors need to ensure compliance with same.

Should you have any queries, contact sanctions@finance.gov.ie

The Bill revises and updates the 2009 Charities Act, and is a key step that needs to be implemented in order to allow for the appropriate regulation, particularly financial regulation, of the sector.

The measures proposed will introduce greater transparency to the way in which charities report, enhancing public confidence in the sector, and will enhance and consolidate the existing legal framework for the Charities Regulator to carry out its statutory functions.

The Bill includes provisions that will ensure that registered charities that are companies will be subject to the same regulatory requirements and rules as all other registered charities. It also increases the financial thresholds which currently apply for the regulation of charities to ensure more appropriate reporting requirements that are reflective of a charity’s size.

While some remain in the planning stage like the proposed automatic enrolment scheme scheduled to be implemented before the end of 2024 and proposals for legislation that would prohibit mandatory retirement ages that are lower than the State pension age of 66.

A new flexible pension model has been available to Employees since the 1st January 2024. Under this revised State pension model, Employees have the option to continue working until the age between 67 and 70. Employees can continue to drawdown the State pension at the age of 66 in the normal way but those that choose to defer their drawdown date will receive an “age referenced rate of State pension” or an actuarially increased rate of payment.

The Essential Role of HR in Business Sustainability Initiatives by Amanda Finnegan

- 1 January 2024: For public interest entities within the scope of EU non-financial reporting regulations (with more than 500 employees), the implementation date is set for.

- 1 January 2025: Other larger companies and public interest entities (with more than 250 employees) are scheduled to adopt these rules starting from.

- 1 January 2026: Listed small and medium-sized enterprises (SMEs) are expected to comply by, although they have the option to defer their adoption until 2028.

Although small and medium-sized enterprises (SMEs) that are not publicly listed are not directly targeted by the directive, they might be required to furnish information to larger companies eventually, as part of the overall value chain.

If there is no ESG strategy in place, HR should facilitate the development of one. This strategy should seek to marry the organisational values with realistic sustainability goals and embed these values into company policies, procedures, and practices. Achievable workplace policies that promote sustainability could include reducing waste, encouraging recycling, supporting sustainable commuting options, and minimising energy use.

Adare HRM Advice: Review current sustainability policies to assess your organisation’s status. Set specific goals to minimize environmental impact, whether quarterly or annually. Identify and act on immediate opportunities to change organisational behaviours, such as eliminating single-use plastics and encouraging digital document viewing over printing. This proactive approach will align company strategy with sustainability goals and demonstrate a commitment to environmental responsibility.

2. Recruitment and Retention

Sustainable policies are becoming increasingly important from a recruitment and retention perspective. This is particularly the case among younger generations who value environmental and social responsibility.

When an organisation demonstrates its genuine commitment to sustainability, it not only enhances its brand image but also helps attract and retain employees who are motivated by working for an organisation that aligns with their own values on environmental stewardship and social responsibility. This alignment often results in a more engaged, productive, and loyal workforce, which is crucial for long-term business success.

Adare HRM Advice: Showcase your organisation’s commitment to sustainability by highlighting three specific examples where this commitment has been demonstrated. Enhance your online presence with visuals on your website and LinkedIn company page that reflect these sustainable practices. Detail the internal committees focused on sustainability and share the time allocated by executives for each team member to contribute to sustainability initiatives annually. This approach not only bolsters your brand image but also attracts and retains employees who value environmental and social responsibility, leading to a more engaged and loyal workforce and valuable Employer Value Proposition.

3. Integrate Sustainability into Performance Management

Where feasible, the reward system could include sustainability-related objectives in employee performance reviews and KPIs. Employees and teams who make significant contributions to sustainability efforts should be recognised and rewarded for their efforts.

Adare HRM Advice: Recognise and reward employees who actively demonstrate their commitment to sustainability. Consider featuring their contributions on your company’s website or LinkedIn page. Encourage employee participation in sustainability committees and track the time allocated for them to invest in sustainability initiatives annually. Integrating these aspects into performance management not only promotes sustainable practices but also fosters a culture of environmental responsibility and acknowledgment within the organisation.

4. Training and Development Initiatives

Training and development are key HR components for organisations aiming to become more sustainable. Integrating sustainability into learning and development programmes will support employee awareness, education, and action. Empowering employees with knowledge and skills in sustainability not only enhances their ability to contribute to the organisation’s environmental goals but also encourages innovation and the adoption of sustainable practices in everyday operations.

Adare HRM Advice: Organise awareness workshops focusing on the United Nations’ 17 sustainability goals and share your organisation’s commitment and plan to meet the 2030 targets. Assist employees in understanding how they can actively contribute to these goals at work, at home, and in their community. Such training initiatives empower employees with the knowledge and skills necessary for sustainability, fostering innovation and the adoption of sustainable practices in everyday operations.

5. Integration of Sustainability Goals into Onboarding

Making sustainability a more prominent part of the onboarding process allows HR to set expectations and emphasise its importance right from the start of the employee’s engagement. As new hires integrate into a company, they should learn how sustainability plays a role in both day-to-day work and long-term planning.

Adare HRM Advice: Encourage new employees to share their personal commitment to sustainability at work, at home, and in their community during the onboarding process. Offer them an opportunity to explore and initially choose one of the internal sustainability committees to join. Additionally, inform them about the support structures and self-help portals available as part of the organisation’s ESG approach, emphasising the importance of sustainability from the outset of their engagement with the company.

6. Empower Employees to Take Action

Promoting sustainability in an organisation also means ensuring the business uses all of its resources effectively — including its human talent. Employees of all levels may have ideas that can prove useful in improving the business’s sustainability. HR should create a space for them to share these ideas. HR should ensure employees feel comfortable voicing their opinions on all issues, including sustainability. If they want to go further, they can implement a recommendation system to give workers a dedicated channel for suggesting sustainable initiatives.

Adare HRM Advice: Encourage your employees to actively participate in sustainability initiatives by setting up a platform for idea sharing and collaboration. Establish ‘Green Teams’ within your organisation to lead environmental projects and engage in community sustainability efforts. Organise regular environmental awareness events to educate and inspire your workforce. By making sustainability a shared responsibility, you foster a culture of innovation and collective action that aligns with your company’s environmental goals.

7. Promote Accountability and Monitor Compliance

In addition to encouraging employees to go above and beyond sustainability policies, HR should keep the company accountable for its goals. Integrating sustainability standards into regular audits lets HR keep the organisation on track. As the scope of ESG reporting laws widens, it will also be important for HR to monitor the organisation’s compliance with green and sustainable legislative updates.

Adare HRM Advice: Regularly audit your company’s sustainability practices ensuring alignment with your set goals and standards. As sustainability reporting requirements evolve, HR should proactively monitor and ensure compliance with the latest green and sustainable legislative updates. Establish clear sustainability standards and integrate them into your internal audit processes. By doing so, you not only promote accountability within your organisation but also demonstrate your commitment to sustainable business practices to stakeholders and the wider community.

Get Expert Support from Adare Human Resource Management

If the sustainability challenges highlighted in this article resonate with your organisation, and you’re seeking support to integrate sustainable practices within your HR strategy effectively, our experts at Adare Human Resource Management are ready to assist.

To learn more, please contact us at 01 561 3594 / 061 363 805 or email info@adarehrm.ie.

The company director restriction regime – the evolution thus far by Aoife McPartland

- company directors are expected to operate,

- certain transparency requirements must be complied with,

- certain protections are afforded to shareholders, creditors, and the wider public, and

- sanctions, both civil and criminal, are provided for in respect of certain non-compliance.

One of these sanctions that serves a public protection purpose is the restriction regime provided for under company law. Since 2003, over 2,700 company directors have been restricted. In this article, I will trace the evolution of this public protection measure.

A restriction order is a declaration from the High Court that a director of an insolvent company cannot become involved in the management of a company for a period of five years unless certain statutory capitalisation requirements have been complied with.

Under the Companies Act 2014 (the 2014 Act), a court shall make a restriction order unless a director of an insolvent company can satisfy the court that:

- s/he acted honestly and responsibly in the conduct of the affairs of the company,

- s/he co-operated with the liquidator, and

- there was no other reason it would be just and equitable to restrict them.

Breach of a restriction order is a criminal offence and, moreover, can expose a restricted person to personal liability for company debts.

The disqualification of company directors’ regime under section 184 of the Companies Act 1963 (1963 Act), pre-dated Ireland’s restriction regime. Restriction was proposed as an expansion of the disqualification of company directors’ regime to take account of a wider array of director conduct. It was aimed at tackling malpractices and/or abuses of company law in the period between insolvency and the conclusion of court proceedings appointing a liquidator over the company. Directors of insolvent companies were to be automatically disqualified from being involved in the management of any subsequent company unless there was a minimum allotted share capital in the subsequent company. The liquidator of the insolvent company would be required to use the restriction period to report to the court on whether the interests of creditors were in jeopardy and request the court make a disqualification order (Department of Industry Commerce and Trade, 1983).

However, concerns arose from these proposals to expand the disqualification regime. Namely, that bona fide directors would be unfairly caught by disqualification of this nature. As a result, the proposals changed to allow directors to apply for relief from the automatic bar on being a director between insolvency and the end of the liquidation of the company (McKenna, 1987).

Around the same time as Ireland was considering implementing the restriction regime, the Cork Report in the United Kingdom (UK) sought to examine company law with the objective of deterring and penalising irresponsible behaviour (Review Committee on Insolvency Law and Practice, 1982).

These recommendations made their way into clause 7 of the Insolvency Bill 1984, which ‘was the most controversial provisions in the Bill and underwent considerable alteration throughout all parliamentary stages’ (Fletcher,1989). Ultimately, despite these proposals, automatic disqualification did not feature in the UK’s Insolvency Act 1986.

The Gallagher Report advocated for the establishment of a centralised executive unit within the Department of Enterprise and Employment charged with making company law applications to court, including restriction applications. The Gallagher Report recommended that liquidators and receivers would be obliged to report to this executive unit within six months of their appointment about whether a disqualification application was appropriate (Company Law Review Group, 1994).

Under the Company Law Enforcement Act 2001, the ODCE was established, and the ODCE, a liquidator or a receiver could bring an application for restriction. Liquidators of insolvent companies were obliged to make a report to the ODCE and to make restriction applications to the court within a required time period if they are not relieved of such a requirement by the ODCE.

In 2007, the Company Law Review Group (CLRG) recommended the introduction of restriction and disqualification undertakings (Company Law Review Group, 2007) and undertakings were provided for by the Companies Act 2014. Restriction undertakings arise where a director consents to being restricted from acting as a company director when invited to do so by the Corporate Enforcement Authority (CEA). No application is made to court if a director consents to a restriction undertaking but the undertaking has the same effect on a director as a restriction order. Undertakings, therefore, provide a cost saving to the directors concerned, as well as freeing up court time.

On 6 July 2022, the Companies (Corporate Enforcement Authority) Act 2021 (2021 Act) was commenced. The 2021 Act established the CEA to replace the ODCE. Section 34 of the 2021 Act included amendments to the restriction regime expanding the grounds under which an applicant may seek to have a company director restricted. The amendments still require company insolvency as a ground for restriction but also impose restriction on directors for failures to:

- convene a general meeting of shareholders to propose nominating a liquidator for the company, and/or

- table a notice to nominate such a liquidator at such a general meeting, and/or

- provide a notice to employees of the winding up on the company.

A director will be restricted on any of these grounds unless they can establish their honesty and/or responsibility, etc.

Around the same period as the restriction regime was proposed, an expansion of the UK’s disqualification of company directors’ regime was also proposed. However, in the UK, concern for honest and bona fide directors being unfairly prejudiced by this automatic disqualification resulted in the proposals being scrapped.

Ireland enacted the restriction regime with amendments to tackle the concern with honest and responsible directors falling within the restriction regime. Many concerns after the enactment of the restriction regime centred on who would be charged with oversight of the regime.

Eventually, this oversight became a responsibility shared by the CEA and liquidators of insolvent companies.

More recently, restriction undertakings were introduced and section 34 of the 2021 Act amended the restriction regime by expanding the grounds for restriction.

Restriction is an important feature in the landscape of company law enforcement in Ireland and has been applied to over 2,700 people since 2003, sanctioning persons who have not met the required standards of behaviour while acting as company directors.

Company Law Review Group, Annual Report of the Company Law Review Group 2007.

Department of Industry, Commerce and Trade, Memorandum for the Government on the Draft Scheme of a Bill to Amend the Companies Acts, 1963 – 1983 (8 August 1983).

Fallon, S., Seanad Deb 27 May 1987, Vol 116, No. 4. For further comment on the likelihood of business failure, see Mr T. Mckenna, Seanad Deb 16 July 1987, Vol 116, No. 19.

Fletcher, I., “The genesis of modern insolvency law – an odyssey of law reform”, (1989) 1 Journal of Business Law 365.

McKenna, T., Seanad Deb 16 July 1987, vol 116, No. 19.

O’Malley, D., TD, Seanad Deb 13 December 1990, Vol 127, No. 2.

Review Committee on Insolvency Law and Practice, Report of the Review Committee on Insolvency Law and Practice 1982, (Cmd 9175).

Working Group on Company Law Compliance and Enforcement, Report of the Working Group on Company Law Compliance and Enforcement 1998, (Pn. 6697).

Senior Enforcement Manager

Finance & Management News

Finance & Management News

The “All In a Day’s Work” campaign by the Local Enterprise Offices is focused on highlighting the supports that will enable small businesses to make significant changes to the way they work that will help them now and in the future. These supports include the Lean, Green and Digital programmes, all of whom enable small businesses to become more competitive and productive in how they work.

Figures from the Local Enterprise Offices show that the Lean for Business programme, running since 2015 with Enterprise Ireland, has helped save businesses an average of €34,000 by helping them work more efficiently and improving their processes.

The programme has saved Irish companies over €28million since it began and is free to all small businesses through their Local Enterprise Office, who are based in the local authorities across the country. The figures also highlighted that the businesses that did avail of these programmes had an average 31% increase in their output or production.

The “All In a Day’s Work” campaign aims to encourage small businesses to link in with their Local Enterprise Office to find out what support is best suited to them at their stage of business and how it can benefit them.

The Local Enterprise Offices also run a number of initiatives to foster entrepreneurship across the country. These include Local Enterprise Week, the National Enterprise Awards, the Student Enterprise Programme, National Women’s Enterprise Day and Local Enterprise Showcase.

The Local Enterprise Offices in local authorities are funded by the Government of Ireland through Enterprise Ireland.

Established in 2014, the Local Enterprise Offices are the essential resource for any entrepreneur looking to start a business or any small business that is looking for support or advice to help them grow. Since their inception eight years ago, the Local Enterprise Offices have helped create over 25,000 jobs across the country.

The LEO’s work with thousands of client companies across Ireland in a diverse range of sectors offering mentoring, training, expert advice and financial supports to small businesses.

For more information on the campaign – www.AllInADaysWork.ie

The impressive new state of the art campus, which spans three buildings over 23,000 square feet, is co-located on the Teagasc, Athenry Campus and is the first of its kind in Ireland. Addressing the food community’s specific need for food grade workspace, the campus offers four fully kitted out pay per use production units and twelve independent “own door” production units for lease.

In addition to these facilities, the BIA Innovator Campus team also provide a powerful mix of technical, innovation and commercial supports to the food community and benefits from direct links to research, development, and innovation with the Teagasc Food Programme.

More than €8 million has been provided in capital funding from Enterprise Ireland, Department of Rural and Community Development, Galway County Council, Teagasc, Galway Rural Development/LEADER and Western Development Commission to deliver the project. The BIA Innovator Campus has the highest impact collaboration of public, industry, community, and education backing assembled to date in the Irish food sector.

In addition to the impressive on-site spaces, the BIA Innovator Campus will host a calendar of in-house events as well as facilitating several education and training courses delivered by the Galway Roscommon Education Training Board. Looking to build knowledge, relationships, and opportunities outside of Ireland, the BIA Innovator Campus is currently active in the EU project sphere and working on a number of European food and entrepreneurship-focused Erasmus+ and Interreg projects.

The Future is Female by AIB

The research highlights the growing financial influence of Irish women and outlines how they are driving changes in workplace cultures and business practices, ultimately leading to a forecasted shift in female economic influence.

The paper goes on to show that even with the gender pension gap and the fact that Irish women’s pensions are worth 35% less than men’s at retirement, it is forecast that women will hold 45% of assets under management by 2030 in line with forecasts for Western Europe. This is a result of better qualifications, more equal pay although the gender pay gap remains, higher levels of home ownership and longer life expectancy, with Irish women living to 84 years and Irish men living to 81.

- Female Economic Influence:

The paper predicts a significant increase in the economic influence of Irish women, with a focus on their role in transforming work cultures and business practices. - Entrepreneurial Growth:

Female entrepreneurship in Ireland is rising, with female founders securing €234m in funding for tech startups in 2022. Ireland ranks third in early-stage female entrepreneurs across all European countries. - Board Representation:

There has been a 21%-point increase in female representation on ISEQ listed companies in the last five years, surpassing the 25% target for 2023 at 28%. - Labour Force Participation:

The labour force participation rate increased by one percentage point to 65.8%, with a notable rise in female participation from 58.9% to 60.8% in the past year. - Generational Impact:

Gen Z and millennial female businesspeople are responsible for starting one-third of businesses globally. - Investment Trends:

While women are generally more risk-averse investors, they prioritise Environmental, Social and Governance (ESG) factors, with 52% preferring to invest in businesses with a positive social or environmental impact. - Leadership Shift:

There is a move towards ‘agile leadership’, promoting female career advancement by shifting away from presenteeism and strict supervision. - Barriers to Ambition:

Globally, challenges like childcare and familial care hinder women’s careers, leading to a shift away from jobs that demand prioritising work commitments over personal life.

“I’m delighted that research like the ‘Future is Female’ is being undertaken, but it’s still shocking that while our financial influence is growing, a cause to be celebrated, women are still retiring with a third less than men. As females, we’re used to putting everybody else before ourselves, but we need to also look after ourselves. Maternity leave, parental leave, career breaks, we don’t think about the impact these will have in terms of gaps in our pension contributions. That’s why it’s really important to review where you’re at, to see if there’s going to be enough to live the life you want to live in retirement. I wouldn’t underestimate the relief you feel when you talk to a financial planning adviser” says Siobhan McNally Head of Business Development Wealth at AIB.”

A financial advisor can help women assess their situation and put a plan in place to address any gaps and highlight where things are being done well. It takes about an hour, and you can meet an advisor in an AIB branch or talk on the phone – the choice is yours.

To set up a chat with an AIB Financial Advisor, call 01 771 5867 or visit the AIB website. Phone line opening hours are Monday to Friday 9am – 5pm.

The Fixed Term Deposit options are for Businesses who have at least €15,000 available to put away for the full term and still have enough money in other accounts that can be easily accessed. To open an account customers can visit one of our 170 Branches across the country and speak to one of our dedicated deposit specialists or contact their relationship manager.

AIB’s Head of SME, John Brennan said: “Reflecting the changing interest rate environment, AIB has increased rates on a number of occasions since November 2022, across our variable and fixed rate deposit products”.

“For business customers who have larger sums to save for longer periods, we have increased all our Fixed Term deposit rates, offering a 3% return on our 2-Year Fixed Term Deposit account, 2.50% on our 1 Year Fixed Term and 1.5% A.E.R. for our 6 Month Fixed Term. We encourage all customers to continuously monitor our savings and deposit offerings”.

The current interest rates available on our Fixed Term Deposit Product are:

Terms and conditions apply. Interest is subject to Deposit Interest Retention Tax (DIRT). To find out more have a look at our website; AIB/Business/Business-Accounts/Fixed-Term-Deposit-Account.

Interest is subject to Deposit Interest Retention Tax (DIRT)

FINANCIAL REPORTING

Financial Reporting News

Financial Reporting News

The proposals are based on amendments issued by the IASB in May 2023.

Comments on FRED 84 were due 31 December 2023.

The FRC expects to finalize the proposed amendments in the first half of 2024, alongside the amendments arising from the current periodic review of FRS 102 and other FRSs.

CPA Ireland responded to FRED 84.

The report highlighted capacity constraints, recruitment and retention challenges, alongside regulatory requirements, as the main obstacles for smaller firms looking to expand their presence – especially in audits of public interest entities (PIEs).

To promote greater competition and choice in the audit market, the FRC has highlighted the importance of a collaborative, cross-system approach involving the regulator, audit firms, professional accounting bodies, and government. The FRC itself has already launched initiatives like Scalebox to help smaller firms understand regulatory standards and grow their PIE audit capabilities.

Audit firms are encouraged to prioritise cultures that better support their staff, including training and resources, while professional accounting bodies should continue efforts to attract new talent into the profession and maintain high auditing standards. Government can also play a role with policies that encourage competition and innovation in the audit market.

The summary indicates:

- The impact of climate change and climate impact mitigation initiatives on companies. This reflects the focus of IAASA on the financial reporting implications of climate change and climate commitments by companies.

- The adoption of European Sustainability Reporting Standards (ESRSs) across Europe on a phased basis from 2024 (ie financial year 2024, with sustainability reporting first being published in 2025) will dramatically impact environmental reporting requirements for companies; and

- That, in general, the level of compliance by companies with financial reporting requirements continues to be strong.

A summary of the report can be found here.

The podcast focusses on two of the Committee’s discussions about:

- Climate-related commitments in IAS 37 Provisions Contingent Liabilities and Contingent Assets; and

- Disclosure of revenues and expenses for reportable segments in IFRS 8 Operating Segments.

Irish Accountancy Sector by Mark Butler

“We’re always on the trail of finding suitable partners who would like to join us. John was 30 years in business and has a similar client base working with privately owned businesses. ‘John, like us, believes that clients should always have access to a partner and an advisory practice is built on the personal relationships forged with clients. Therefore, culturally they were a perfect fit to join us.

“We are focused on ambitious growing entrepreneurial led businesses,” he added.

Technology, he said, was allowing HLB Ireland to strengthen its relationships with clients. “Traditionally business needed an accountant in-house, and then we dealt with historic information predominantly for compliance purposes.

The right technology and having an advisory mindset is changing the focus of these relationships and we can now be much more hands on in assisting and providing much more timely current information which facilitates us being in a better position to advise our clients, and this approach also reduces risk for businesses.”

The traditional mindset of accountancy firms is focused on building enduring relationships; within our experience, these trusted relationships can last decades. We have recognised that in order to maintain and grow these relationships into the future, investment in technology for focused service delivery is essential. Additionally, being in a position to focus on advisory across our full range of clients along with services such as Cyber Security, Wealth Management, ESG and Sectoral expertise, will be critical into the future as client needs and indeed competition continues to evolve.

The global accountancy sector is experiencing a wave of consolidation, driven by factors such as technological advancements, regulatory changes, succession challenges and the need for firms to enhance their service offerings. Larger firms are seeking to expand their market share and capabilities by merging with or acquiring smaller, specialised firms.

Digital Transformation:

The traditional model of individual client acquisition is giving way to a more interconnected, leader- and specialist-driven model. Embracing digital tools and diverse distribution channels has become essential for accountancy firms to stay competitive.

Talent Acquisition and Retention:

Attracting, securing and retaining talent, spanning from recent graduates to seasoned professionals, presents an enduring challenge for firms of varying sizes. The traditional model of structuring an accountancy practice is changing, partly I believe, to try deal with the talent shortage and to continually attract a high calibre professional to practice.

Private Equity:

The accountancy sector has witnessed a notable surge in the influence of private equity, as an increasing number of firms have been acquired by consolidators or firms, some of which are private equity backed. To date in Ireland these are generally UK-based entities. This trend reflects a dynamic shift in the professional services landscape, as private equity firms recognise the strategic value and potential profitability within the accountancy sector. The infusion of private equity investment brings not only financial backing but also a drive for operational efficiency and strategic innovation thereby disrupting the traditional model. This growing trend of acquisitions by UK parties underscores a transformative phase for those accountancy firms, as they navigate new partnerships and ways of working.

1. Cultural Alignment in Mergers:

Cultural alignment takes centre stage in the intricate process of merging firms, demanding a prioritised focus to orchestrate a seamless transition and foster harmonious collaboration. The success of any merger hinges significantly on the compatibility of firm cultures and the resonance of shared values. This emphasis on cultural synergy is particularly critical in Ireland, where the close-knit nature of the business community places a premium on relationships and shared values. Here, the interconnectedness of professional and personal networks amplifies the significance of aligning cultures, creating a foundation for enduring success.

2. Client First Approach:

Engagement and expertise are crucial factors for clients who wish to build trusted relationships with professionals who have the advisory skill set to help them grow their business and indeed for professionals seeking to build their careers. It is therefore critical that there is this alignment evident for the long term in building these client relationships post merger.

3. Strategic Mergers for Growth:

Younger professionals in the Irish accounting profession are increasingly aware of their career progression options and the potential impact mergers have upon their career trajectory. Merging with the right firm is seen as a strategic move to enhance career prospects, leverage a broader client base, and access additional resources. Access to an international network is key to forward thinking firms keen to ensure they retain clients as they in turn need access to global support. International accounting networks serve as invaluable platforms, facilitating cross-border knowledge exchange among firms, enabling them to learn from each other’s diverse experiences and insights along with aligning strategies for growth.

1. Leadership Cultivation:

In professional services firms, the cultivation of effective leadership is paramount to ensure that leaders are optimally positioned to navigate and serve the evolving needs of the firm in the future. Leadership development programs should be thoughtfully designed to hone the skills required in the dynamic landscape of professional services. This involves fostering strategic thinking, adaptability, and a deep understanding of emerging industry trends. Cultivating a culture of mentorship and continuous learning further contributes to leadership excellence. In the face of technological advancements, global complexities, and shifting client expectations, leaders must be equipped with the ability to inspire innovation, foster collaboration, and drive sustainable growth. By prioritising leadership development, professional services firms can fortify their resilience and readiness for the challenges and opportunities that lie ahead.

2. Segmentation:

To drive ongoing growth, a clear view of your market is important to ensure real meaningful engagement with that target audience. Segmentation by industry is an approach forward-thinking firms have adopted and, in turn, have built deep expertise in key sectors with a view to being the top-of-mind option in their field. This approach builds a deep understanding of evolving client needs in specific industry segments. In our experience and the experience of professionals adopting this approach, this focus yields results beyond the specific segments focused upon and elevates the firm’s profile as a true expert. Market segmentation is crucial for efficiently allocating scarce resources and time, allowing firms to tailor their efforts to specific client segments strategically.

3. Three Essentials for Strategic Growth:

Sophisticated marketing, evolved pipeline management, and innovative service development form the three essentials for strategic growth. The synergy of sophisticated marketing, evolved pipeline management, and innovative service development surpasses the impact of each individual component, marking these three essentials as a formidable force for strategic growth. Together, they constitute the cornerstone for navigating the dynamic terrain of the accounting sector. The harmonious balance of these elements not only ensures a comprehensive strategy but also forms a powerful alliance that propels sustained growth.

4. Pipeline Management and Business Development:

Integrating business development as a core requirement for professionals leading specific segments is crucial. Growth doesn’t happen accidentally. Firms focusing on effective pipeline management for both recurring revenue and project work tend to maximise opportunities, aligning business development strategies with the growth objectives. Fundamentally it is important to understand the source of inbound valuable referrals so they can be built upon.

5. Recruitment of Multifaceted Leaders:

Accountancy firms should actively recruit leaders with additional skills to core technical requirements, including business development and innovation. The ability of professionals to be willing and open to widen their skill base ensures a firm’s agility and adaptability in a rapidly changing environment.

Embracing change and investing in the right talent, technologies and new services are essential for navigating the challenges and opportunities that lie ahead, ensuring sustained success for accountancy practices in the future.

Mark Butler can be contacted directly and in confidence at mbutler@hlb.ie

Mark Butler, managing partner of HLB Ireland has led the firm through a number of mergers in recent years, most recently with John McCarrick & Associates, an accountancy firm founded in 1990 by former Irish international runner John McCarrick. The deal is the fifth transaction HLB Ireland has been involved in so many years as it continues to scale the firm.

Don’t Defer your Tax Accounting by Dympna Cassidy and Brian Murphy

In practice, deferred tax creates many questions when the guidance is being pragmatically applied to various situations. For example, International Financial Reporting Standard (“IFRS”) reporters noted some challenges in interpreting how deferred tax should be applied to leases when the new IFRS leasing standard was issued. To address the diversity in practice, the International Accounting Standards Board (“IASB”) had to issue a narrow scope amendment to IAS 12. The accounting for deferred tax also receives quite a lot of scrutiny from external auditors, internal decision-makers and accounting regulators alike.

The accounting for deferred tax in your accounting records requires an understanding of the core concepts. From an FRS 102 perspective, some examples include deferred tax liabilities, deferred tax assets, sufficient future taxable profits, taxable and accounting profits, substantially enacted rates, and permanent and timing differences. There are also heightened considerations concerning the recognition and measurement of deferred tax assets due to recoverability considerations and specific rules around discounting and the offsetting of deferred tax assets and liabilities. The successful accounting for deferred tax requires not only a knowledge of the core definitions, but also the exceptions in conjunction with an in-depth knowledge of the guidance for specific balances, for example, business combinations. Topical areas such as Pillar 2 and the impact of climate-related risks on entities also create bespoke deferred tax considerations for companies.

Getting your deferred tax accounting correct is not only salient from the perspective of presenting appropriate statutory financial statements, but also from the perspective of reducing volatility within the financial statements. It also assists FRS 102 reporters in understanding future obligations to pay taxes that are based on profits that have already been earned. This ultimately supports the management of cashflows associated with taxes and signposts the quantum of cash that is needed to pay tax bills once the deferred tax becomes current tax.

A deferred tax liability is defined in the glossary of FRS 102 as income tax payable in future reporting periods in respect of future tax consequences of transactions and events recognised in the financial statements of the current and previous periods. So it reflects a future outflow payable by the entity. On the other hand, a deferred tax asset reflects a future tax deduction i.e. a benefit to the entity. Section 29 of FRS 102 defines them as income taxes which are recoverable in future reporting periods in respect of:

- future tax consequences of transactions and events recognised in the financial statements of the current and previous periods;

- the carry forward of unused tax losses; and

- the carry forward of unused tax credits.

The threshold for recognition of a deferred tax asset is higher than a deferred tax liability. Prior to the recognition of a deferred tax asset, an entity must ensure that there are sufficient future taxable profits against which the deduction can be recovered. An entity is required to challenge itself by assessing whether it is considered probable that it will have sufficient taxable profits available in the future to enable the deferred tax asset to be recovered. There is also emphasis placed on “probable” which is defined in the glossary of FRS 102 as “more likely than not”. Unrelieved tax losses and any other deferred tax assets can only be recognised to the extent that it is probable that they will be recovered against the reversal of deferred tax liabilities or other future taxable profits. The fact that there are unrelieved tax losses in the first instance is strong evidence that there may not be other future taxable profits against which the losses will be relieved.

When it comes to the assessment of whether a deferred tax exists at the year-end that needs to be captured in the statutory financial statements, Section 29 requires a “timing difference plus” approach to be taken. Timing differences occur when there is a difference between the accounting and taxable profit or loss. Accounting profit or loss is the amount calculated using an accounting basis i.e. FRS 102, and is the amount presented in a company’s profit or loss or total comprehensive income. The taxable profit or loss is the amount for a reporting period upon which income taxes are payable or recoverable, determined in accordance with the rules established by the taxation authorities. As a result, there can be differences between the accounting and tax profit or loss which can cause a timing difference.

The “timing difference plus” approach requires deferred tax to be recognised on all timing differences, however, there are a number of exceptions to this. For example, unrelieved tax losses and other deferred tax assets, as mentioned earlier, can only be recognised to the extent that it is probable that they will be recovered either against the reversal of deferred tax liabilities, or other future taxable profits. In addition, no deferred tax is recognised on permanent differences, for example, a grant which is not subject to tax or an expense that is disallowable for tax purposes. There is however an exception to permanent differences relating to business combinations. Again, this re-emphasises the need not only to be familiar with the core definitions in Section 29 but also the exceptions . The “plus” in the “timing difference plus approach” refers to the required recognition of deferred tax on asset revaluations and on assets (except goodwill) and liabilities arising on a business combination.

Applying these core concepts to a simple example, let’s assume the following:

Company A, which has a year-end of 31 March 20XX operates a defined contribution plan for its employees. The Company pays the annual charge for the plan in advance and tax relief is provided on the plan in the accounting period in which the payment is made. As the contributions have been paid in advance, the tax relief is greater than the expense recognised in the profit and loss account for accounting purposes. This is because the advance payment for accounting purposes is recognised as a prepayment and released to the profit and loss account over time, however, the full tax deduction was allocated when the annual charge was made. In the following period, the financial statements will have those advance contributions charged as an expense, but no tax relief will be available. This is a timing difference which would result in a deferred tax liability.

Some other salient technical considerations pertaining to deferred tax include, but are not limited to, discounting what rate is used to calculate deferred taxes, and the offsetting of deferred tax assets and liabilities. It should be noted that the discounting of deferred tax assets or liabilities is prohibited applying Section 29 of FRS 102. This is helpful from a practical perspective as, if required, this would create complexities and require detailed schedules to understand the expected timing of reversals.

Section 29 also requires the application of a substantially enacted tax rate. There are also additional considerations in relation to the tax rate applied in the calculation of deferred tax, for example, concerning profits affected by distributions and balances such as investment property which is recognised and measured using the revaluation model.

The offsetting of deferred tax assets and deferred tax liabilities is permitted only where certain conditions have been met. Specifically, the entity must have a legally enforceable right to set off current tax assets against current tax liabilities. They also must relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities which intend either to settle current tax liabilities and assets on a net basis, or to realise the assets and settle the liabilities simultaneously in each future period in which significant amounts of deferred tax liabilities or assets are expected to be settled or recovered.

For those with group members applying both IFRS and FRS 102 it should be noted that there are distinct differences in the approach outlined in Section 29 of FRS 102 requiring a “timing difference plus” approach rather than the “temporary differences” approach as outlined in IFRS’s equivalent income taxation standard IAS 12. In terms of detail, whilst the standards are fundamentally different, generally, you would expect the FRS 102 approach to give the same answer as the IFRS one. Other areas of difference include convertible debt and business combinations.

Interestingly, FRED 82 brings quite significant changes to FRS 102 including greater alignment with IFRS on some core topics, however, it does not address deferred tax. Section 29 remains broadly unchanged with the exception of the inclusion of inserted guidance about uncertain tax positions. As a result, the core differences between IFRS and FRS 102 on the topic of deferred tax will continue to exist after FRED 82’s effective date of 1 January 2026.

Overall the application of the guidance in Section 29 of FRS 102 in relation to deferred tax requires a knowledge of the core terms in conjunction with the exceptions and specific rules on certain topics. It has a far reach over your financial statements as any balance with timing differences has the potential to create a deferred tax impact.

Deloitte Ireland LLP

Taxation News

Taxation News

There are 3 important changes that will apply to Irish traders:

- Pre-notification requirements for live animals, animal products and high and medium risk category plant products;

- Full customs controls;

- Health certification on medium risk animal products, plants, plant products and high risk food and feed of non-animal origin.

The new rules will impact you if you export goods to Great Britain or via the UK landbridge to the rest of Europe.

Approximately 275,000 of the returns filed to date resulted in an overpayment of tax.

Among the key tax credits and reliefs claimed by PAYE taxpayers are the rent tax credit and health expenses. Revenue also reminds PAYE taxpayers that they need to tell Revenue about any additional income which has been earned outside the PAYE system.

2023 saw record tax receipts with Revenue collecting €87.2 billion in taxes and duties for the Exchequer. In addition, Revenue collected over €26 billion on behalf of other Departments, Agencies and EU Member States.

The record receipts for 2023 was underpinned by high timely compliance rates across all taxes. This reflects very positive engagement by businesses, individual taxpayers and agents with their tax compliance obligations. Revenue supports this culture by providing a wide range of services to make it as easy as possible for taxpayers to pay the right amount of tax at the right time, while also confronting and tackling non-compliance in all its forms.

The identification, targeting and disruption of shadow economy and other illegal activity such as smuggling, continues to be a key focus for Revenue.

In 2023, Revenue seized almost 70 million cigarettes valued at over €55 million, and a record breaking 9,085 kilos of drugs with an estimated value of almost €302 million.

Tax and Duty Manual – Taxation issues for Registered Farm Partnerships- has been updated as follows:

- To reflect an increase to €20,000 in the maximum cash equivalent of relief a partner is entitled to receive over a 3 year period.

- To include new content at section 2.1.2. regarding Regulation (EU) No.1408/2013 which deals with de minimis aid in the agriculture sector and sets out the maximum de minimis aid available to any individual farmer.

Tax and Duty Manual – Tax credit for succession farm partnerships has been updated to provide for an increase in the maximum amount of relief that may be granted under sections 667D (relief for succession farm partnerships) and 667D(stock relief) TCA 1997 and under section 81AA SDCA to €100,000.

Determining Employment Status by Mairéad Hennessy

When comparing employed versus self-employed status, there are several distinctions to consider, which include differences in rights, responsibilities, and tax implications.

The following checklist provides some of the considerations in determining whether an engagement is an employment or self-employed arrangement. The below list is not exhaustive, and every case should be considered on its own merits.

Overturning the Court of Appeal, the Supreme Court has determined that the delivery drivers of Domino’s Pizza were employees and not independent contractors.

This case has received a lot of attention over the last few years and its decision is very significant to employers. In its judgment the Supreme Court has clarified the position with regards to workers who fall within the legislative interpretation of the “employee” definition by setting out a five-step test to determine whether a contract is one of service or for services, although the underlying historical tests remain valid.

- Karshan produced and delivered pizzas and ancillary food items to customers, who placed orders by telephone, the internet and attending its stores.

- Karshan engaged drivers to deliver the pizzas to its customers.

- Each driver entered into a written agreement with Karshan, which outlined the company’s need to sub-contract the delivery of pizzas, as well as the promotion of its brand logo, and that the driver (referred to in the agreement as the “contractor”) would be willing to provide those services.

- The agreement stated that the driver would be retained as an “independent contractor” and that the company had “no responsibility or liability whatsoever for deducting and/or paying PRSI or tax on any monies [he/she] may receive under this agreement”.

- Each driver was required to provide his/her own delivery vehicle in a roadworthy and safe condition and to insure same for business use. Alternatively, the driver could rent such a vehicle from Karshan, with the agreement stating that the company was also prepared to offer third-party insurance at a predetermined rate. (TAC found no evidence that company vehicles were available for the drivers to rent).

- Drivers were also required to wear a fully branded uniform (subject to checks by store managers), with a deposit requested by the employer from the drivers for same.

- The driver could engage a substitute provided the substitute could undertake all of the driver’s contractual obligations, with the substitute being paid by Karshan.

- On a shift, drivers clocked in and out using a computerised system located on Karshan’s business premises and were given a cash float by the company, which was returned at the end of the shift.

- Drivers were required to use their own phones when contacting customers. The company also limited the number of pizzas that could be delivered to two per time, and some drivers folded boxes while waiting for deliveries, often at the request of the store manager.

- The contract envisaged that invoices would be prepared and submitted to Karshan by the drivers, but it was found that not all drivers prepared such invoices. Karshan would prepare invoices for many (but not all) of the drivers that would then be signed by the relevant driver.

The Appellant, the Revenue Commissioners, argued at all times that they were employees retained under contracts of service.

The dispute has a long history commencing with a TAC decision which held that the drivers were employees. This was upheld by the High Court but overturned by the Court of Appeal. The Court of Appeal was of the view that there was no mutuality of obligation between the drivers and Karshan and as such, they were independent contractors.

- The mutual commitments had to present some type of continuity (“continuity”)

- They had to have a forward-looking element (“extending into the future”)

- There had to be an obligation on the part of the employer to “provide” work

- There had to be an obligation on the part of the employee to “perform” work

Karshan argued that without mutuality of obligation, a contract of service could not exist.

The Supreme Court maintained that the mere fact that an individual does not owe any contractual obligation to an employer when they are not working, does not preclude a finding that the individual is an employee, at the times when he/she is working.

In the end, the Supreme Court dismissed the argument that an agreement cannot be classified as a contract of employment unless there is the mutuality of obligation outlined by Karshan. It stated that this reasoning relied on adding a new, arbitrary requirement to the employer-employee relationship that has no basis in principle and is not backed by authority.

In this decision, the Supreme Court primarily considered whether mutuality of duty is a necessary need for the establishment of an employment contract. The Supreme Court disagreed, confirming that mutuality of responsibility is a significant consideration for determining employment status rather than a necessary condition for the existence of an employment contract.

- Does the contract involve the exchange of wage or other remuneration for work?

- If so, is the agreement one where the worker agrees to provide their own services, and not those of a third party, to the employer?

- If so, does the employer exercise sufficient control over the supposed employee to render the agreement one that is capable of being an employment agreement?

- If requirements 1-3 are met, the decision maker must then determine whether the terms of the contract between employer and worker and the reality of the working arrangements are consistent with a contract of employment, or whether they point to some other form of contract.

- Finally, it should be determined whether there is anything in the particular legislative regime under consideration that requires the court to adjust or supplement any of the foregoing.